ChatGPT launched a year ago and the tech world will never be the same. The New York Times has an in-depth look at the impact of this revolutionary new product, focusing on big tech.

It is interesting to me that one of the greatest tech launches of the past decade came not from a big tech company but from an AI startup that was not even seven years old and was set up as a non-profit research lab.

Until now, if you wanted to use the myriad of Stripe's product offerings, you had to process payments through Stripe. But that is no longer the case. At the company's annual conference in San Francisco yesterday, Stripe Chief Product Officer Will Gaybrick announced that the company is "extending our modularity to the very core of Stripe: payments processing."

The Israel-Palestine conflict rages on, and for many fintech workers in Tel Aviv, life has had to continue through the chaos.

It is a bold or naïve CEO that prefaces a major announcement with the words, "This will shock the world".

New PayPal CEO Alex Chriss said exactly that in his first public interview since becoming CEO. That was a week ago and he was referring to major announcements that would happen at the company's Innovation Day that it conducted yesterday.

The Wall Street Journal is reporting that Apple has indeed decided to move on from Goldman in roughly 12 to 15 months. This will mean both the Apple Card and the savings account (that was rolled out just a few months ago) will need a new banking partn

TransUnion, one of the big three credit bureaus, has launched a new data analytics platform called OneTru.

The new platform will offer banks and fintechs AI and ML tools for addressing a variety of credit, anti-fraud and marketing needs.

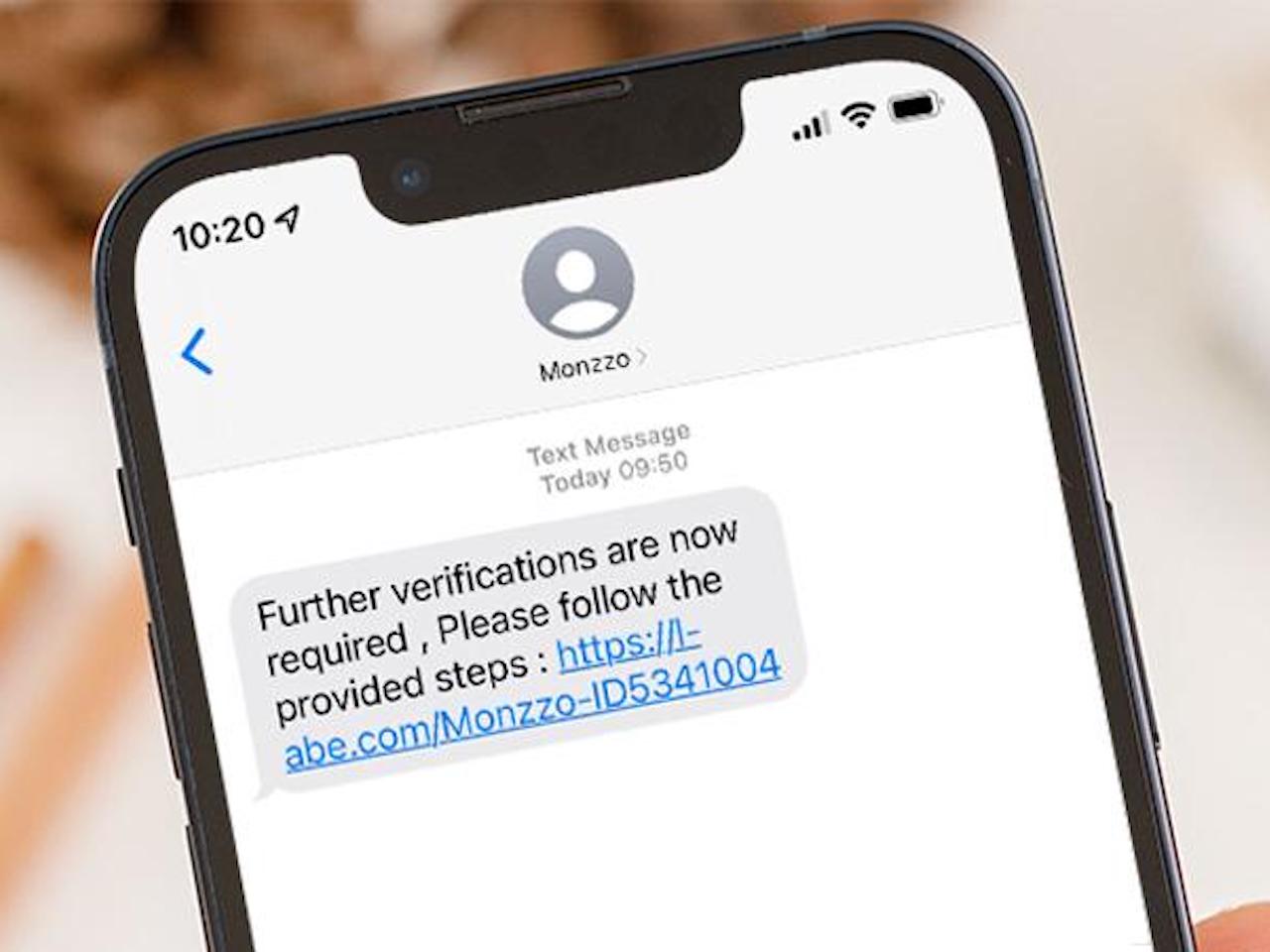

In lieu of a solution that stops the crimes from happening in the first place, bank reimbursement is the only source of protection.

No, you did not wake up back in 2021 but there is news this morning of a €285 Million (over $300m) fintech funding round.

Germany-founded but London-based SumUp has closed the massive funding round that is "mostly equity" which tempers our initial enthusiasm somewhat. But even a nine-figure equity round is enough to make the news these days.

Upstart has been a trailblazer when it comes to using AI in lending. They were the first fintech lender to make it a core part of their offering.

A lack of financial literacy can be devastating to maintaining financial health.

The big problem is that most people find financial literacy programs boring and don't stick to it. Many fintechs and banks have tried to counteract this by creating gamified learning.