[Update: There will be a webinar at 11am ET on September 27 on the The Orchard Deals Platform brought to you by LendIt and Crowdfund Insider. Details here.]

When I first invited Orchard Platform CEO, Matt Burton, on the Lend Academy Podcast back in 2014, we talked about their ambitions around launching an institutional secondary market for marketplace lending. It has proven to be a massive undertaking and it has taken several years longer than anticipated but with the launch of Orchard Deals today it has now become a reality.

To be clear, Orchard’s new platform is far more than just a secondary market. It has several new features:

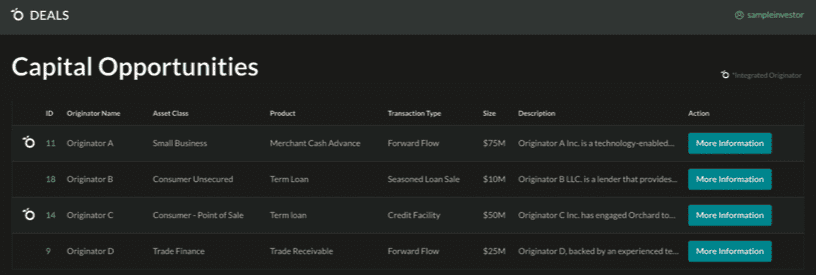

- Deals – Pre-qualified investors can browse listings of a range of different investment opportunities offered by originators.

- Capital Management – For originators to help monitor and optimize capital utilization across multiple funding sources.

- Advanced Analytics – Benchmarking of performance data against an anonymized peer group.

- Data Services – Helping originators improve the quality of their data and client reporting.

- News & Insights – Industry news and economic data as well as Orchard’s own research and commentary.

I spoke at length with Orchard CEO, Matt Burton, yesterday to get more insight into the new Orchard Platform. The first thing that Matt stressed is that the entire Orchard Platform has been redesigned from the ground up and is a far more robust product than anything they have had before.

The New Orchard Deals Platform

The key piece that I was interested in was the new Orchard Deals platform. The old Orchard Platform provided technology solutions for both originators and institutional investors but Deals is the piece that finally connects the dots. The platform connects institutional investors with origination platforms that have listed specific investment opportunities. Orchard has 55 institutional investors registered on their platform and 25 originators (with several more in the queue). Originators cover the gamut of consumer, small business and real estate lending.

At launch time they had an initial $500 million in active deals from 10 originators listed on the platform. These are both primary and secondary deals. Their goal is to support all transaction types. So, whether an originator is looking for a new forward flow agreement, a credit facility, or to sell off a pool of seasoned loans, Orchard Deals is meant to help them find a qualified investor and then provide the technology to facilitate the transaction.

Orchard has taken a conservative approach with regards to operations and regulation and went through the process of creating a new entity in 2016, Orchard Platform Markets, LLC, registering it as a broker-dealer with the SEC, and applying for membership with FINRA and SIPC. This allows them to collect a fee for capital introductions while the settlement and actual movement of money happen outside of Orchard. At least for now.

As for the kinds of originators Orchard works with Matt said the sweet spot for them is for those originators looking to scale. Those companies that have proven their underwriting model works and feel they are ready to grow to the next level. While new originators with little to no origination volume will likely not be a great fit for Deals initially, Matt stressed that Orchard wants to talk to all originators, no matter the size. If Orchard can help a new company get off on the right foot when it comes to data quality, it makes an integration down the road that much easier.

Matt gave an example of a typical originator they are looking to work with – an originator that has been in test mode where they are available in, say, three states. This platform has now partnered with an originating bank and are looking to roll out to 45 states, so they are going to have new capital needs. Their existing capital providers likely will not be able to completely meet this new scale. Orchard can help introduce this platform to new sources of capital.

My Take

The Orchard team have worked hard over many years to bring their new platform to reality and they are rightly proud of what they have created. The industry needs an easier way for large investors to enter the space and access multiple originators quickly and easily. We also need a place where platforms can go to help match them to a broad range of investors. And lastly, we need a place where pools of loans can be placed for sale. No company is better positioned than Orchard to make all this a reality.

The industry has come a long way since Matt first talked about his goal for an expanded platform that included a secondary market back in 2014. We are a more established industry now and we have moved lending forward into a more tech-enabled future. Tools like Orchard Deals will be critical as we move into the next innings of our evolution.