For the past two decades, the investment banking ecosystem in fintech has been dominated by one player: Steve McLaughlin's FT Partners. Now, that is not to say that other investments have not done deals. The really big deals are often done by the likes of Goldman Sachs, Morgan Stanley, or JPMorgan Chase.

No, you did not wake up back in 2021 but there is news this morning of a €285 Million (over $300m) fintech funding round.

Germany-founded but London-based SumUp has closed the massive funding round that is "mostly equity" which tempers our initial enthusiasm somewhat. But even a nine-figure equity round is enough to make the news these days.

Payment by bank account is a functionality that has existed for more than a decade in many countries. But it is still a relatively new phenomenon in the U.S.

Stripe has, for some time, been one of the leading fintech companies globally when it comes to scale.

But the numbers it revealed today in its annual letter are truly staggering. It processed $1 trillion, around 1% of global GDP, through its platform in 2023. It crossed that milestone just 15 years after it was founded.

It has been almost two weeks since the SEC approved Bitcoin ETFs and we now have some data on the 10 ETFs that have been trading since then.

The two biggest and oldest names in finance are leading the way: BlackRock and Fidelity. Each fund has attracted more than $1 billion in inflows.

Twitter/X has been going state-by-state obtaining money transmitter licenses. The social media platform is now approved in 12 states.

We learned a couple of weeks back that the former head of Marcus, Swati Bhatia, had taken a job at Santander to lead U.S. consumer and business banking.

Yesterday, we learned more details about what this new job is going to entail.

The Fed came back with a plan yesterday to debit card fees for merchants. Will it be too much for banks to handle?

Swift announced today that the European Payment Council's awkwardly named One-Leg-Out Instant Credit Transfer scheme (OCT Inst) went live this week and it enables payments to and from Europe to be processed 24 hours a day, seven days a week.

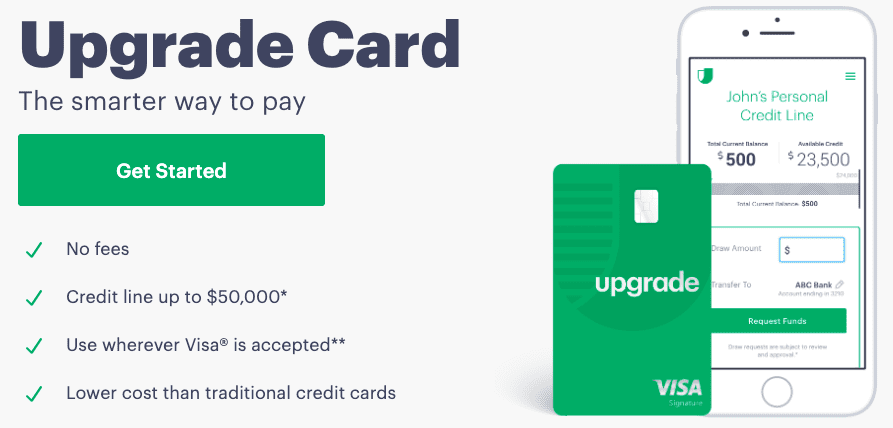

Upgrade continues to break new ground in consumer fintech.

When the Upgrade Card launched in 2019, it was the first credit card ever to marry the benefits of a revolving line of credit with a fixed-rate installment loan.