Last month, it was Chase, this month, it is PayPal launching a new ad business.

PayPal has hired Uber's former head of advertising to run PayPal Ads, the new division that will be selling targeted ads based on its customer data.

It has been the talk of the crypto world all week. SEC watchers noticed early this week that the regulator appeared to be getting ready to approve an ETF for funds holding Ethereum.

The slow-moving dumpster fire that is the Synapse-Evolve meltdown has turned into a nightmare for many fintech customers.

Synapse acted as a middleman between banks and fintechs, but there have been several disagreements between Synapse and these banks and fintechs. Consumers who assumed their money was safe are caught in the middle.

It has been a busy last few days for the CFPB and their fintech work. For the third consecutive day this week our lead story concerns actions taken by the CFPB.

This time it is around BNPL. The CFPB is proposing new rules that would essentially lump BNPL in with credit cards when it comes to consumer protections.

Speaking at an event yesterday, CPFB Director Rohit Chopra said his agency is looking at "price gouging" in credit reporting.

With credit reports required for selling mortgages to Fannie and Freddie, mortgage lenders have no choice but to pay for them. Some lenders have shared that the costs for credit reports have increased by up to 400% since 2022.

On Friday, the CFPB announced it was suing mobile peer-to-peer lending platform SoLo Funds for multiple issues.

SoLo Funds targets minority and other underserved borrowers with short-term loans of up to $575. This is a challenging population to serve and a difficult niche to profit from.

Yesterday, in a 7-2 vote, the U.S. Supreme Court ruled that the funding structure of the Consumer Financial Protection Bureau is constitutional.

This is a big deal for financial institutions. Even though the agency has been a thorn in the side of many fintechs and banks, if the Supreme Court found it unconstitutional, it would undo more than a decade of work and could mean chaos for the industry.

Visa is hosting its annual Visa Payments Forum in San Francisco this week, and yesterday, there were some major announcements. Some are calling this the biggest thing in card payments since the card chip.

Chime is getting into the earned wage access business.

The leading digital bank announced yesterday that it is launching MyPay, a new earned wage access service that will allow customers to access up to $500 of their paycheck before payday.

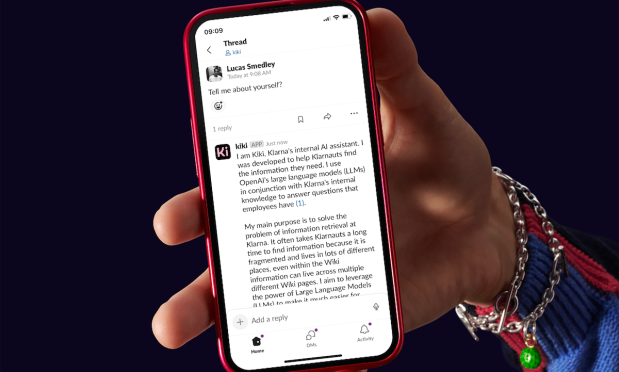

We learned back in February that Klarna's AI chatbot was doing the work of 700 people.

Today, Klarna is reporting about its employee's internal use of AI. It's internal AI assistant, named Kiki, is answering 2,000 employee questions a day and over 87% of its employees are now using it.