Sibstar supports carers in managing day-to-day money safely, giving them peace of mind as they continue to enjoy everyday activities.

·

Every Saturday I bring you the latest news from the world of peer to peer lending. These are the best...

Embedded finance and buy now, pay later (BNPL) are hotbeds of innovation, and Marqeta is in the middle of the action, CEO Simon Khalaf said.

·

If a financial institution looks beyond the hype of AI and tempers its expectations, it can use AI to deliver measurable business results. That’s been the experience of Amount’s director of decision science Garrett Laird.

One-on-one networking opportunities are a bread-and-butter highlight for many past attendees at Fintech Nexus USA.

Like many interested in the crypto space, Crapo has asked for months about the stablecoin report.

Global warming's associated effects are posing an increased risk to financial institutions worldwide. The Basel Committee has issued guidelines to help mitigation

Cambridge announced a joint research effort between the Cambridge Center for Alternative Finance and 16 private sector leaders.

Despite the drop in funding and waves of layoffs, employee equity remains a priority across the US and Europe.

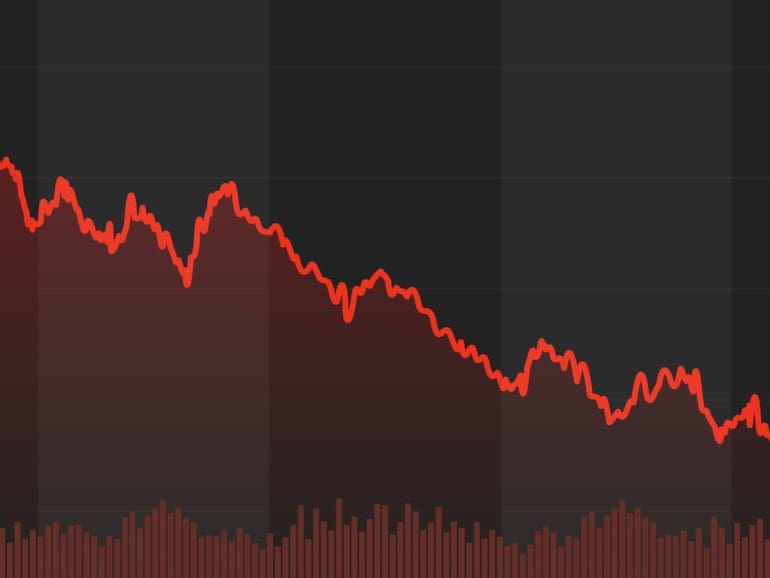

One quarter into 2022 and results from top fintech public companies are not pretty: regardless of revenue, prices crashed.