A lack of financial literacy can be devastating to maintaining financial health.

The big problem is that most people find financial literacy programs boring and don't stick to it. Many fintechs and banks have tried to counteract this by creating gamified learning.

LendIt Fintech has teamed up with leading fintech firm Amount to put together a survey asking banks and fintechs about launching a BNPL credit product.

A new report from company builder and venture group Team8 shows it’s a good time for fintechs to pursue unicorn status, provided they do the groundwork.

According to Belvo, the new product will function as a gate for users to initiate payments directly inside third-party apps.

Watch the replay of our weekly news roundup show with hosts Todd Anderson and Peter Renton, with special guest Nicole Casperson.

If you work for a fintech planning to offer services in an emerging market, you'd be wise to take a few steps from DriveWealth's playbook.

Sponsored

Sponsored content is a type of promotional media paid for by an advertiser but created and shared by a publisher. Fintech Nexus contracts sponsored content articles to experienced journalists comfortable in the fintech space.

By December 2022, PagSeguro had 28 million customers, making it the second-largest digital bank in Brazil.

Zelle has started refunding imposter scam victims, after years of banks questioning their responsibility to do so.

Yesterday, the OCC issued new guidance for banks, addressing the risks of buy now pay later lending. The guidance focused on the popular "pay in 4" segment of BNPL.

Not surprisingly, the national bank regulator recommended tight oversight of third-party servicers, the importance of transparent loan terms and fraud mitigation.

·

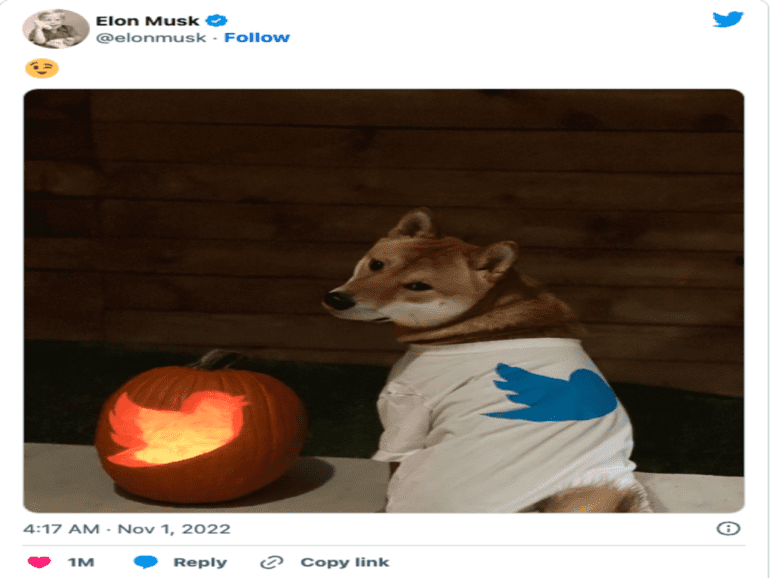

Changpeng Zhao explained he has yet to ask Musk for a detailed plan but that charging for comments and blue ticks are both in the pipeline.