“The future of finance is tokenized. Right?” said Ralf Kubli, Director and Member of the Board for The Casper Association, during a keynote late last year. “We expect all financial assets, specifically financial contracts, to live in blockchain and DLT-enabled environment.”

“But truly, we’re headed for a disaster. And why is that? Because the current way that we tokenize is terrible.”

Distributed Ledger Technology (DLT) and tokenization could significantly disrupt the global financial system. Despite the ‘crypto winter’, multiple instances of alleged fraud, and the US’ regulatory stonewalling of crypto companies, businesses continue to invest in the infrastructure.

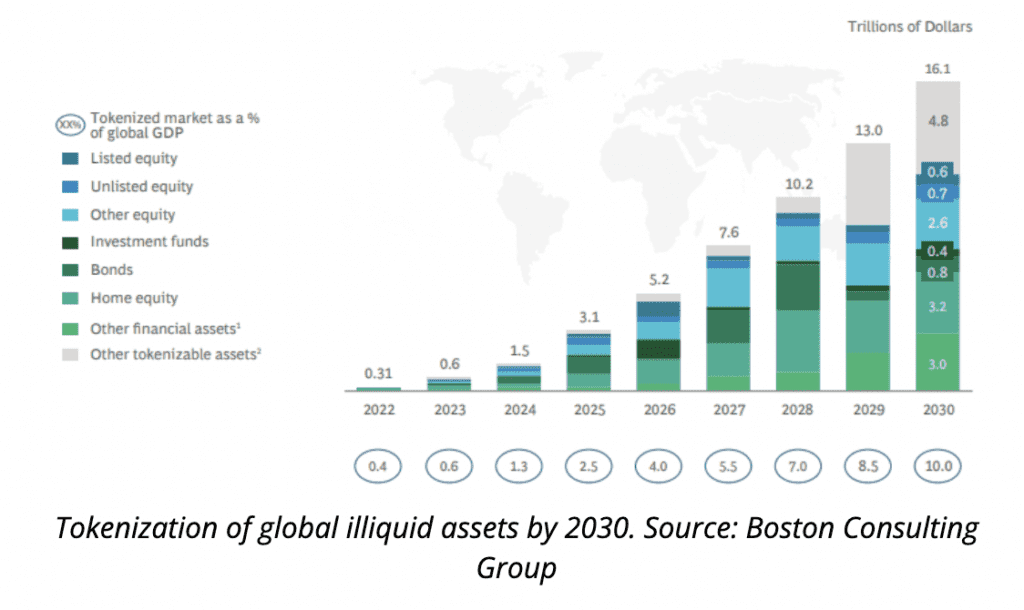

Seen as a tool to improve efficiency and accessibility to financial instruments, the sector’s market value is predicted to rise consistently over the next decade, reaching between $13 trillion and $16 Trillion by 2030. The authors of the Boston Consulting Group on-chain asset tokenization report stated this estimate is “highly conservative,” suggesting the value could surpass even $60 trillion.

Using on-chain “smart contracts” processes can be baked into assets, allowing for increased automation that could span a global network.

Yet, despite leaders’ assurances of growth, adoption may still be limited, even within areas where regulators embrace its potential.

Tokenization was embraced, but innovation limited

According to Kubli, the current approach to “smart” contracts could be part of the problem. “The real prize, so to speak, is in the tokenization of financial obligations of cash flows over time,” he said.

Kubli explained to Fintech Nexus that jurisdictions already allow the tokenization of real-world and financial assets.

“There’s really a difference between representing a real physical asset with a connection to the physical assets on-chain, as opposed to the representation of cash flows of a financial contract,” he said.

He explained that the financial contract needs to be digital and on-chain from inception to realize efficiency. While many that work with tokenization include a standardized data model that determines the types of payments, “What they forget,” said Kubli, “is the definition of the streams afterward. That’s what we call the algorithm.”

According to the Casper Association, current tokenization attempts to digitize assets to bring them on-chain, attaching a comparatively archaic PDF of terms and conditions. Cash flows after that are calculated by human intervention, doing little to move beyond traditional financial systems.

He explained that tokens’ position on-chain allows them to be “truly smart contracts,” overriding the need for human intervention and, therefore, possible fraud and error.

Applying smart contracts to cash flows

Nick Szabo, accredited as the first person to coin the term “smart contract” in 1994, defined them as “a set of promises, specified in digital form, including protocols within which the parties perform on these promises.”

“Smart contracts are not smart, nor are they a contract,” said Kubli. “They have to have certain conditions.”

He explained that regardless of whether positioned on the blockchain, the data should be observable, verifiable, and enforceable. These conditions should therefore be digitally baked into the smart contracts to make them truly “smart.”

“You can do stupid tokens,” he said. “When you have a token framework, you can do stupid tokens. You can do tokenized securities. You can tokenize fund certificates. You can tokenize bonds. You can do it from a regulatory point of view, and you can do it from an infrastructure point of view with things like digital wallets. But you will not get the efficiency you hope for if you do stupid tokens. “

“We have to do intelligent tokens where the logic of the cash flow, the logic of the agreement between you and me, is contained in a machine-readable and machine-executable form. That’s the difference. One is the form and the intelligence, and the other has the intelligence inside.”

He explained that doing this allows smart contracts to incorporate elements of financial instruments that could push the adoption of DeFi and tokenization infrastructure.

“All that DeFi does today is over-collateralized lending. There’s not much else that is going on in DeFi. In the real world, there is rarely over-collateralized lending,” he said, explaining that the application of the technology had been restricted to “primitive” financial instrument models because they did not yet incorporate machine-readable and machine-executable elements.

Related:

“Without this algorithmic setup, the machine-readable and machine-executable definition of this financial contract, we cannot gain any scale. No one will adopt these infrastructures.”

The key to this is open finance standards.

ACTUS could make ‘smart contracts’ intelligent

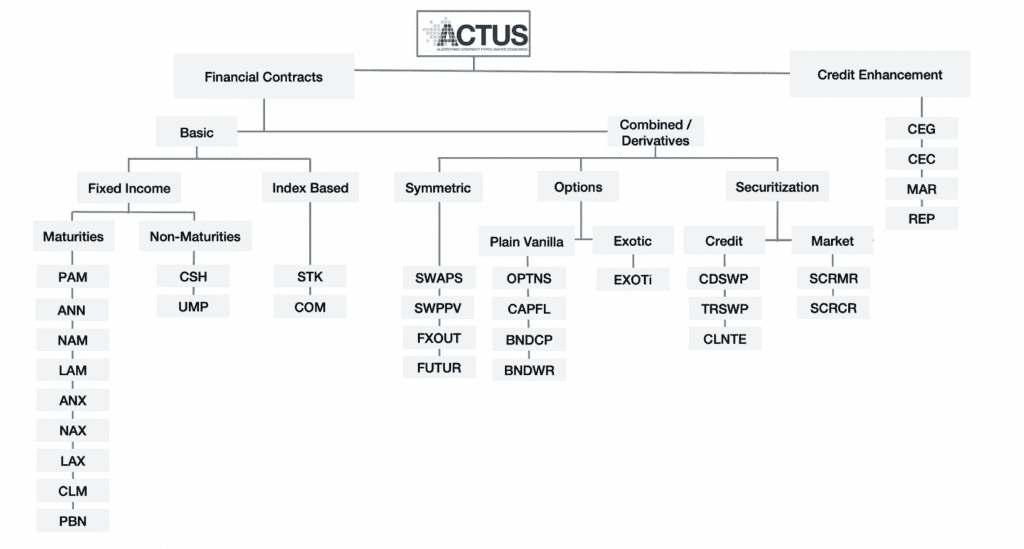

Established in the wake of the 2008 financial crisis, the Algorithmic Contract Types Unified Standards (ACTUS) Research Foundation was formed to help clarify the cash-flow patterns of financial instruments based on collateralization.

ACTUS states that financial crises have “laid bare” risk management and financial regulation deficits. A lack of timely data reported in a data standard capable of supporting financial analysis may have contributed, compounding the ability for shortcomings to go undetected.

Their solution was a clearly defined open-source standard that could be applied to any business. Stemming from the belief that when focused on cash flow obligations, the diversity of financial contracts reduces, they could define contract types. Their categorization is based on the underlying contractual algorithm patterns that respectively cover different classes of financial products.

While the words algorithm and blockchain in the same sentence may cause many to shudder with PTSD (Post Terra Stress Disorder), the algorithms defined by ACTUS apply to any financial instrument within traditional finance. Therefore, their incorporation into a blockchain-based “smart contract” could open the financial system to more innovation using DLT and tokenization.

“This has precisely nothing to do with blockchain. This is finance,” said Kubli. “I really believe the only difference between traditional finance and DeFi is the nature of the counterparty..so we take this open source standard, ACTUS, and combine it with blockchain.”

“We start with real finance, and we make it digital.”