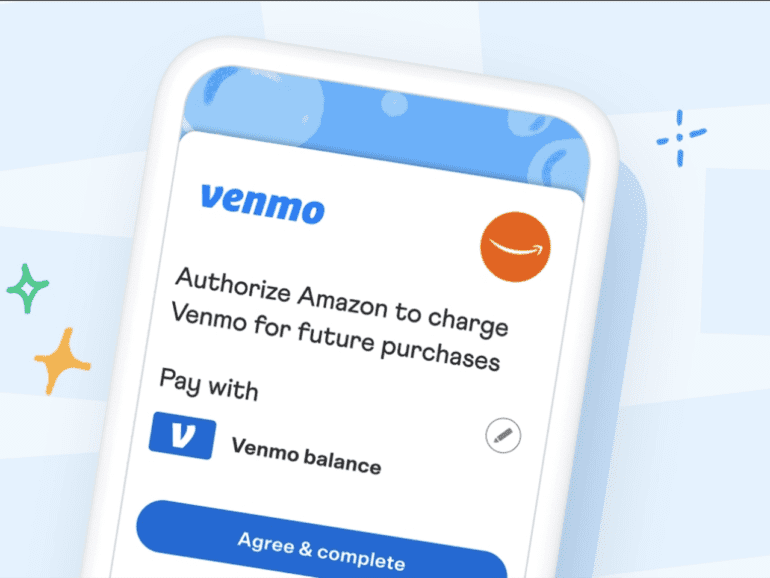

Amazon's deal with Venmo has the potential to set a new standard for payment tenders in general, and other brands are likely to follow in its footsteps.

Interested in sharing an op-ed? Review our op-ed submission guidelines.

Get startedAs embedded finance grows in prevalence and popularity, businesses must consider BaaS and understand the impact different licenses offered by providers will have on their offerings.

The best chatbot AIs like ChatGPT can generate code, not just natural language. Banks could use that to streamline app development to expand their fintech investments in less time.

The canary is now 10+ years old as prominent platforms like SoFi and Upstart launched in the early 2010s, and Freedom Financial (now Achieve) has been around for two decades.

For entrepreneurs looking to overcome these challenges, revenue-based financing is a compelling alternative.

To help curb the effect of inflation and recession on the bottom line, the key is to challenge the internal costs, more specifically, the internal costs of the purchasing chain and processes.

It is becoming increasingly necessary for financial institutions to start thinking outside the box for ways to grow and diversify their loan portfolios.

While many "green" fintech startups like Aspiration or Sugi appear on the market, their infrastructure can stay environmentally harmful.

With regulation taking center stage, there's an opportunity for banks to take the place of some large BNPL providers and lead the space.

Banks must find a way to optimize the digital customer experience while simultaneously ramping up security.