Argentine payments fintech Pomelo secured $40 million in a Series B round led by Kaszek Ventures, taking total funding to over $100 million.

SoFi reported financial results for Q4 2023 showing 35% revenue growth and its first ever quarter of profitability

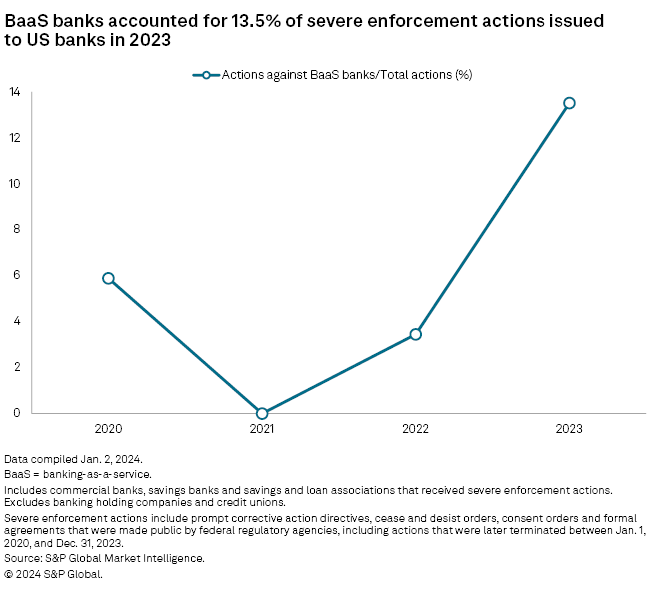

It was only Thursday of last week when our lead story was about the challenges banks were facing in the Banking-as-a-Service space.

Then Friday we learned that Blue Ridge Bank was hit with its second regulatory action in less than 18 months and is now deemed to be in a "troubled condition".

It is a bold or naïve CEO that prefaces a major announcement with the words, "This will shock the world".

New PayPal CEO Alex Chriss said exactly that in his first public interview since becoming CEO. That was a week ago and he was referring to major announcements that would happen at the company's Innovation Day that it conducted yesterday.

As B2B payment technology catches up to other areas of fintech, TreviPay CEO Brandon Spear said exciting trends are emerging. In late 2023, TreviPay released the B2B Buyers Payments Preference Study. It updates similar research conducted in 2019.

The payments landscape is undergoing a significant shift right way with new payments rails gaining more market share. And we have only just begun.

It is a bold or naïve CEO that prefaces a major announcement with the words, "This will shock the world".

New PayPal CEO Alex Chriss said exactly that in his first public interview since becoming CEO. That was a week ago and he was referring to major announcements that would happen at the company's Innovation Day that it conducted yesterday.

The SEC’s new cybersecurity rule can protect investors and ensure companies take security seriously. But it creates as many questions as it answers.

You could say Banking as a Service is under siege.

The number of severe enforcement actions BaaS banks received skyrocketed in 2023 to 13.5% of the total. When you consider there are probably only around 100 banks out of 4,800 that are involved in banking as a service, you can see why this number is disturbing.

The meetings program at Fintech Meetup is what sets this event apart from every other fintech event.