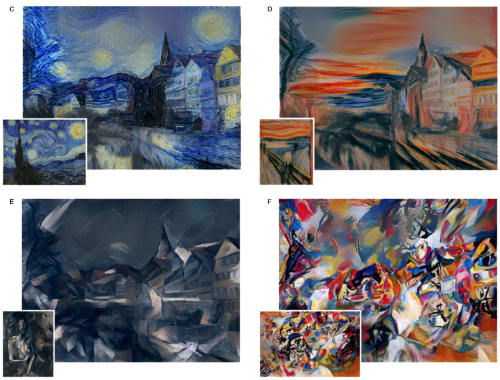

However, mastery is not immune to automation. As a profession, portraiture melted away with the invention of the Camera, which in turn became commoditized and eventually digitized. The value-add from painting had to shift to things the camera did *not* do. As a result, many artists shifted from chasing realism to capturing emotion (e.g., Impressionism), or to the fantastical (e.g., Surrealism), or to non-representative abstraction (e.g., Expressionism) of the 20th century. The use of the replacement technology, the camera, also became artistic -- take for example the emotional range of Fashion or Celebrity photography (e.g., Madonna as the Mona Lisa). The skill of manipulating the camera into making art, rather than mere illustration, became a rare craft as well -- see the great work of Annie Leibovitz.

We’ve had this write-up in some various mental states floating around for a while, and better done than perfect. So treat this as a core idea to be fleshed out later.

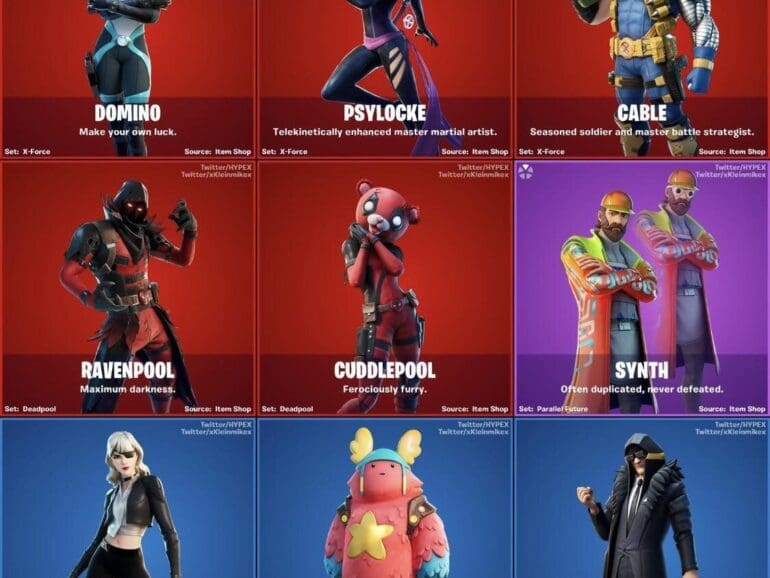

Payments and banking companies should be looking at how people purchase and store digital goods and digital currency in video games. That experience has been polished over 40 years, and is what will be the default expectation for future generations.

For those interested, here is a website that collects user experiences of shopping across hundreds of designs.

We discuss the Facebook pivot into the metaverse and its rebrand into Meta. Our analysis touches on the competitive pressures faced by the company from big tech players, other ecosystem builders, and limits to growth for a $1 trillion business that likely motivated this refocus. We further dive into network effects around platforms, and why super apps and financial features are attractive, and how owning the hardware is a required defensive strategy. Lastly, we discuss these development through the crypto and Web3 lens, deeply disappointed with Facebook trying to domain park a generational opportunity with a centralized solution.

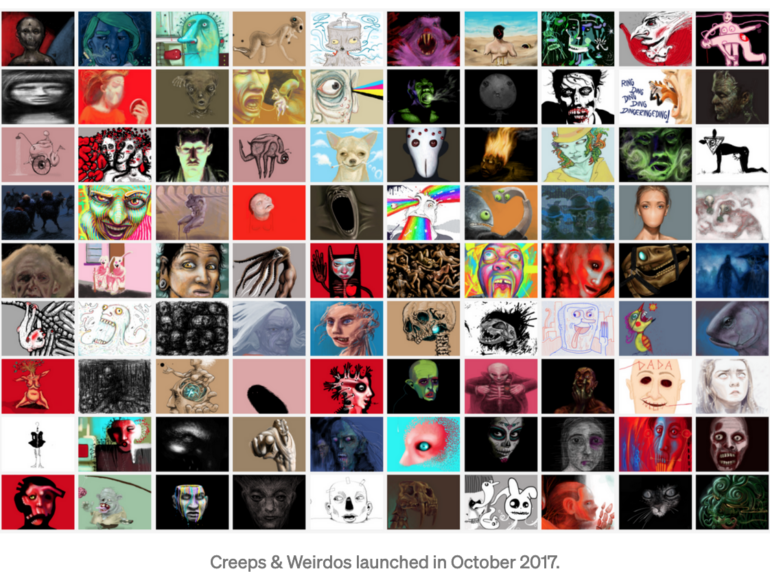

In this conversation, we talk with Beatriz Helena Ramos – artist, entrepreneur, film director, producer and illustrator – the mind behind DADA.art. DADA is “a space where everything is about cooperation and solidarity, which are amazing ways to allow self-expression, as well as constant inspiration. Additionally, we provide simple tools to encourage creativity, and erase intimidation.”

More specifically, we discuss Beatriz’s journey to creating DADA, decentralized power structures, community-inspired creative collaboration, assymetric rewards in NFT markets driving new value distribution methodologies, DADA’s latest project called “The Invisible Economy”, and technology-inspired and centric approaches to empower artists in the future.

In this conversation, we chat with Erick Calderon is the founder and CEO at Art Blocks, a platform for creating on-demand, generative art pieces. Since its launch a year ago, Art Blocks has garnered the attention of many, including auction house Sotheby’s, which recently sold 19 of the platform’s pieces in a deal totaling $81,000. Calderon, a native Houstonian, uses the online handle Snowfro, which stems from a snow cone stand he used to own.

More specifically, we touch on projection mapping, generative vs. algorithmic art, machine learning, smart contracts, the constructivist art movement, Artblocks’ unique approach to NFT algorithms and minting, NFT flipping vs. scalping, gas price wars, flashbots, dutch auctions, and the massive demand for anything Artblocks in the world today and the justifcations behind such demand.

In this conversation, we talk with Michael Sena of uPort, 3Box Labs, and The Ceramic Network about web3.0, decentralized identity, and the various standards that he has been implicit in creating. Additionally, we explore the nuances around data ownership and identity, the journey from founding uPort to now 3Box and the Ceramic network and how the practical implementation of these ideas has changed as the decentralized web has changed from Web2.0 to Web3.0, and conclude on how the metaverse will be composed of decentralized identity and the protocols on which it travels.

In this conversation, we talk with Jamie Burke of Outlier Ventures. This is a fascinating and educational conversation that covers frontier technology companies and protocols in blockchain, IoT, and artificial intelligence, and the convergence of these themes in the future. Jamie walks us through the core investment thesis, as well as the commercial model behind shifting from incubation to acceleration of 30+ companies. We pick up on wisdom about marketing timing and fund structure along the way.

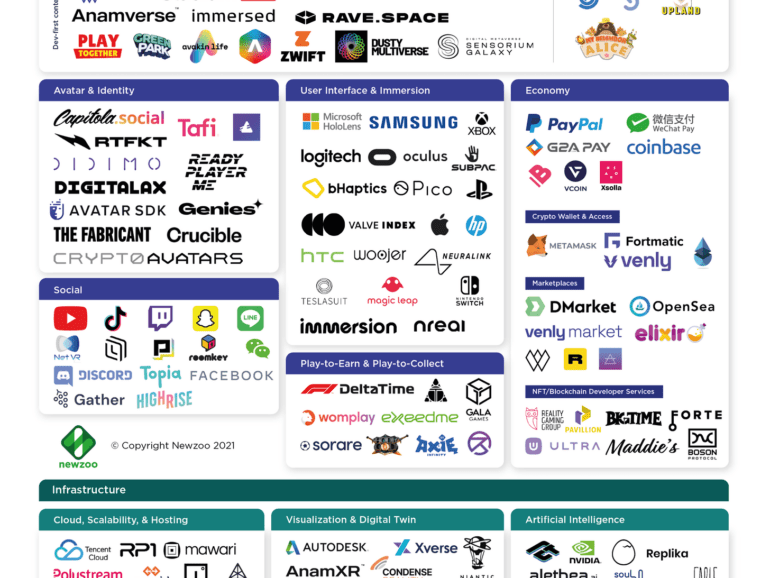

In this conversation, Cris Sheridan, who is the Senior Editor of Financial Sense and Host of FS Insider, leads the conversation around the basics to understand the exciting new digital universe, more commonly known as The Metaverse.

More specifically, we discuss all things VR & AR including social media’s proliferation into the sector, Millenial vs GenZ behavioural approaches to the metaverse, the creator economy, NFTs, Axie Infinity, Mr Beast, Computational Blockchains, Decentralized Autonomous Organizations (DAOs), ConsenSys, MetaMask, and Ethereum vs Institutional Finance (Schwab).

This week, we look at:

How the medical reality is accelerating remote work and digital commerce, including the success of buy-now-pay-later companies like Affirm and Klarna

The emergence of virtual worlds and video game environments that generate $ billions in revenue and have millions of participants, with examples of Zwift, Fortnite, Tomorrowland, Roblox, Genshin Impact

How to connect digital environments to digital communities and their economic activity, including through mechanisms like non-fungible-tokens in Rarible and Async Art

Advice for shifting thinking from manufacturing financial product, to starting with the customer, to leveraging the community

A few delicious morsels for us today, connecting ideas between the automation of the institutional art world, and the rise of non-fungible token art. We are surprised by how things are clicking.

We caught up recently with Lori Hotz of Lobus. Lori used to work in the wealth and investment management businesses of Wall Street (Lehman, Lazard) and comes to art with a background of asset allocation and investment assets. One core narrative in wealth management has of course been roboadvisors and digital wealth, and the automation of the financial advisor process. Whether you are doing client experience, CRM, financial planning, trading, or performance reporting, there are now lots of platforms for everyone from mass-retail to ultra-high-net-worth and family office advisors.