How dismantling the Consumer Financial Protection Bureau turns back the clock — exposing consumers to financial harm and encouraging unfair...

Interested in sharing an op-ed? Review our op-ed submission guidelines.

Get startedWhile Synapse collapse is in the news a lot right now, this is a reminder that not all fintech is created equal. Let's not forget that there are many fantastic innovations that have come out of the rise of fintech.

Funding Circle was approved for a 7(a) license by the SBA but now there are some in Congress that want to take that away from them.

·

In today’s rate-shopping environment, it is important for Americans to be able to accurately compare credit products and make the best possible decisions for their financial future.

SME-focused fintechs are better known than banks as sources of advice and guidance on financial matters, such as cash flow management.

Open Lending's latest research, "Loans Within Reach: Lending Enablement Benchmark 2023," surveyed 95 automotive lending leaders at U.S. financial institutions to understand their current challenges and how technology is helping them adapt.

Colorado passed a law this week that could have a dramatic effect on the ability of fintech lenders to do business in the state.

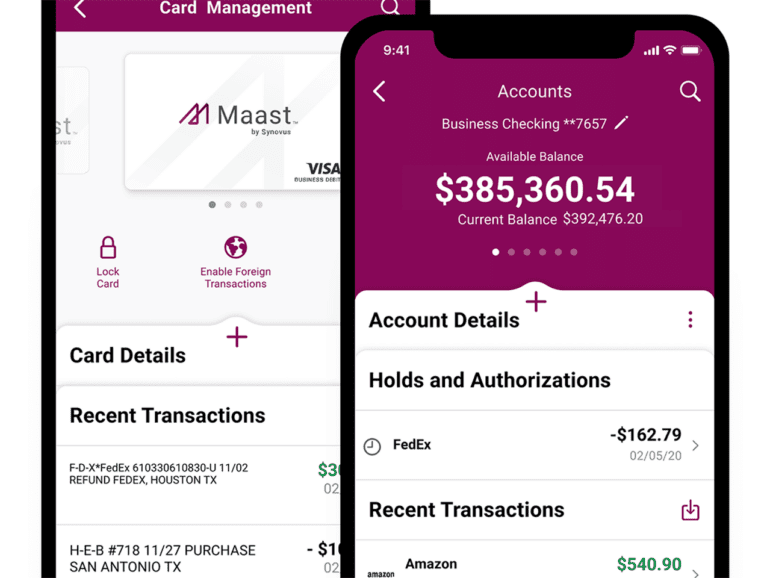

Adopting an API-first approach to card issuing allows fintechs to create personalized payment solutions tailored to their customers' needs.

Americans overwhelmingly prefer digital payments over cash establishing that embedded finance is the next frontier.

With a volatile backdrop, companies trading internationally want to future-proof their payments and their ability to deliver for shareholders.