On Friday, the CFPB announced it was suing mobile peer-to-peer lending platform SoLo Funds for multiple issues.

SoLo Funds targets minority and other underserved borrowers with short-term loans of up to $575. This is a challenging population to serve and a difficult niche to profit from.

The FIS Fintech Accelerator 2024 will see 10 startups meet with business leaders, scale their products, and develop a market-centric value proposition.

A new report from the Financial Health Network reveals that governments and businesses have almost three trillion reasons to close the financial gender gap.

With a message on Twitter and complaints of locked accounts, Crypto.com announced it was the first significant exchange hacked in 2022.

Money Laundering is a perpetual thorn in the side of financial institutions. BIS reports that AI and use of networks could be way forward.

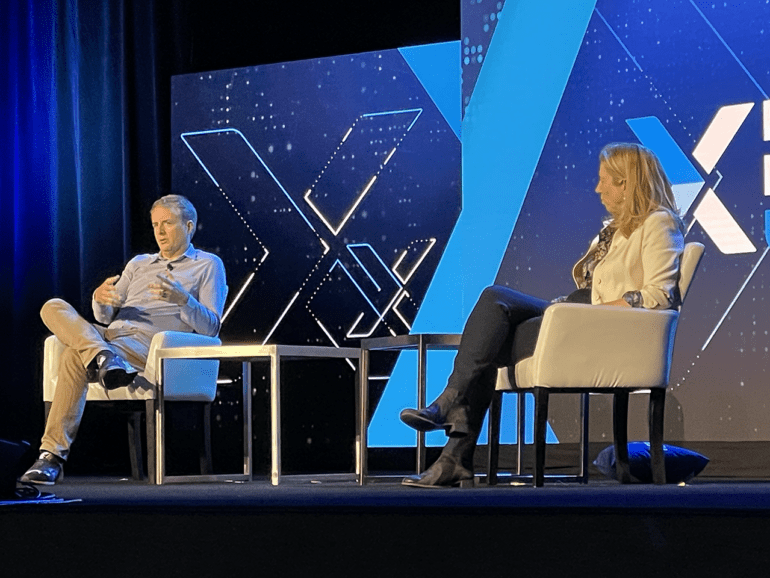

'If you have the right business ball on the right day and in the right situation, there is capital going to certain companies'

We've amalgamated all of the content from the news.lendit site here, including the full archive dating back to 2016 as an evergreen research resource.

The financial services industry's approach to third-party risk management is changing in response to an increasingly complex environment.

It is unsurprising that the UK has embraced the financial market shift to fintech, but where do they stand on a global scale?

·

Every Saturday I bring you the latest news from the world of peer to peer lending. These are the best...