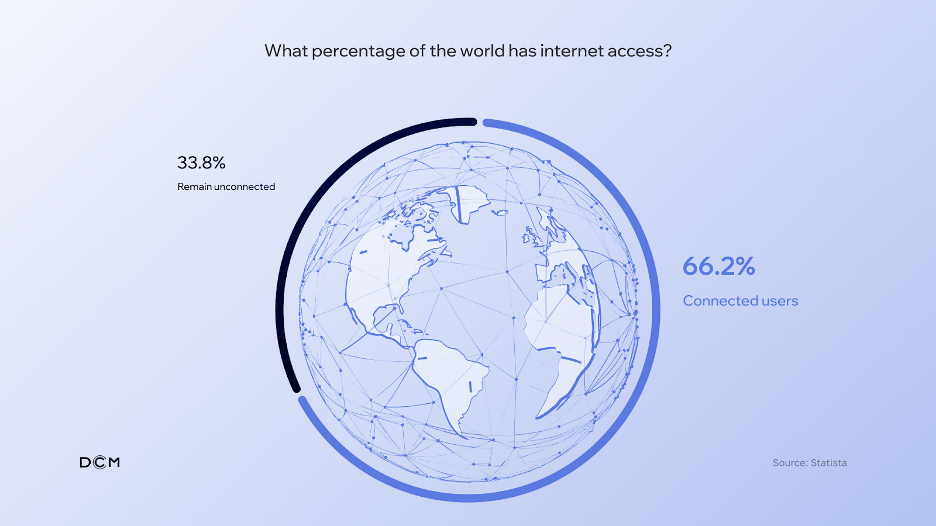

Access to the internet already seems something widely accessible and ordinary. Most of our daily activities, including remote work, communication with friends and relatives, payments, and more, depend on this facility. But is it as accessible as we think? You may be surprised, but only 66.2% of the population globally has access to the internet. Consequently, around 2.65 billion people don’t have access to online services and, most importantly, to digital banking and similar services.

The problem may seem distant; however, I’m not talking about some emerging economies here. Almost six million Americans are unbanked. Meanwhile, 1.4 billion people outside of the US don’t have or can’t have a bank account. So, in the times when we tap or scan to pay, and businesses refuse to take cash, those people find themselves cut off from the civilized world.

The dependency of digital payments on the internet or telecoms connectivity is a big problem. While we hear lots of talks about racial wealth gaps and gender-based income inequality, financial exclusion is kept low on the agenda. However, the latter is one of the contributors to global poverty, where people can’t access digital financial institutions to save, invest, or borrow. They aren’t welcome in the digital-first world and are forced to apply to alternative financial organizations, pay high fees, get buried in this vicious poverty cycle, and use cash. Worldpay’s Global Payments Report 2024 found that cash transaction value totaled $6.1 trillion in 2023, compared to $6.7 in 2022. Let’s admit it: the YoY difference of 8% is minimal.

Tapping into offline digital payments, still not

Developing offline digital payment solutions could significantly address the issue of financial inclusion. However, that is easier said than done. The concept in a nutshell looks promising, but it faces operational, security, and technological hurdles. These solutions represent an untapped market with substantial potential, highlighting the need for further research and development to quantify this opportunity accurately.

Moreover, we shouldn’t forget the complexity and expense of existing banking methods. Current transaction fees are still so high that they can easily eat up a large percentage of a small transfer or payment of a low-income individual. I hear you saying that it is another vicious cycle, but it is not the case. The problem is that we are trapped in a narrow mindset regarding the forms and ways of payments.

Playing trump cards: modern technologies as offline payment enablers

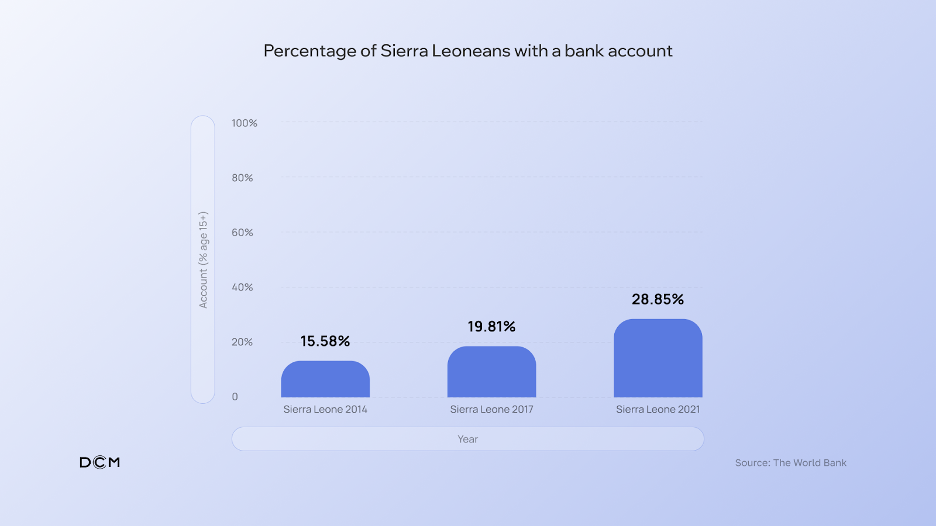

The case of Sierra Leone’s journey towards financial inclusion has emphasized the role of digital financial services in overcoming barriers to banking. In 2014, when the country started receiving tech assistance and grants for digital financial services, only 15.58% of adults had a bank account, despite dozens of commercial/community banks and multiple financial institutions present in the country??. In 2021, after the first phase of the National Strategy for Financial Inclusion project, those numbers reached 28.85%. In 2023, the government launched the National Payment Switch—a financial infrastructure enabling payment interoperability among banks, fintechs, and other institutions.

Admittedly, much work is ahead, but Sierra Leone’s case is another proof that modern technologies are the accelerants of inclusive financial services. The use of blockchain technology, Central Bank Digital Currencies (CBDCs), and stablecoins could be pivotal in implementing offline payment infrastructures. These technologies offer a foundation for affordable, secure, and accessible financial services for unbanked populations. How can they make it possible?

Enabling offline transactions for the ‘not-so-digital’ world

There are various strategies for offline digital payments, including near field communication (NFC) wallets, QR codes, and token-loaded notes. Each approach has its own set of challenges and considerations, including device dependency, infrastructure needs, and the need to integrate these technologies into current financial systems. So, let’s look closer at each of them.

- Near field communication (NFC) wallets, cards, and devices that contain balance data and are able to wirelessly share it with other devices in close proximity. Offline NFC payments are supported by some apps and cards; however, they mainly offer limited functionality or allow transfers within a certain limit. Challenge: The need for a device that activates and supports NFC technology.

- QR code as a payment carrier is a more convenient and inclusive way to enable offline payments. In most cases, consumers may face specific limits related to the amount or number of offline transactions introduced for security reasons. Plus, QR-code payment still requires a wallet to store balance data and infrastructure to lock the transaction amount. But despite that, it is the best way to process offline payments so far. Challenge: The need for technology to read or process QR codes.

- Token-loaded notes—a blockchain offline wallet to store assets, aka Ledger wallet, in the form of a banknote or any other convenient carrier that can be loaded with currency to spend offline by handling the note to another person offline, like traditional cash. Though it is the most futuristic but yet reliable way to enable offline payment using digital money as they can easily be transferred from such note-based wallets to digital wallets and vice versa. Challenge: The need for NFC or special minting devices.

The role of blockchain in promoting financial inclusion

The top-priority task for technology companies is not about giving the unbanked access to traditional banks. In most cases, low-income people won’t meet their criteria, such as fees, minimum balances, credit scoring, or others, and thus remain unbanked. The goal here is to provide an alternative way for them to access the advantages of the digital economy. Blockchain technology not only supports the development of digital payment solutions but also plays a critical role in enhancing economic conditions for unbanked populations. Digital banking, credit, and retirement savings may become accessible to even more people globally, ensuring stability and financial security.

Blockchain-enabled solutions can facilitate secure and efficient transactions, thus removing barriers to financial inclusion. By doing so, companies can foster and support more sustainable and equitable economic development.