The digital euro has been making progress but in a recent ECB consultation, it became clear there could be major issues in its design.

In our second Office Hours session, Sarah Hinkfuss provided insight into startup success and navigating the current landscape.

Over $70 trillion in wealth transfer is in motion, underscoring the need for institutions to invest in serving the needs of younger consumers.

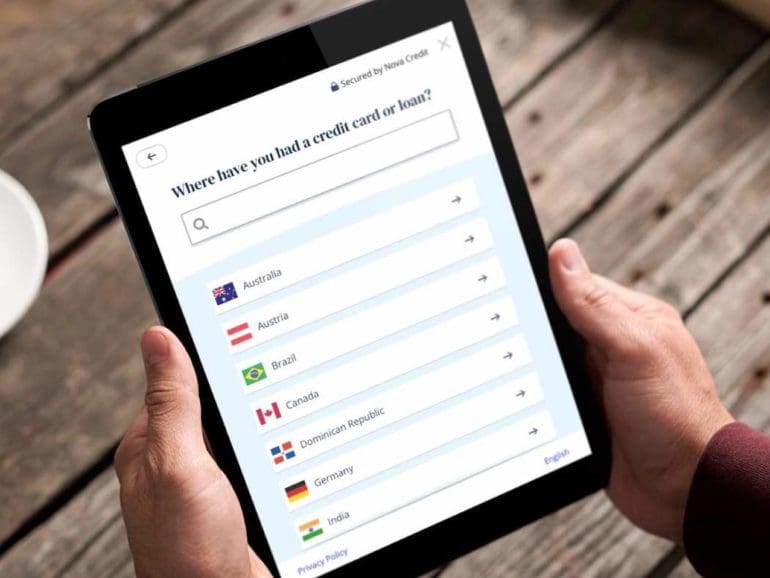

Nova has created products to assist migrants in gaining access to credit across borders. Their partnership with HSBC brings new capabilities.

In Latin America's fast-growing digital space, Quick Response codes have quickly risen as a serious contender to cash and are now ubiquitous.

Despite some recovery, the reality is most banks have not been generating a sufficient return on equity to cover their cost of capital.

Over my decade-plus covering fintech, I see parallels between earned wage access (EWA) and equity crowdfunding, P2P lending and BNPL.

The island seeks to consolidate itself as a leading Caribbean fintech hub, with 55 reported fintech companies as of 2021.

Capstack Technologies’ founder and CEO Michal Cieplinski believes he has the antidote to the Silicon Valley Bank meltdown, and Citi Ventures agrees.

Smart contract technology, although essential to the digitalization of financial platforms, does not come without challenges.