Last quarter the the big news for OnDeck was the creation of their technology subsidiary called ODX, a platform that houses their lending as a service offering. While OnDeck has had a longstanding partnership with JP Morgan Chase it showed a renewed focus on that side of the business and a look into what the future at OnDeck may look like.

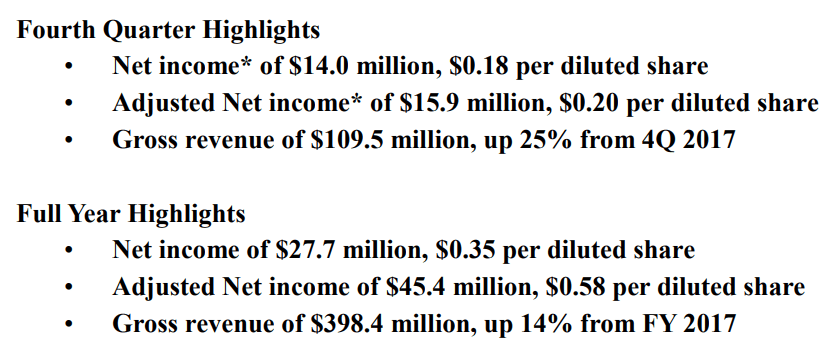

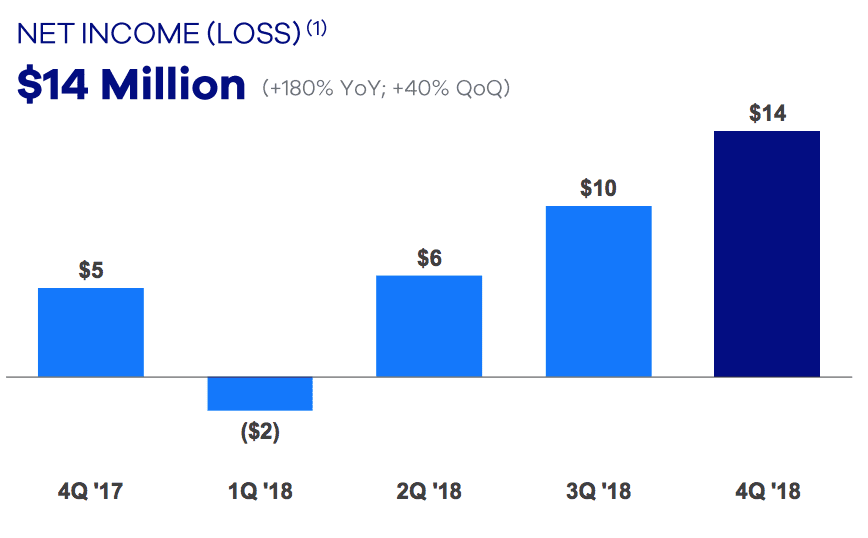

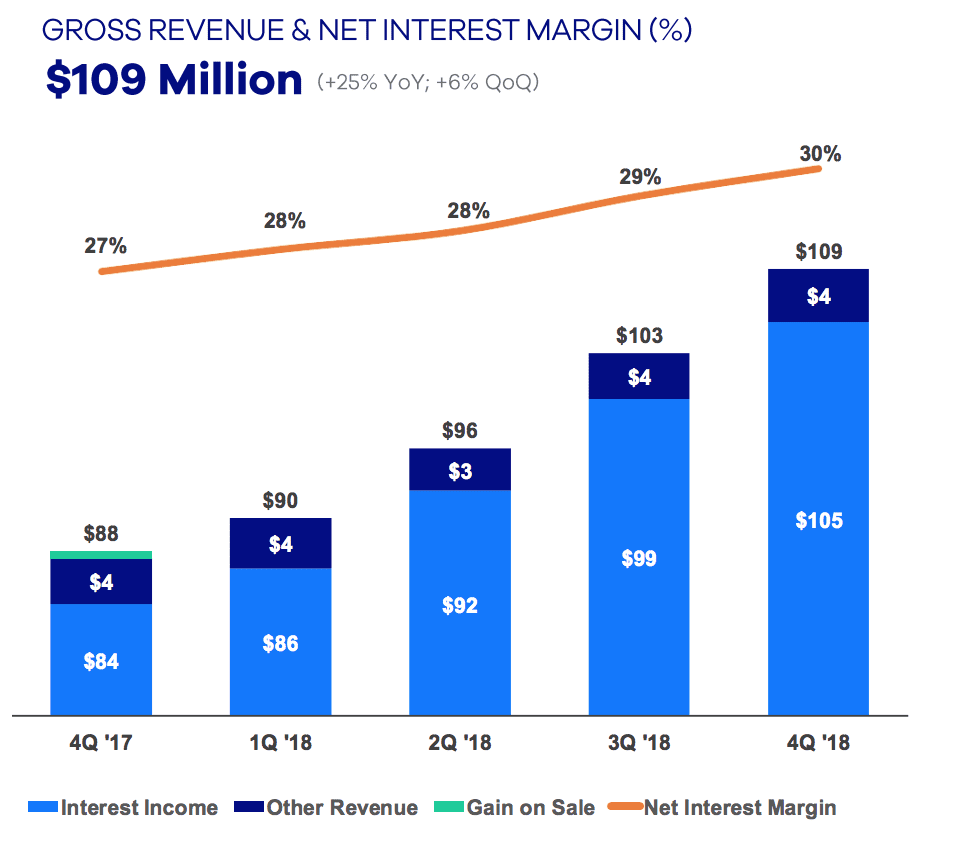

The company achieved much of what they set to do in 2018 and posted another solid quarter as they rounded out the year. Q4 2018 net income came in at $14 million on gross revenues of $109.5 million. The company ended the year with a total of $27.7 million in net income. Below is a snapshot of their Q4 and 2018 full year highlights.

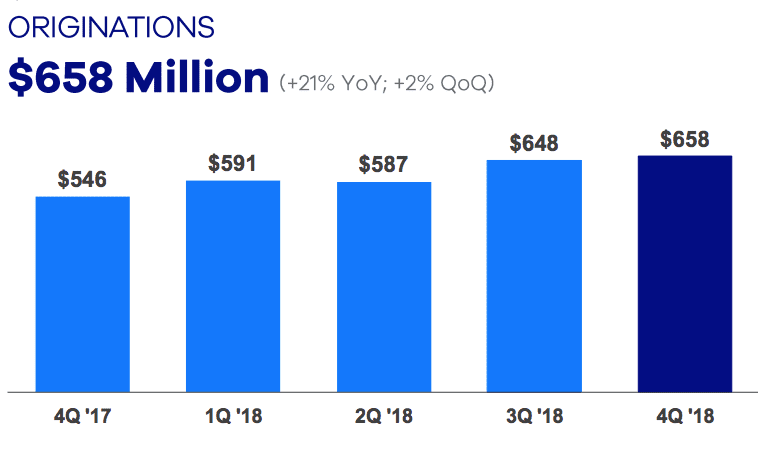

After coming off a tough Q1 2018, the company turned the rest of the year around and moved well into profitable territory. What has been a main driver of profitability for the company has been decreasing funding costs since Q2 2018 even as originations have increased and interest rates broadly have increased. Sales and marketing expenses as a percentage of originations have also held steady at 1.7% for Q4. As of Q4 2018 the company still had $246 million of excess debt capacity.

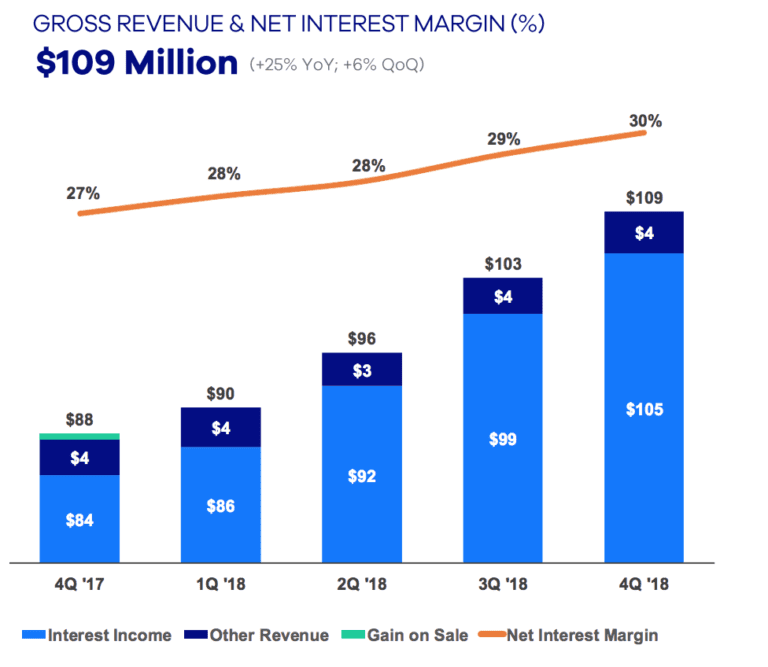

You can see below how OnDeck has been able to consistently increase revenue over time even as their business model shifted. Gain on sale revenue, or loans sold to investors was just a small sliver of revenue back in Q4 2017. What I imagine many investors are keeping a close eye on is the other revenue category which has remained stagnant over the past year.

It appears as though the partnership with OnDeck hasn’t yet resulted in a meaningful increase of revenue. OnDeck noted that JP Morgan Chase volume increased in Q4 after a dip both in Q2 and Q3. ODX is slated for a full rollout in 2019 and OnDeck plans to expand their work with PNC, which was announced late last year as their second bank partner. Commenting on the pipeline of bank partnerships through ODX, CEO Noah Breslow noted that the pipeline has strengthened since the last earnings call and there is a mix of large scale banks and mid-sized to smaller banks which have entered the pipeline.

On the origination side, the company increased volume $10 million sequentially. OnDeck did share that they saw an increase in charge offs and delinquencies in Q4 which were attributed to some selective testing the company was doing. They have since ended these tests and kept the ones that were performing well.

Looking forward there are a few interesting things happening at OnDeck. While it won’t have a meaningful impact on their business in 2019, OnDeck recently announced they were entering the equipment finance space. OnDeck also has their Australian business which is not often talked about. They grew their portfolio organically 80% in 2018 albeit this is likely off of a smaller base. Last December OnDeck shared they were merging their Canadian business with Evolocity Financial Group creating OnDeck Canada which will be the second largest online small business lender in Canada once the deal closes midyear.

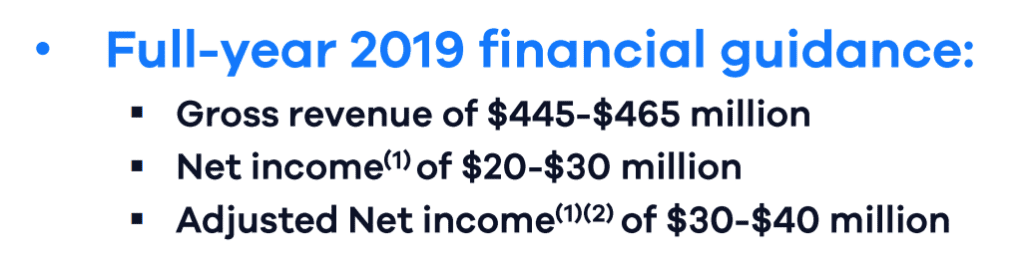

OnDeck provided the below guidance for Q1 2019 and the full year.