The ECB announced the results of their two year digital euro investigation. Many questions still stand. They have decided to move forward.

While there will likely be a change in how organizations use sanctions as a tool, their increased use looks to continue.

·

Every Saturday I bring you the latest news from the world of peer to peer lending. These are the best...

Just a month away, USA 2022 is shaping into LendIt's the most successful event yet. Here is a sneak peek at the featured speakers.

The Wall Street Journal is reporting that Apple has indeed decided to move on from Goldman in roughly 12 to 15 months. This will mean both the Apple Card and the savings account (that was rolled out just a few months ago) will need a new banking partn

LendIt Fintech has added a new in-person event in Europe called Merge: Where Banking and Fintech meet Web3.

A new article from global payments processing company DECTA describes the vast opportunities available in contactless payments, along with some of the security challenges which must be addressed.

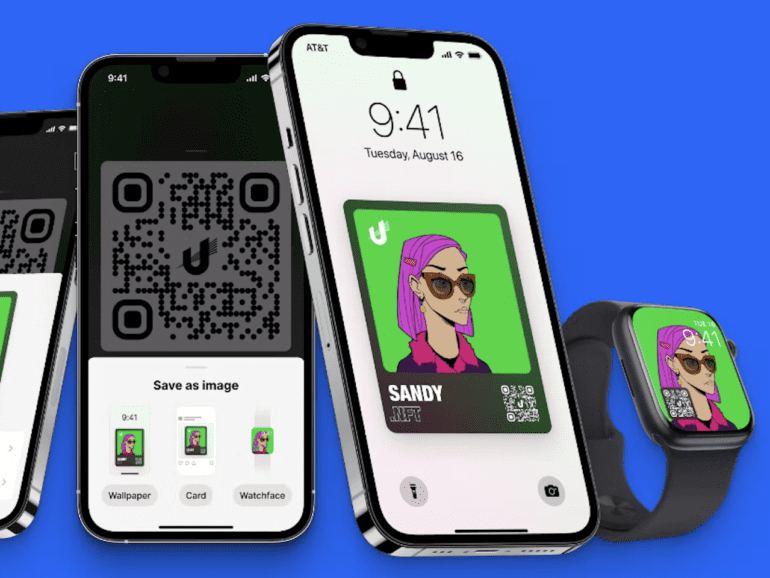

With accessibility long being a barrier for most mere mortals to enter Web3, Unstoppable Domains has launched an app to break it down.

F-Prime's latest state of fintech report shows a sector being refined towards genuine disruption. Valuations are down, but not all is lost.

Fintechs are among the sectors contending with a shortage of cybersecurity professionals, where the global shortage is 2.72 million. This comes as the global cost of cybercrime in 2021 was pegged at $6 trillion.