Following a solid start to 2023, investors are beginning to grow in confidence that a prosperous period for bitcoin is on the horizon.

Interested in sharing an op-ed? Review our op-ed submission guidelines.

Get startedDespite some recovery, the reality is most banks have not been generating a sufficient return on equity to cover their cost of capital.

The rapidly changing landscape of finance has translated to an excessive amount of pressure being placed on financial directors and their departments.

The historically difficult process of going solar means the massive potential of the commercial solar market remains largely untapped.

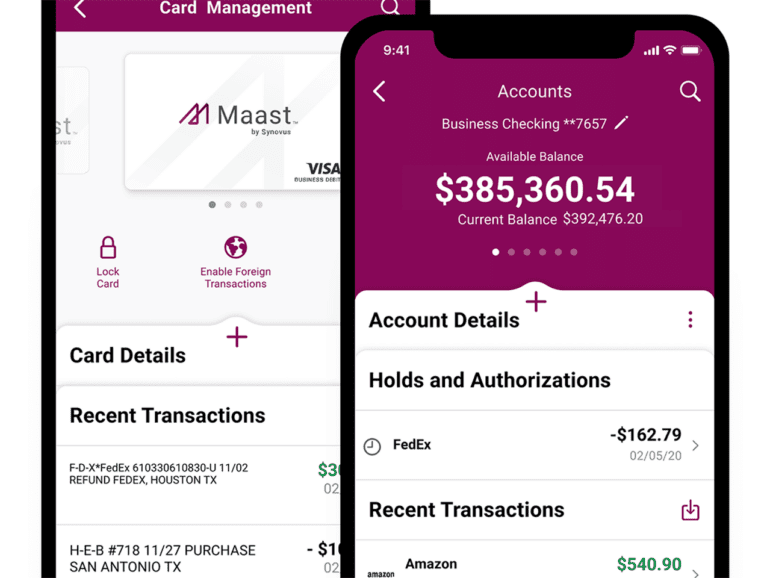

In a world where user experience is do or die, fintechs lose wallet share and loyalty due to mistakes around frontend design and development.

The Financial Health Network released a study on overdraft fees highlighting that it is still a problem for the financially vulnerable.

Fintech advances, including emerging digital neobanks, embedded banking, AI, and other tools, are expanding consumer options.

With a volatile backdrop, companies trading internationally want to future-proof their payments and their ability to deliver for shareholders.

Americans overwhelmingly prefer digital payments over cash establishing that embedded finance is the next frontier.

Adopting an API-first approach to card issuing allows fintechs to create personalized payment solutions tailored to their customers' needs.