Payment by bank account is a functionality that has existed for more than a decade in many countries. But it is still a relatively new phenomenon in the U.S.

Late yesterday, we heard the news that Onfido, a pioneer in ID verification used by banks and fintechs all over the world, is going to be acquired by Entrust, a diversified security and verification company.

We are entering the thick of fintech earnings season and in the last 24 hours, we have seen earnings from two fintech pioneers: PayPal and Adyen.

They tell very different stories.

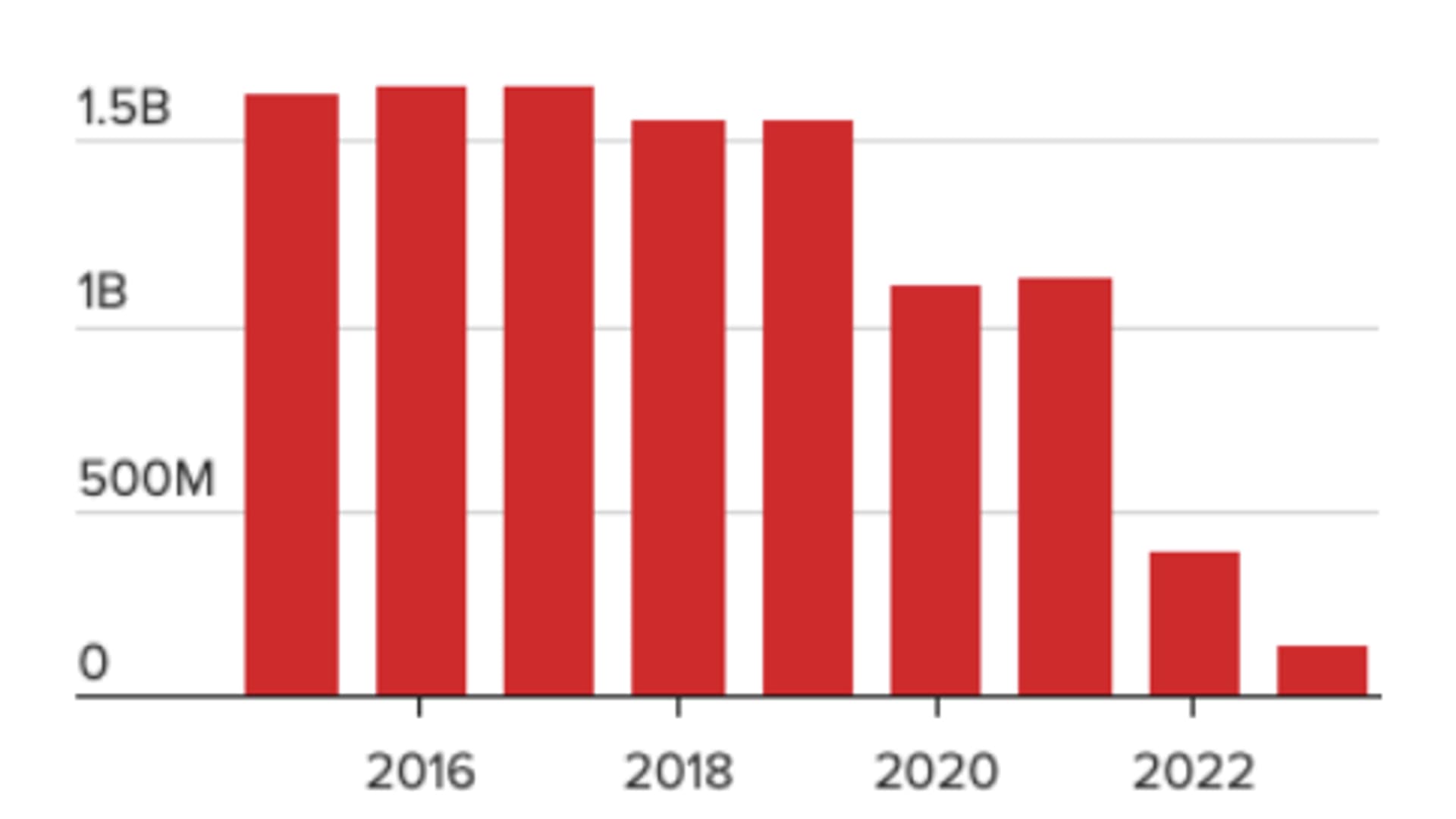

Overdraft revenue is on the decline, but recent filings show that JPMorgan Chase and Wells Fargo remain by far the largest generators of the controversial fees.

Today, Visa announced a new suite of payments capabilities called Visa Commercial Pay. This is a suite of B2B payments tools targeted at corporations.

Fintech Nexus Newsletter (February 13, 2024): The 50 Hottest Startups in Fintech According to Forbes

Forbes is out with its ninth annual Fintech 50 this morning, a subjective list of the hottest startups in fintech. The list is created by Forbes editors, is only open to private companies and it involves analyzing data as well as interviews with company CEOs and industry insiders.

Global fintech behemoth FIS has signed a new partnership with Banked to expand pay-by-bank options for consumers and small businesses. Banked has created an alternative payment rail based on account-to-account (A2A) connectivity and powers real-time payments through this technology.

European core banking provider Temenos is the latest victim of a Hindenburg Short Report. The detailed report cites interviews with 25 former employees that allegedly uncovered manipulated earnings and accounting regularities.

We haven't talked about crypto for a while in this newsletter. Coinbase reported earnings yesterday so this provides a perfect opportunity to reflect on the state of crypto.

Many people have called Capital One the original fintech.

Founded in 1994 by Richard Fairbanks and Nigel Morris (of QED) Capital One broke new ground as a monoline credit card bank that married technology and data science before that was a thing in banking.