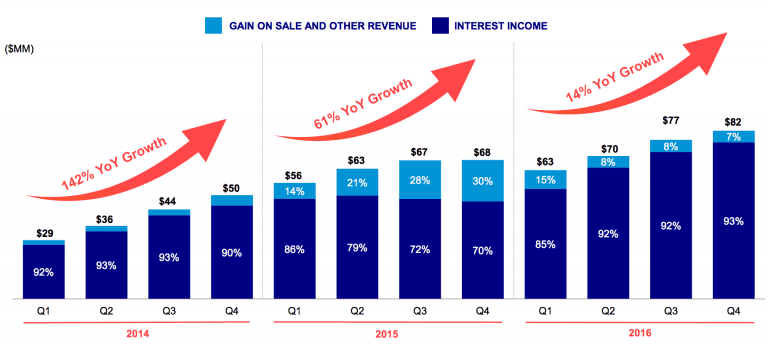

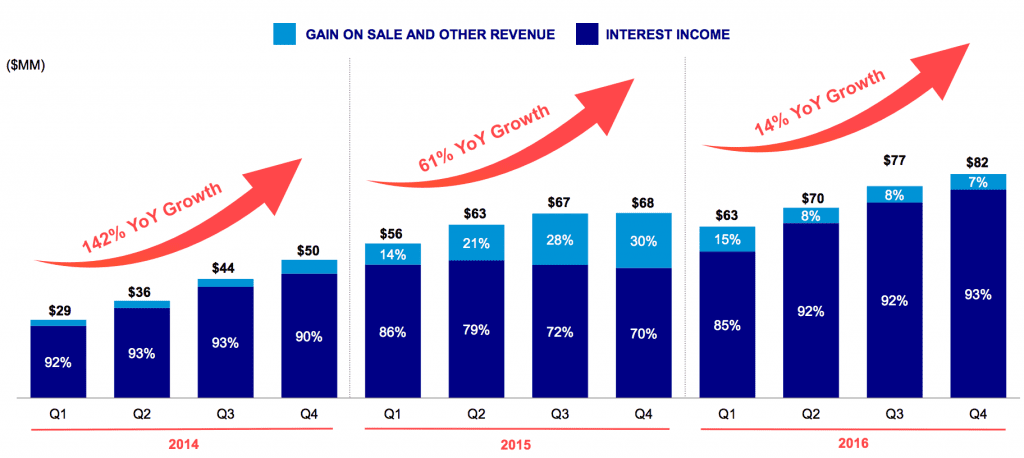

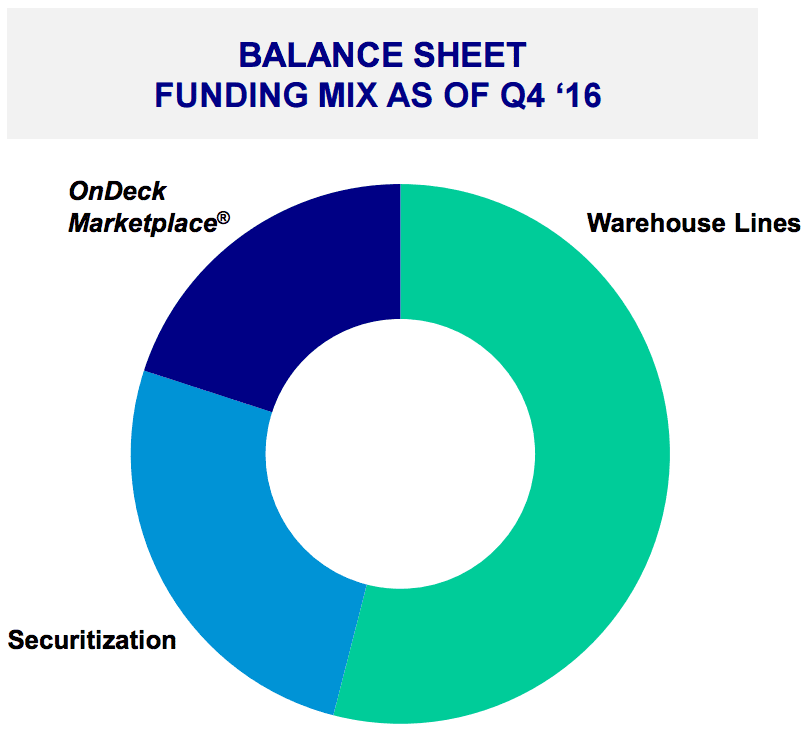

This morning OnDeck shared their Q4 2016 and full year 2016 financial results. Originations grew in Q4 by 13% to $632 million and gross revenue grew by 21% to $81.8 million. The company originated a total of $2.4 billion in small business loans in 2016. According to the press release the increase in gross revenue was driven by higher interest income (totaling $76.1 million) as OnDeck continues to hold a majority of loans on their balance sheet. Revenues were offset by lower gain on sale revenue ($1.8 million) as a result of this continuing trend for the company. To give a perspective on how the business has shifted since Q4 2015, gain on sale revenues were down 90% year over year. The company is reducing expectations of the OnDeck Marketplace part of the funding total to between 5-15% of originations. In Q4, the premiums paid by investors purchasing loans remained flat, which continues to make holding loans on balance sheet more attractive for the company long term. The current funding mix is depicted below.

As part of the earnings release, the company shared some bad news. OnDeck announced cost cutting measures which includes a reduction of 11% of its staff with hopes to achieve positive adjusted EBITDA in 2017 and GAAP profitability in 2018. Part of the cost cutting also includes non-labor expenses, primarily in sales & marketing and technology & analytics. The cost cutting will total approximately $20 million in savings compared to their 2016 operating expense run rate. In the Q & A CEO Noah Breslow shared that moving towards profitability can be accomplished by keeping the marketing spend flat while still growing originations. A portion of the $20 million cost cutting measure will be related to marketing efforts that haven’t been delivering. The company is prioritizing marketing channels instead of driving leads at any cost. The faster the company grows, the harder it is for OnDeck to be profitable due to having to hold loan loss provisions.

The company added $19 million in provision expenses following a “recalibration of loss estimates for loans with original maturities of 15 months or longer.” According to Breslow, “Most of these loans were originated in 2016 as part of our expanded offerings to OnDeck customers and, even with the updated loss estimates, continue to generate attractive returns.” Total provisions are $55.8 million, up from $20 million in the prior year. Provision Rate for the fourth quarter of 2016 was 10.2%, up from 5.6% in the prior year period. The provision rate for 2016 was 7.4%.

Many of the analysts focused heavily on these 15 month+ loans which represents around 30% of their loan book and resulted in increased provisions. The adjustments to the provision rate on 2016 loans is coming from data on loans from 2015 that have had more time to season. Some analysts were critical, speculating that the OnDeck score was not accurately pricing risk, but Breslow clarified that if you look back at these loans the model is predicting the risk ranking of the loans accurately, but obviously delinquencies or charge-offs are trending higher than expected. They have since taken a hard look at these loans and now that they have more data it will only improve the latest version of the OnDeck score. According to OnDeck no specific channel is to blame for the underperformance. Despite this news OnDeck still likes the longer term loans and believes they can generate healthy returns with respect to how they reprice them and turning some yes’s into no’s.

On a positive note, Breslow commented on the JP Morgan Chase partnership that kicked off in April 2016. The program is a fee for service model and he spoke positively about the combination of bank data with OnDeck’s scoring. They have opened up the program to longer and larger loans, across more regions with Chase’s customers. According to Breslow, the partnership is exceeding their expectations. Not surprisingly this is OnDeck’s largest strategic partner, but they continue to seek out partners. The most recent partnership being with Wave, a small business software provider. The company will use Wave’s accounting data to help underwrite small business borrowers. Another comment that Breslow made regarding partnerships was that OnDeck focuses on deeper data integrations with partners to provide an end to end solution as opposed to a simple lead generation partnership. This is a competitive advantage for the company and the perfect example of this is what they have done with JP Morgan Chase.

It also sounds like OnDeck is making progress on the international market expansion with growth over 100% which is likely off of a small base. They are seeking to grow the capital markets teams in Canada and Australia. Currently the Canadian operation is run primarily by the US office and OnDeck believes they can become a major player in Australia. On the subject of competition the team noted that they have seen improvements in the competitive landscape with less intensity in the direct marketing channel in the fourth quarter.

The other aspect of the business worth noting is the expansion of credit facilities. As the company continues to grow originations and hold more loans on their balance sheet this becomes an increasingly important part of the business. Total funding debt at the end of the fourth quarter was $727 million, up 93% from the prior year period. OnDeck recently added a new warehouse facility with Credit Suisse. The warehouse facility with Ares has been expanded and the maturity date extended. According to the press release, “The company remains in active discussions to further strengthen its financial flexibility, including opportunities to add new debt facilities, upsize or extend existing debt facilities and enter into additional securitizations.”

For the first quarter of 2017, the company expects revenues between $89 and $93 million and adjusted EBITDA between negative $4 million and negative $8 million. Full year guidance is gross revenues between $377 million and $387 million with adjusted EBITDA between a positive $5 million and $15 million.

Conclusion

The fourth quarter was a tough one for OnDeck. It’s always bad news when a company lays off employees but at least it seems that OnDeck now has a path to profitability. The theme of this earnings call might have been different if OnDeck didn’t have to shift to a model where they hold more loans on their balance sheet. The company is dealing with pressures of trying to grow the company at the same time when marketplace funding continues to tighten. Funding loans on balance sheet is not conducive to short term revenue and holding such significant provisions also makes it difficult. Compared to other companies in this space, OnDeck’s success relies heavily on the performance of loans and the income they produce from that performance. If loans perform it will pay off for the company in the long run.

I believe there is still a lot of untapped potential in the OnDeck as a service model as they have implemented with Chase. The company has built the technology out and banks want to leverage technology without having to built it out themselves. I expect we’ll see many more partnerships going forward as OnDeck is still a leader in small business lending.

[Disclosure: Peter Renton, the founder and CEO of Lend Academy, owns ONDK stock.]