There have been quite a few fintech startups in recent months that have pivoted to B2B from B2C (Tally, HMBradley, Onyx Private for example), but we haven't seen any fintechs go in the other direction until Mercury announced their personal banking product today.

Cybersecurity needs to be a focus for fintech companies right now. Here are the most important factors to consider to ensure strong cybersecurity governance.

While check usage has been in decline for years, for many businesses it is still a primary method of payment.

According to the Federal Reserve we processed over three billion commercial checks in 2023 valued at over $8 trillion.

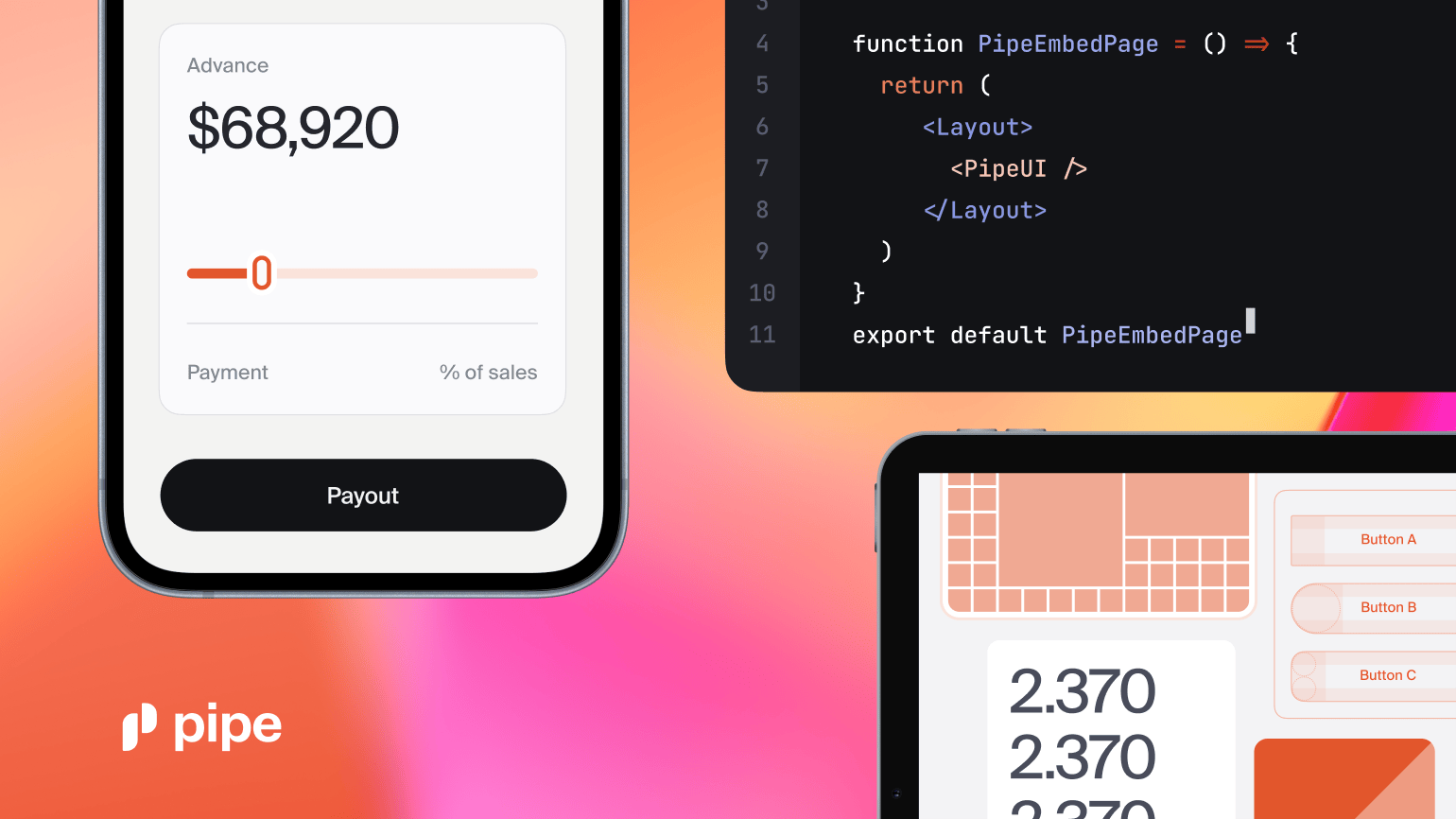

Pipe is launching a new embedded finance product to help small businesses. Their Capital-as-a-Service product has three launch partners.

Those of you following along closely will know that Fintech Nexus sold its event business to Fintech Meetup in June of last year. We have been focused on digital media since then.

Fintech Nexus is for sale and we are currently seeking expressions of interest.

After Pix and Open Finance, the central bank of Brazil is closing in on the launch of Drex, its central bank digital currency.

Earnings season for financial services officially kicked off this morning, with three of the top four banks reporting earnings. Let's look at JPMorgan first. By most measures, they crushed it. The country's largest bank reported $13.42 billion in profit on $41.93 billion in revenue - that is for the first quarter folks, not a year.

A new report from Open Lending and TransUnion dispels the myth that many thin-file consumers, especially younger ones, are more risky.

We learned a couple of weeks back that the former head of Marcus, Swati Bhatia, had taken a job at Santander to lead U.S. consumer and business banking.

Yesterday, we learned more details about what this new job is going to entail.