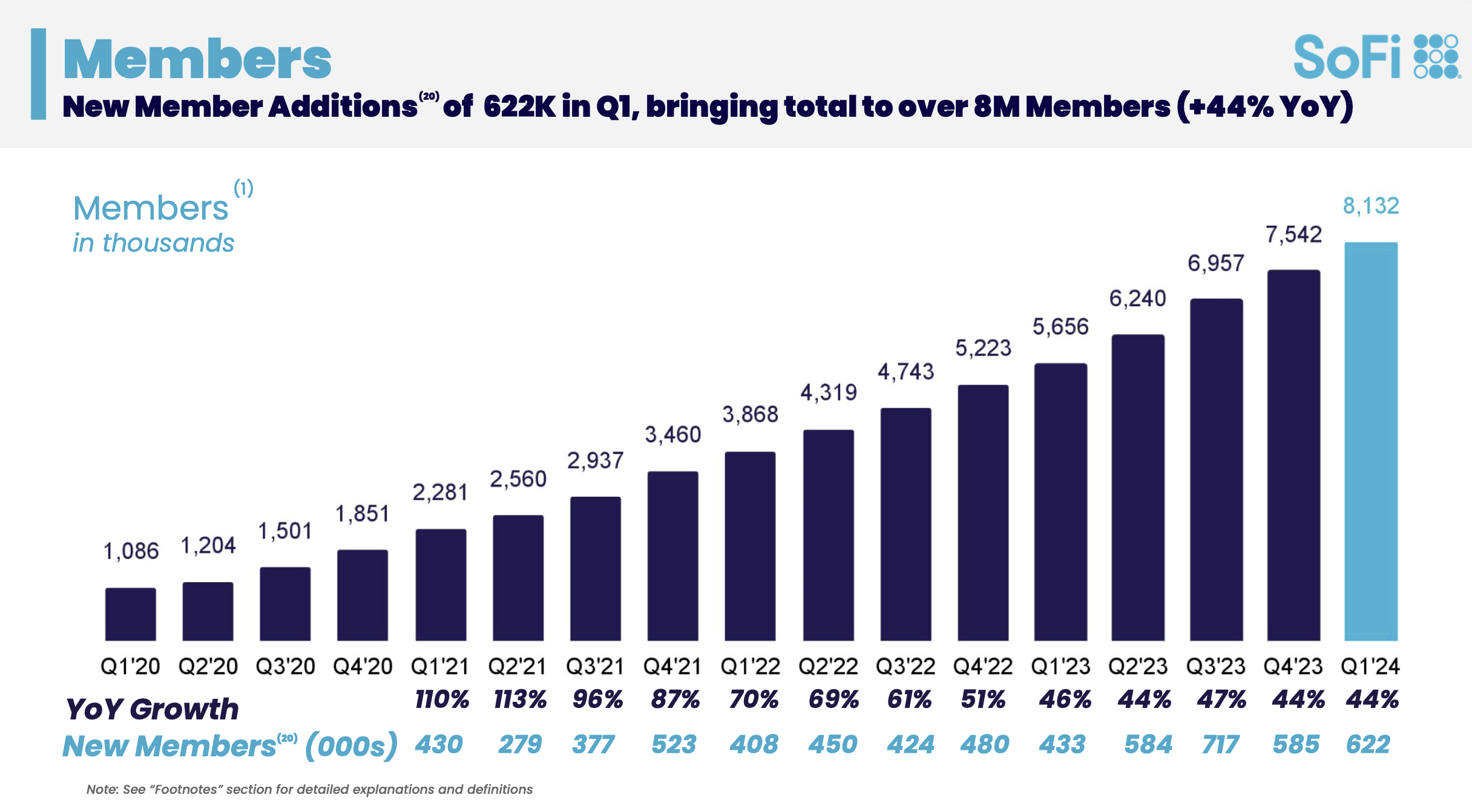

SoFi is the first publicly traded fintech to report earnings and it was a strong report with revenue, profit and member growth.

Caitlin Long, the CEO and founder of Custodia Bank, has been fighting for access to the Fed payments system for many years. Custodia first applied for a Fed master account in October 2020.

After her application was endlessly delayed, she sued the Fed to review her application. They eventually did and ruled against her. So, she sued the Federal Reserve again.

A report reveals that 9 in every 10 SMBs in the region are currently underserved. This presents an opportunity for Latin American fintechs.

Fintech Nexus Newsletter (April 26, 2024): SVB Financial Group’s $2 billion lawsuit against the FDIC

We haven't written about Silicon Valley Bank in almost a year, but the saga of the third-largest bank collapse continues.

SVB's parent company, SVB Financial Group, had $2 billion on deposit at its bank subsidiary. When the FDIC made it clear that all depositors would be made whole, one would assume that included the $2 billion of the parent company's money.

It is time for digital wallets to come into their own. They can and should be more than a payment method, they could become the financial

Until now, if you wanted to use the myriad of Stripe's product offerings, you had to process payments through Stripe. But that is no longer the case. At the company's annual conference in San Francisco yesterday, Stripe Chief Product Officer Will Gaybrick announced that the company is "extending our modularity to the very core of Stripe: payments processing."

More than two dozens neobanks are vying for digital customers in Mexico, Latin America's second-largest economy.

Today, Klarna announced an interesting new global partnership with Uber.

Klarna is now a payment option for Uber users in the U.S., Germany and Sweden. Interestingly, Klarna is not offering its typical Pay-in-4 payment method. Instead, this is for the Pay Now option that allows users to pay in full with their Klarna account in one click.

Results of a new survey from PayNearMe show demand for digital payment types and general dissatisfaction with the loan-paying process.

For businesses to improve customer experience it is important that data is not lost between entities in the payments chain.