Mexican fintech Kapital raised $40 million in a series-B funding this month and $125 million in debt financing to expand to new markets.

With the trial of Sam Bankman-Fried in the spotlight last month it is easy to forget that there is still the massive FTX bankruptcy that has to be sorted out.

The next step in that process has now been revealed in the form of a proposal. At this stage, it is just a proposal that must be approved by creditors before it can go to the bankruptcy judge. But the major creditor and consumer groups have agreed to the plan outline.

The responsibility for managing compliance is increasingly falling on fintechs. Here are seven areas where fintechs need to focus.

The buy-now-pay-later industry continues to grow in popularity. And part of the reason is consumers are starting to understand that most of BNPL stands outside the traditional credit scoring system.

Nubank, the largest neobank in Latin America, will introduce USDC to its Brazilian clients, a significant advancement for the stablecoin.

Thanks to improvements in technology, innovative businesses like Melio are bringing B2B payments into the 21st century. This week, Melio launched Real-Time Payments, supported by J.P. Morgan.

We are moving to a world of instant payments but how we get there is still uncertain.

A blockchain-based payments system designed for central banks has just completed its first live transactions with the Bank of England. Created by Fnality, the system processed live payments from member banks, Lloyds, Santander and UBS.

The results of a recent Axway survey on open banking in America bode well for its adoption stateside. More than half, 55%, have heard of open banking, with 32% believing they have a decent understanding of it.

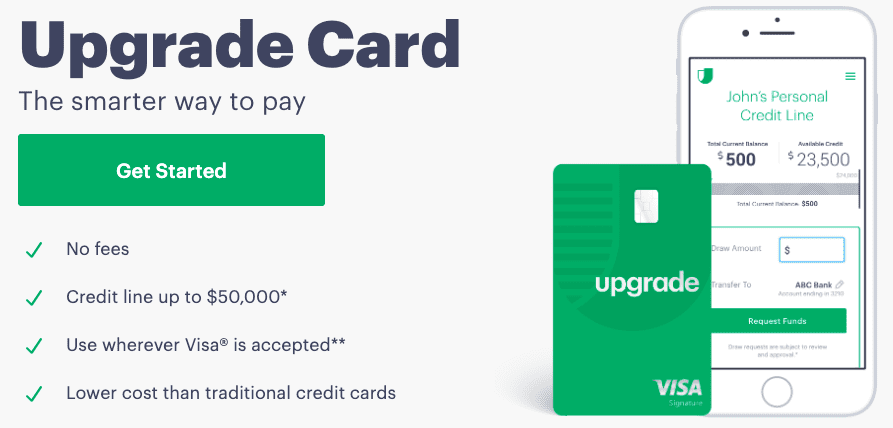

Upgrade continues to break new ground in consumer fintech.

When the Upgrade Card launched in 2019, it was the first credit card ever to marry the benefits of a revolving line of credit with a fixed-rate installment loan.

E-commerce fintech SellersFi secured a $300 million credit facility from Citi, leveraging the increasing popularity of alternative payments.