While AI seems to be everywhere these days, one place it is getting real traction is in the compliance space.

There is a lot of manual, repetitive work in the compliance teams at large banks and fintechs. Hummingbird is looking to ease that burden with the launch of a new AI-based compliance tool.

·

It was not a question of if it would happen, just when. Well, now it is official. Today Lending Club...

The top five stories in fintech this week as featured on the Fintech Nexus 5 are from CFPB, JPMorgan and Mastercard, The State of New York, The Federal Reserve and Plaid

·

Every Saturday I bring you the latest news from the world of peer to peer lending. These are the best...

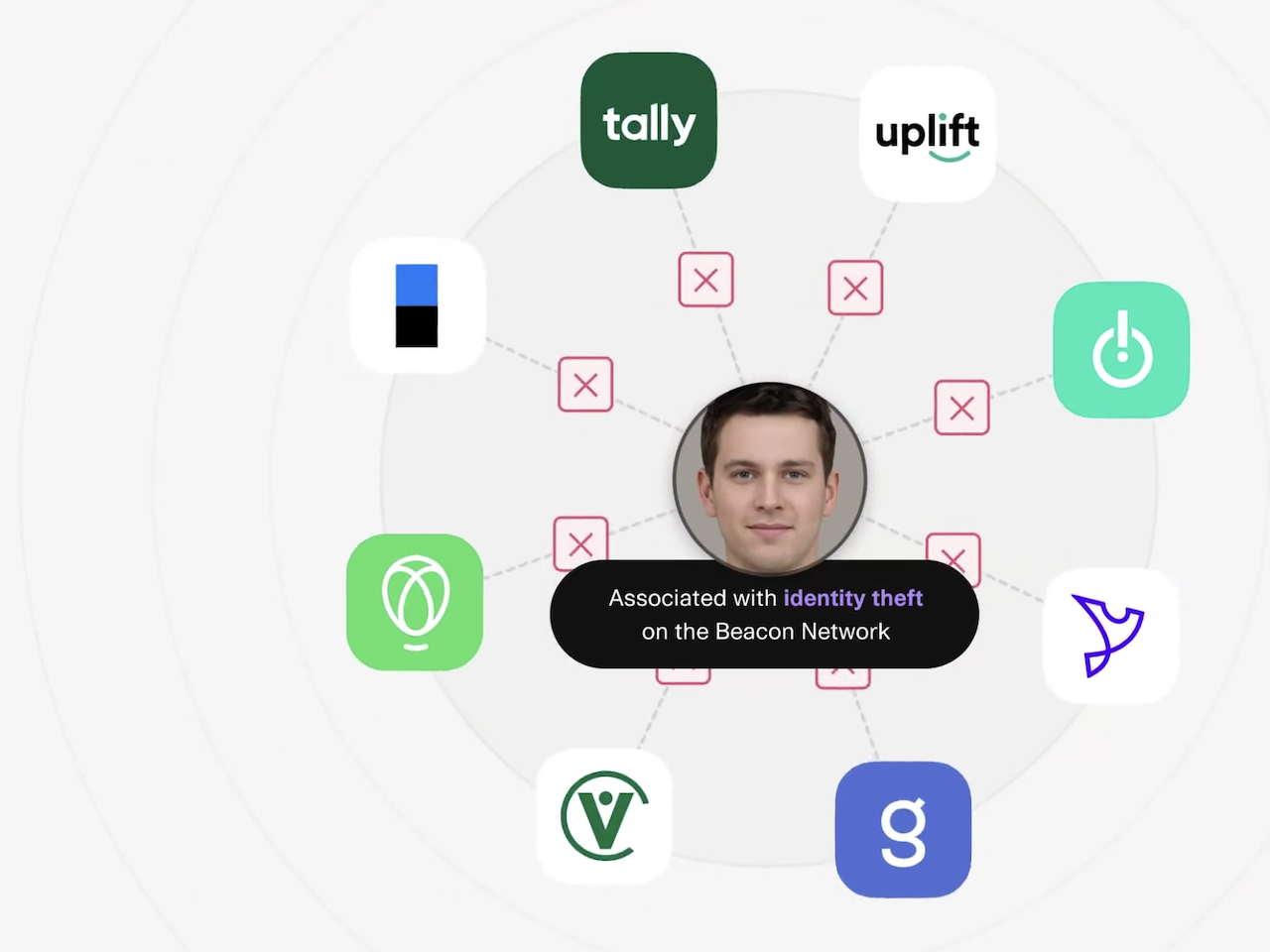

An announcement from Plaid, launching their collaborative fraud fighting network, Beacon, which is designed to "stop the chain reaction of fraud."

While the financial services world is woefully unprepared for the coming impact of quantum computing, Mario Galatovic has a few suggestions.

Over $70 trillion in wealth transfer is in motion, underscoring the need for institutions to invest in serving the needs of younger consumers.

Making news this week were First Republic Bank, Shopify, Cross River Bank, Wise, Coinbase, Binance.US, Klarna, First Republic Bank, Nubank, Congress and more.

Payment by bank account is a functionality that has existed for more than a decade in many countries. But it is still a relatively new phenomenon in the U.S.

With a message on Twitter and complaints of locked accounts, Crypto.com announced it was the first significant exchange hacked in 2022.