The Brazilian fintech Nubank confidentially filed for IPO at a $50-billion valuation.

It will lead the challenger bank IPO pack. Other fintechs are not far behind in valuation. Rumor has it fintech Chime plans to go public by March 2022, at $35 to $45 billion.

It’s not just those two: many of these firms have aimed to go public in the vague “end of 2021/ early 2022/ when we have enough money” time frame while participating in increasingly rare-letter funding rounds, like Fs and Gs at dramatically large numbers.

Chime raised $1.1 billion in an August series G, at a cool $25 billion valuation. From January through June, Nubank raised a whopping $1.1 billion series G to match $30 billion V.

Contemporaries are right behind them: N26 raised $900 million in a Series E, Varo raised $510M in an E– doubling the total money raised since its founding, and Revolut raised $800 million over the summer. Whoever these firms employ to raise capital should be applauded.

At these prices, are challenger “bank” IPOs going to be the next SPACs, BNPL, or NFTs, or is it another mass hysteria event like WeWork?

What about performance?

By comparing Nubank to Chime, the American runner-up, not all challenger banks are valued equally.

When it comes to revenue, Nubank posted its first profitable quarter this year, making about $13 million from its credit card payment sector. Chime reported it was on track to close a billion in revenue this year, primarily through interchange fees, split between Visa and Chime when customers use Chime debit cards.

CEO Chris Britt told Forbes the company turned a profit last year, “But we are not optimizing for that because there’s great growth opportunity ahead of us.”

They are archetypes of the neobank crowd, like Uber and tech-based platforms focused on growth over profitability.

According to Statista Research, Nubank has grown to about 40 million users across Latin America, up from 20 million last year. Chime’s user base is hard to estimate, mainly because it’s a private American company.

As late as February of this year, Analyst Ron Shevlin published research by Cornerstone Advisors that found Chime had grown by then to an estimated 12 million U.S. consumers- 8 million of whom saw the fintech as their primary bank provider. Moreover, unlike its international competitors, Chime does not have to post quarterly results, leaving all insiders to guess how things are going.

Nubank has an edge

Nubank might have a bit of an edge over Chime: there are more unbanked people in LatAm than in the U.S. By some estimates, there are 200 million who need no access to financial services in LatAm, compared to 14 million in the states.

Without a banking license, Shevlin wrote that Chime was a top-five primary bank service provider in America.

“I’m surprised they waited this long to go public given how far they’ve grown their user base and their product base,” Shelvin said. “Why did they continue to need to raise money? Maybe it was for technology development; maybe they were spending so much money on advertising and personnel had to raise money.”

The Chime service focuses on the underbanked niche of the market, Shelvin said. Chime offers mobile financial services like payments, paychecks, debit, and credit building accounts through partners Bancorp Bank and Stride Bank. Nubank offers more, from personal banking to loans, credit, and insurance. Just like Chime, however, Nubank is not formally a bank.

Chime is not a bank and lost the ability to call itself a bank in May, but its valuation has doubled since then. Shevlin said it services mainly an unbanked lower-income demographic, and its user count could now be closer to 20 million.

Challenger bank fund

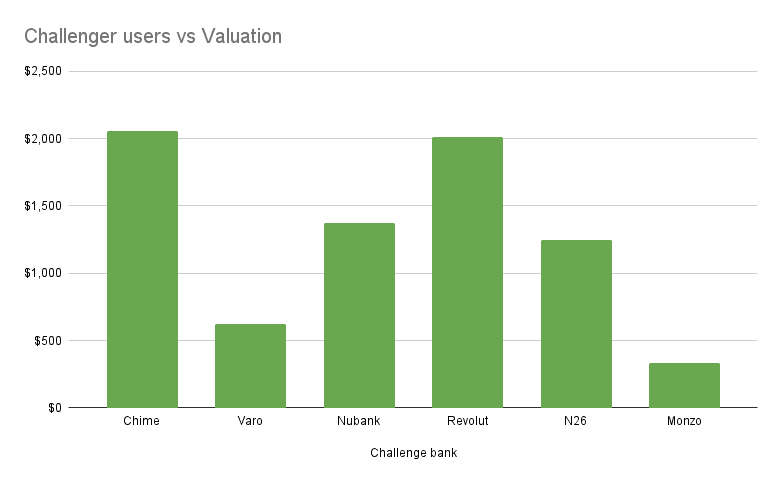

Based on Shevlin’s estimates, fintech writer Jason Mikula compared the valuations of a couple of neo banks and their customer amounts: he found Chime had one of the highest, more than $2,000 in value per customer. Nubank, based on new valuation numbers, has a value per user of $1,375.

However, as Mikula pointed out, Varo, a fintech bank with a banking license, is at the other end of the spectrum.

“Interestingly, Varo, which targets a similar user base to Chime but has the added benefit of a bank charter, comes in at a substantially lower $625 per user,” Mikula wrote.

Compared to revenue, Mikula found the challenger bank valuations are even further from reality.

“Monzo and Varo are valued at 15x and 16x revenue, respectively, while N26 is valued at 78x and Revolut at an astounding 108x revenue. If the numbers in this Forbes piece are to be believed, Chime is looking to price its IPO at a (somewhat!) more reasonable 35-45x revenue,”

Revolut, a UK-based bank — another financial cornucopia — was right up there with Chime at a high valuation to customers but is only now branching off into the U.S. from across the sea and applying for banking licenses.

Chime ‘a bit high’

Shelvin said that Chime’s high value per user might be too high. By definition, lower-income demographics are not high spenders, and they use financial products less.

“I give Chime a lot of credit for growing its business and carving out a niche, but their niche is low to middle-income,” Shelvin said. “From a financial services perspective, there’s just only so much money you can make off of low to middle-income consumers with financial services products.”

Most banks who serve these consumers make money off of them through penalties and fees, Shelvin said, like an overdraft.

Chime has an anti overdraft product that spots customers for their overdrawn amount up to $200 until their next deposit comes in.

When creating a lending product, Shelvin said that being successful in the debit world does not necessarily translate to credit.

“The other thing is that by definition again, their market isn’t the best credit risks.”

Looking at its long-term prospects, Shelvin expects many challenger “banks” and fintechs to add products and services outside of the banking space because, at heart, they serve their community rather than serve up financial products.

Compared to that future, Chime has a way to go. But Shelvin said that Chime might be a good buy compared to other neo banking fintechs coming onto the public scene.

“I think it is overvalued given their long-term potential is, but it may not be overvalued, in the context of all the other challenger banks that are out there.”

Last Thursday, WeWork finally went public, at a valuation of around $9 billion. It proved to be a fraction of the previous $47 billion valuation.

A spokesperson for Chime declined to comment. Nubank did not respond to contact attempts.