For entrepreneurs looking to overcome these challenges, revenue-based financing is a compelling alternative.

iCred will use these resources to expand its operations and enter the payroll loan market for the beneficiaries of the social security fund.

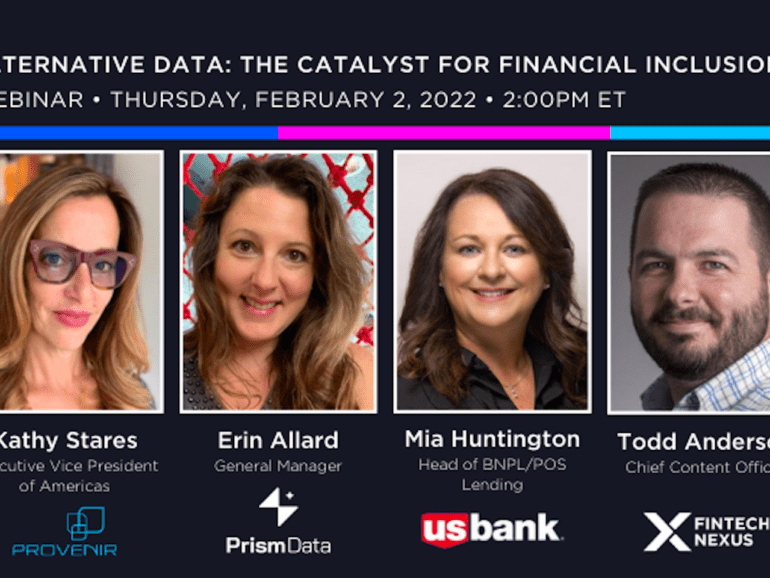

Alternative data could be critical to financial inclusion, but industry experts say it isn't all plain sailing. Find out why.

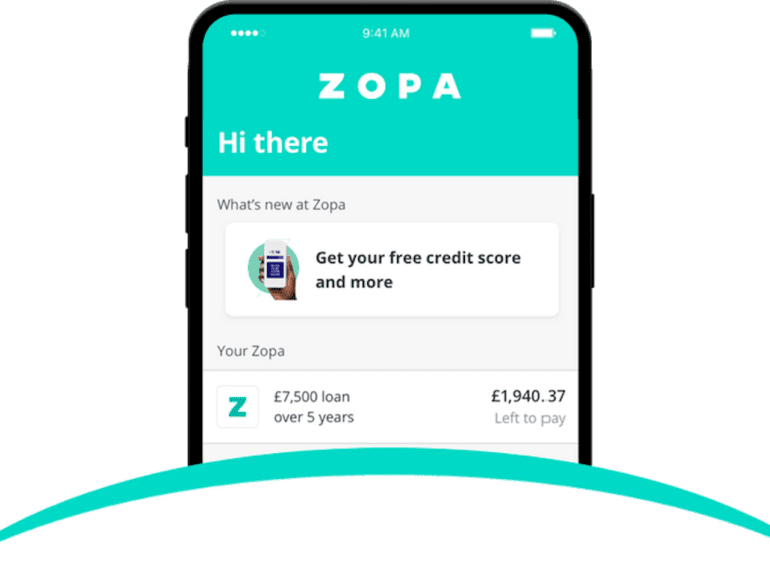

Fintech funding rounds of this size are few and far between- Zopa plans to use the investment to further its plan to "be Britain's best bank."

Nubank announced it was no longer serving its clients with investment advisory, cutting its headcount by 40.

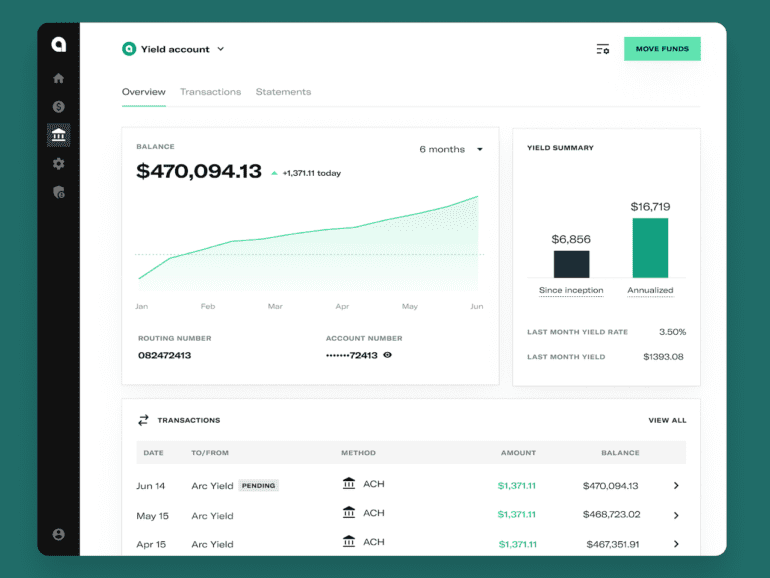

The day after The Fed announced yet another (albeit smaller) rate hike, Arc launches a high yield account so startups can gain on idle cash.

·

Comply Advantage has found that the majority of businesses are bracing for worsening financial crime in 2023.

In the latest Arthur D. Little (ADL) report on cryptocurrencies, study authors suggest the creme of the crypto crop will float to the top while the dregs will get dumped in the slop bucket.

To help curb the effect of inflation and recession on the bottom line, the key is to challenge the internal costs, more specifically, the internal costs of the purchasing chain and processes.

This year has already seen some major shifts in focus for the BNPL market- should banks be concerned about the B2B focus?