We learned back in February that Klarna's AI chatbot was doing the work of 700 people.

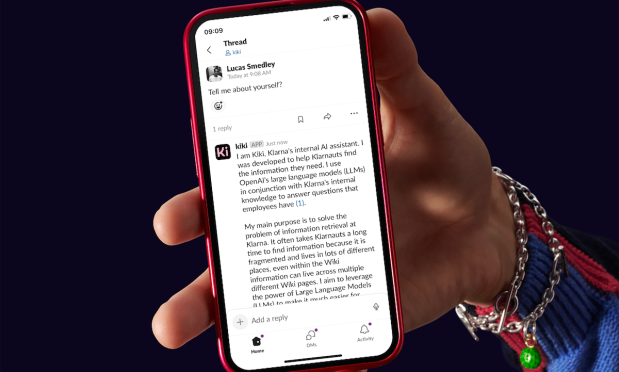

Today, Klarna is reporting about its employee's internal use of AI. It's internal AI assistant, named Kiki, is answering 2,000 employee questions a day and over 87% of its employees are now using it.

Marqeta, having already made their mark as a debit card issuing partner, has launched a credit card issuing platform.

In May of last year, Petal announced it had raised a new funding round and was spinning off its infrastructure unit, Prism Data.

But then we heard in November that Petal was struggling and looking for a buyer.

More positive signs for fintech as spend management unicorn Ramp closed another large funding round.

The $150 million was officially called a Series D extension, but it comes at a $7.65 billion valuation, a significant improvement over the $300 million raised for the initial Series D, which was at $5.8 billion.

Greenlight has been a leader in helping young children and teenagers develop financial skills. Its app is used today by more than six million parents and children.

While the company was traditionally focused on a direct-to-consumer model, it is increasingly developing partnerships with large banks to accelerate its growth.

It has been a lean legislative session in Congress for fintech. But this week some progress was made on earned wage access.

Today, Google has announced a pilot program with Affirm and Zip to bring BNPL natively into the Google Pay wallet.

Consumers continue to choose BNPL as a payment option and its popularity continues to grow, particularly during the holiday shopping season.

TransUnion, one of the big three credit bureaus, has launched a new data analytics platform called OneTru.

The new platform will offer banks and fintechs AI and ML tools for addressing a variety of credit, anti-fraud and marketing needs.

Caitlin Long, the CEO and founder of Custodia Bank, has been fighting for access to the Fed payments system for many years. Custodia first applied for a Fed master account in October 2020.

After her application was endlessly delayed, she sued the Fed to review her application. They eventually did and ruled against her. So, she sued the Federal Reserve again.

Swift announced today that the European Payment Council's awkwardly named One-Leg-Out Instant Credit Transfer scheme (OCT Inst) went live this week and it enables payments to and from Europe to be processed 24 hours a day, seven days a week.