Chime is getting into the earned wage access business.

The leading digital bank announced yesterday that it is launching MyPay, a new earned wage access service that will allow customers to access up to $500 of their paycheck before payday.

A new Financial Health Network study shows a circular relationship between financial health and mental health.

We learned back in February that Klarna's AI chatbot was doing the work of 700 people.

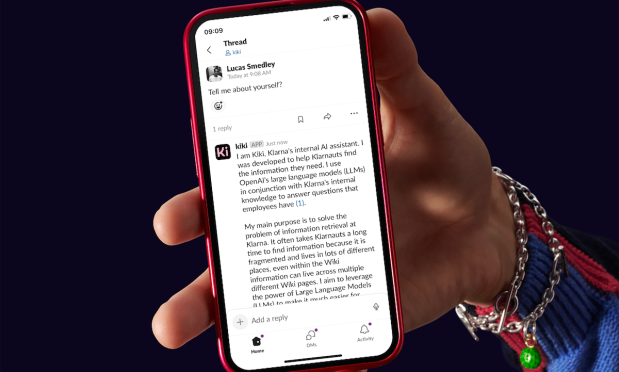

Today, Klarna is reporting about its employee's internal use of AI. It's internal AI assistant, named Kiki, is answering 2,000 employee questions a day and over 87% of its employees are now using it.

Findings from AI-powered tax-filing product april’s 2023 customer impact study suggest customers are receptive to a self-guided, mobile-first process.

As the digital economy expands, chargebacks will remain a vital consumer protection tool. The onus is on financial institutions to adapt to this changing landscape, ensuring that chargeback processes are efficient, transparent, and aligned with the evolving needs and expectations of consumers.

While the AI hype cycle continues, we are starting to see real fintech products come to market using this new technology.

Today, core banking provider Temenos has announced the release of its Responsible Generative AI solutions for core banking as part of its "AI-infused banking platform."

As 43% of Generation Z and millennials increase credit card spending, it's an incentive to learn the preferences of this influential group.

The fintech soap opera that is the Synapse saga took another turn yesterday.

We learned less than three weeks ago that TabaPay was acquiring Synapse out of bankruptcy. Now, that deal appears to have fallen apart as disagreements between Synapse, Evolve Bank and Trust and Mercury remain unresolved.

Jifiti is quietly shaping the future of embedded finance by working strategically with banks to deliver personalized solutions.

Financial institutions are grappling with increasing cybersecurity threats due to heightened cloud adoption and technological sophistication. To combat these challenges, financial institutions must take proactive measures to protect themselves. Red Hat’s Dr. Richard Harmon provides insight on three key measures that can mitigate risk: collaboration, automation and standardization.