Happy New Year! The books have just been closed on 2013 and what a year it has been for Lending Club and Prosper. Back in 2012 the two companies combined for $871 million in new loans issued. The numbers for 2013 have completely dwarfed that number – the combined total was $2.42 billion. That is a growth rate of 177%.

Lending Club Issues Over $2 Billion in New Loans in 2013

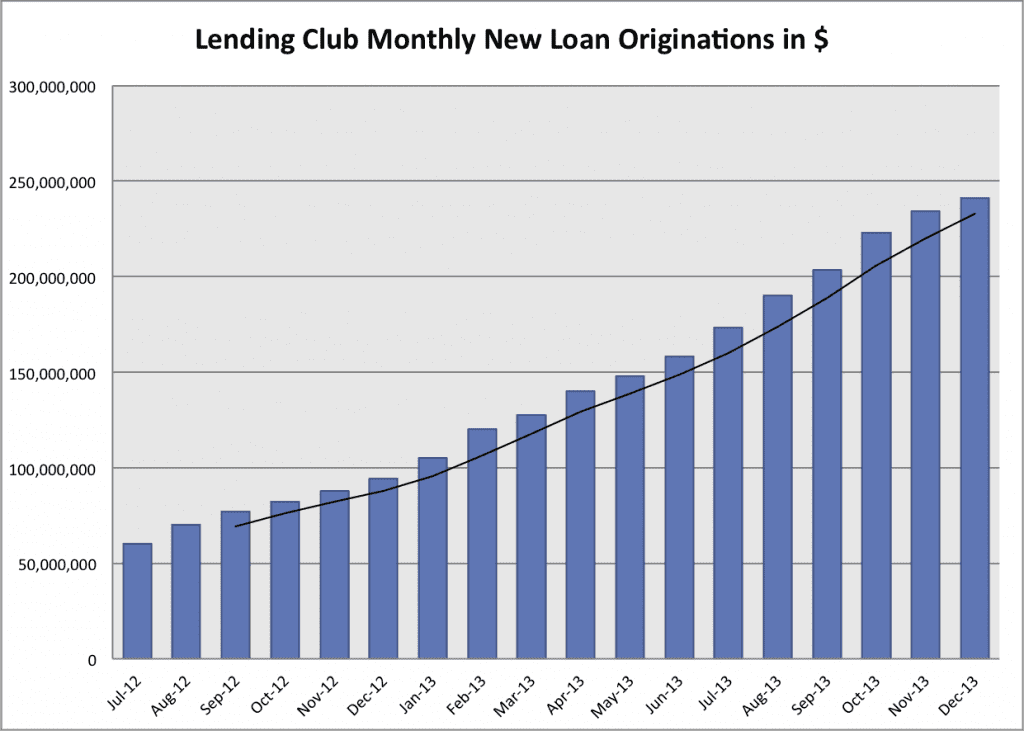

About half way through the year Renaud Laplanche, the CEO of Lending Club, started saying publicly that Lending Club would issue $2 billion in loans this year. It was a nice round number that garnered a lot of attention. Sure enough, Lending Club achieved their goal comfortably, issuing $2.06 billion in total loans for the year up from $718 million in 2012.

For the month of December Lending Club issued $241.3 million in new loans, just short of the quarter billion mark. This number was up from $234 million in November and is just slightly less than they issued in all of 2011. Their growth continues unabated and there is no end in sight as far as I can tell. If they keep this same growth rate they will issue over $5 billion in 2014.

Below are the monthly statistics for Lending Club as well as the 18-month loan volume chart (the black line is the three-month moving average).

Average loan size: $14,157

Average dollars issued per business day: $11.5 million

Percentage 36/60 month loans: 77.2%/22.8%

Average interest rate: 15.54%

Percentage of whole loans: 36.6%

Total Policy Code 2 loans: $15.6 million (6.5% of the total)

Prosper Ends 2013 With a Very Strong Month

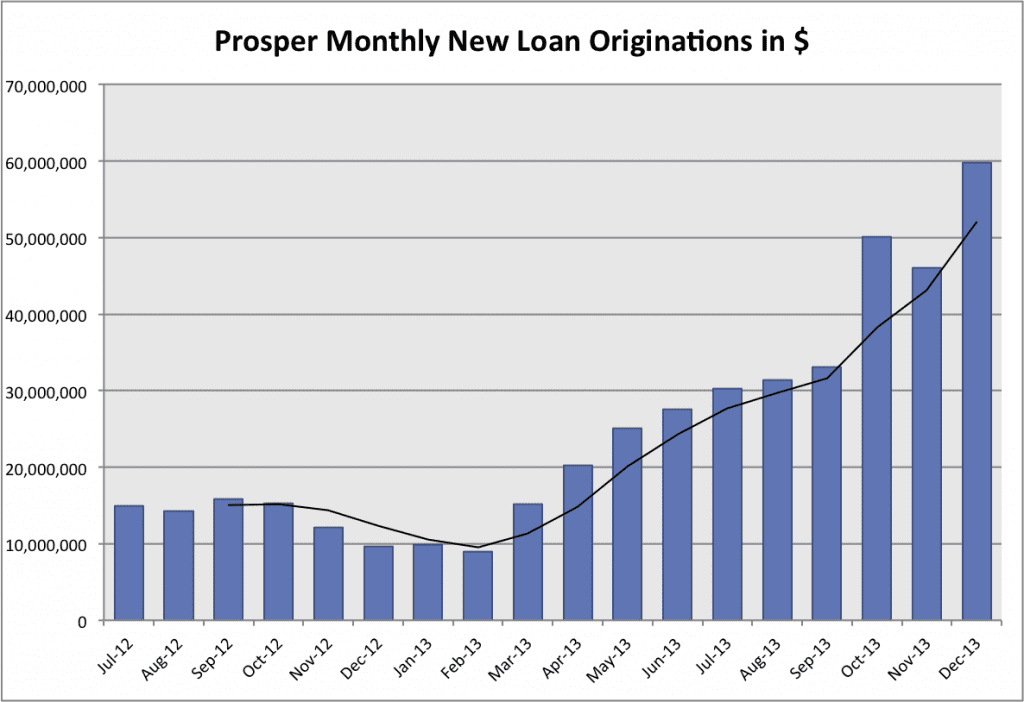

I remember writing this end of month post 12 months ago where Prosper was seeing a precipitous decline in loan volume. In December 2012 they issued just $9.6 million in new loans and it was their third straight month of lending volume declines. Fast forward 12 months and we have a very, very different story.

This December Prosper had their strongest month ever with $59.8 million in new loans issued. This was up 29.9% from $46.0 million in November and marks a new high water mark for the company. As Ron Suber pointed out to me in an email today they are very focused on growing dollars originated per business day and this month saw that number increase $425,000 over last month.

Here are some of the stats from this month as well as Prosper’s 18-month loan volume chart.

Average loan size: $11,746

Average dollars issued per business day: $2.8 million

Percentage 36/60 month loans: 64.0%/36.0%

Average interest rate: 16.4%

Percentage of whole loans: 70.7%

Average FICO score: 700