Bloomberg reported on Friday that Chime is planning a 2025 IPO, according to "a person familiar with the matter."

Chime is the largest consumer-facing fintech in the country and this blockbuster IPO has been anticipated ever since their massive 2021 funding round that valued the firm at $25 billion.

Today, a new global report was released from Nasdaq and Oliver Wyman on illicit money flows and the numbers are sobering.

The Global Financial Crime Report quantifies the total amount of illicit financial activity and the number is an eye-popping $3.1 trillion. Included in this number is bank fraud covering payments, checks and credit card fraud which is estimated at around $450 billion.

It has been the talk of the crypto world all week. SEC watchers noticed early this week that the regulator appeared to be getting ready to approve an ETF for funds holding Ethereum.

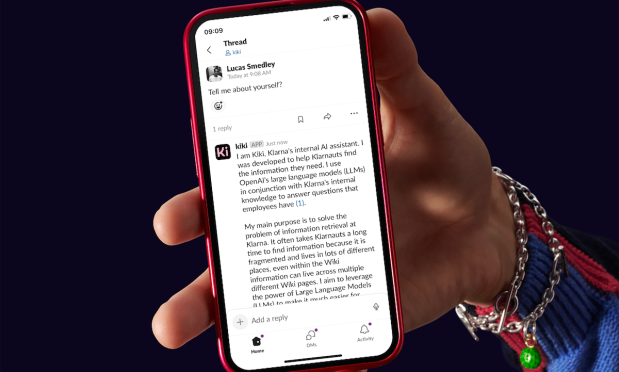

We learned back in February that Klarna's AI chatbot was doing the work of 700 people.

Today, Klarna is reporting about its employee's internal use of AI. It's internal AI assistant, named Kiki, is answering 2,000 employee questions a day and over 87% of its employees are now using it.

Fintech Nexus Newsletter (February 13, 2024): The 50 Hottest Startups in Fintech According to Forbes

Forbes is out with its ninth annual Fintech 50 this morning, a subjective list of the hottest startups in fintech. The list is created by Forbes editors, is only open to private companies and it involves analyzing data as well as interviews with company CEOs and industry insiders.

It has been almost two weeks since the SEC approved Bitcoin ETFs and we now have some data on the 10 ETFs that have been trading since then.

The two biggest and oldest names in finance are leading the way: BlackRock and Fidelity. Each fund has attracted more than $1 billion in inflows.

Chime is getting into the earned wage access business.

The leading digital bank announced yesterday that it is launching MyPay, a new earned wage access service that will allow customers to access up to $500 of their paycheck before payday.

One has kept a low profile since Walmart announced the creation of its new fintech startup in January 2021.

We have seen an occasional announcement, but the fintech startup has largely remained under the radar.

No More Content