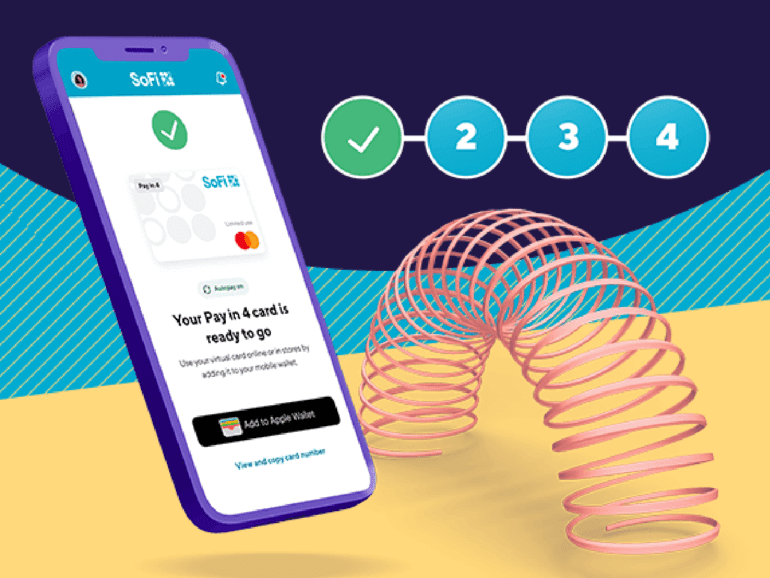

SoFi is the first bank to begin 'Pay in 4' within the Mastercard Instalments program that began in Mid-December.

Cortex collaborates with several fintechs and giants of the financial market in Brazil, such as BTG Pactual and XP.

Quontic punches above its weight 13 years after launching as a community bank on Long Island, and it recently launched in the metaverse.

Itaú joins the digital banking frenzy with "Itu," a digital banking initiative in Chile offering a virtual account and a debit card.

Cambridge announced a joint research effort between the Cambridge Center for Alternative Finance and 16 private sector leaders.

The real estate market is a rocky road for first time buyers. Nationwide has invested in Kettel to improve access.

·

Normally, every Saturday I bring you the latest news from around the web about p2p lending. Today, I will do...

Nubank is doubling its bets in crypto technology. The neobank announced plans to develop its virtual token to drive a loyalty program.

Mercado Libre launched Mercado Coin, its first-ever token that will be initially available in Brazil as part of its loyalty program.

Open Lending's latest research, "Loans Within Reach: Lending Enablement Benchmark 2023," surveyed 95 automotive lending leaders at U.S. financial institutions to understand their current challenges and how technology is helping them adapt.