Upgrade continues to break new ground in consumer fintech.

When the Upgrade Card launched in 2019, it was the first credit card ever to marry the benefits of a revolving line of credit with a fixed-rate installment loan.

We are moving to a world of instant payments but how we get there is still uncertain.

A blockchain-based payments system designed for central banks has just completed its first live transactions with the Bank of England. Created by Fnality, the system processed live payments from member banks, Lloyds, Santander and UBS.

The buy-now-pay-later industry continues to grow in popularity. And part of the reason is consumers are starting to understand that most of BNPL stands outside the traditional credit scoring system.

With the trial of Sam Bankman-Fried in the spotlight last month it is easy to forget that there is still the massive FTX bankruptcy that has to be sorted out.

The next step in that process has now been revealed in the form of a proposal. At this stage, it is just a proposal that must be approved by creditors before it can go to the bankruptcy judge. But the major creditor and consumer groups have agreed to the plan outline.

The CFPB has just released a 90-page report on the use of overdraft and Non-Sufficient Fund fees and it paints a bleak picture for those consumers that are struggling financially.

This is happening even though the CFPB has been attacking these kinds of "junk fees" over the last couple of years.

Fintech Nexus Newsletter (December 21, 2023): Small business lenders must get ready for Section 1071

In Congress, anything that helps small businesses typically comes with bipartisan support. But section 1071 of Dodd-Frank is a little complicated.

In the kickoff to the Holiday shopping season, consumers are spending, with retail sales up 1.1% and e-commerce sales up 8.5% according to Mastercard SpendingPulse.

ChatGPT launched a year ago and the tech world will never be the same. The New York Times has an in-depth look at the impact of this revolutionary new product, focusing on big tech.

It is interesting to me that one of the greatest tech launches of the past decade came not from a big tech company but from an AI startup that was not even seven years old and was set up as a non-profit research lab.

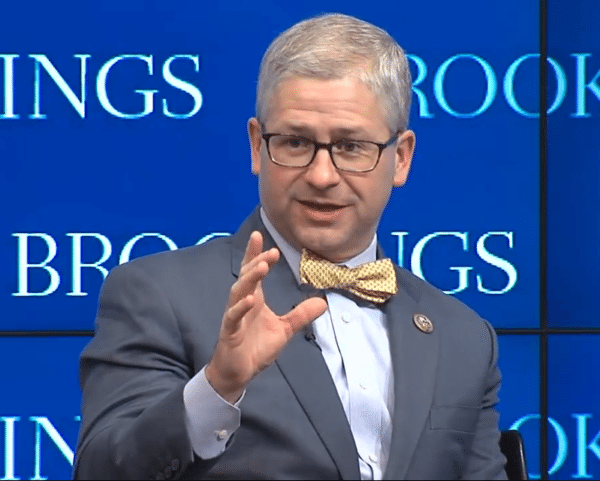

House Financial Services Committee Chairman Patrick McHenry (R-NC) announced yesterday that he will not be seeking reelection to the North Carolina seat he has held for almost 20 years.

Over the years whether serving as the Committee Chairman or as the Ranking Member, he has been a tireless champion for financial innovation on the House Financial Services Committee.

Yesterday, the OCC issued new guidance for banks, addressing the risks of buy now pay later lending. The guidance focused on the popular "pay in 4" segment of BNPL.

Not surprisingly, the national bank regulator recommended tight oversight of third-party servicers, the importance of transparent loan terms and fraud mitigation.