One of the many things I love about this business is its transparency. Anyone can download the entire loan history of Lending Club and Prosper and see how every single loan has performed. It is in this spirit of transparency that I bring you details of my own p2p investment returns each and every quarter.

This past quarter marked my five-year anniversary of investing in p2p lending. I started with just $500 and as I have become more comfortable with this investment I have added more money. Today, I have a very high level of comfort so I continue to add new money here. I have been slowly taking money out of the stock and bond markets and putting it to work in this industry.

Overall P2P Lending Return Now at 11.87%

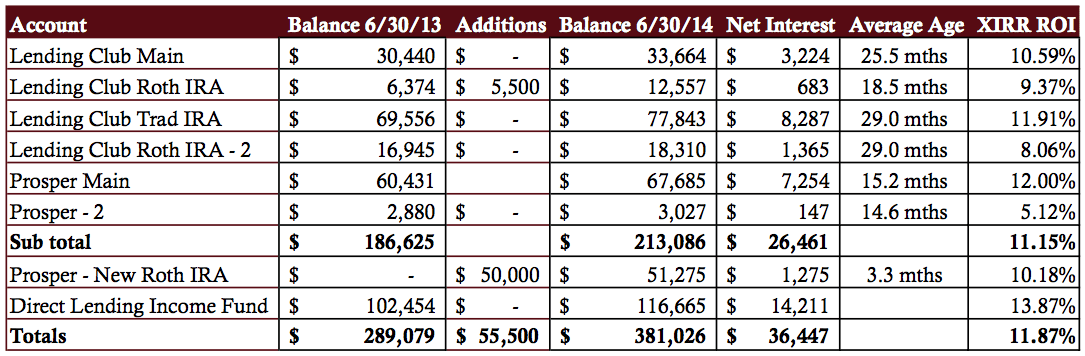

Before I get into the details of my returns I want to give a quick overview for newcomers. I have had six accounts, four at Lending Club and two at Prosper for several years. These accounts have formed the core of my p2p lending portfolio and their results can be tracked back to the fourth quarter of 2011. Last quarter I introduced two new accounts into the mix. In February I opened a Prosper SMA account through Lend Academy Investments, my new wealth management firm, and last year I invested in the Direct Lending Income Fund, a fund that invests in small business loans.

Below is the quarterly table of all my p2p lending investments. I have continued to separate these two new accounts from the six established accounts – mainly so I can continue to track the overall returns of these core accounts. Speaking of which, last quarter was my first overall decline for my core accounts since I switched to a more aggressive investment approach three years ago. My overall return for my core accounts went down from 11.87% to 11.15%.

This was not unexpected although the magnitude of the drop did surprise me somewhat. Most of my core accounts had a larger than average number of defaults this past quarter, which led to lower returns across the board. You can see the details in the table below. You can see the table at full size and you can view the table with the extended return percentages here.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Age column shows how old, on average, the notes are in each portfolio. Because I am reinvesting all the time this number changes slowly.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way to determine your actual return.

- The two new accounts have been separated out to provide a level of continuity with my previous updates.

- I do not take into account the impact of taxes.

Now, I will delve into the details on each of my accounts. I am also going to refer to my investment strategy for each account, so you will need to read my How I am Investing in 2014 post to be able to follow along.

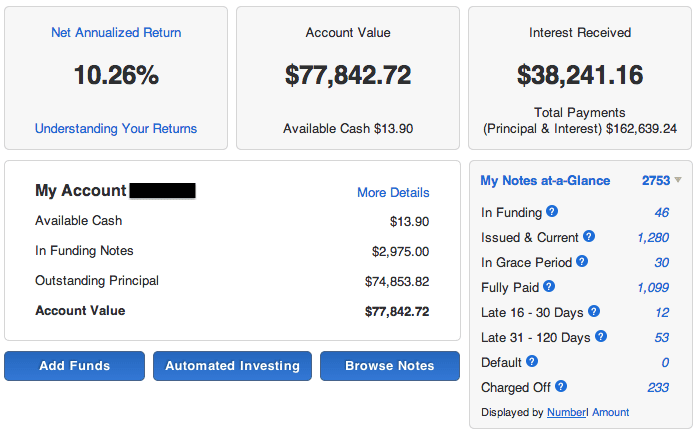

Lending Club Main

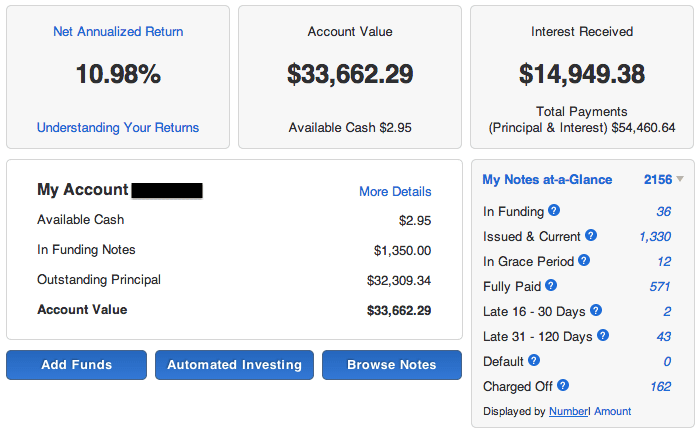

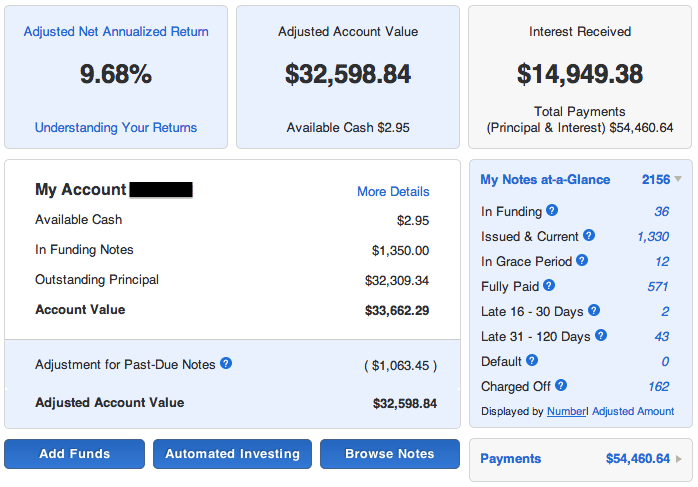

This is a taxable account and was the first account I ever opened at Lending Club. Like many new investors I started this account in a conservative way, investing in mainly B and C grade loans. Now, as with most of my accounts I am focused on the more aggressive loans, typically D-grade and below. As I said above most of my accounts had a higher than average number of defaults and my main account was no exception.

The 27 defaults I incurred in the second quarter caused my real return to decline almost a full percentage point. And with 43 loans in the 31-120 days column I might see even more defaults than that this quarter. Below is a screenshot of my Adjusted Net Annual Returns for this account. Interestingly, this number has remained reasonably steady – it has been between 9.5% and 10% now for many months. In recent months I have been using P2P Picks exclusively to invest in this account.

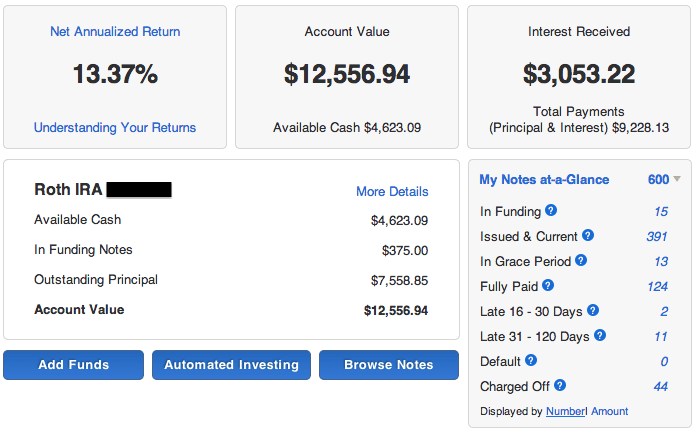

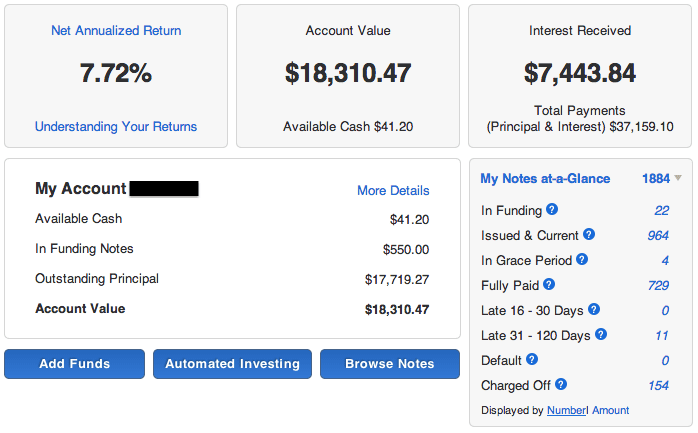

Lending Club Roth IRA

I opened this account with a mission – to only invest in high interest notes and see what kind of return is possible with that strategy. The weighted average interest rate is 18.61% and I continue to stick with this strategy. I made my 2013 IRA contribution of $5,500 into this account in April and using my Lending Club Filter 1 it has taken a long time to invest. After noticing this I have recently increased the note size on this account from $25 to $50 and since then I am deploying cash more quickly.

While this account did have several defaults this past quarter the main reason for the drop in real return from 12.32% to 9.37% is because of this cash drag. This is something that any investor who adds significant new money into an account needs to weigh. I am ok with a temporary cash drag to keep to my aggressive loan selections.

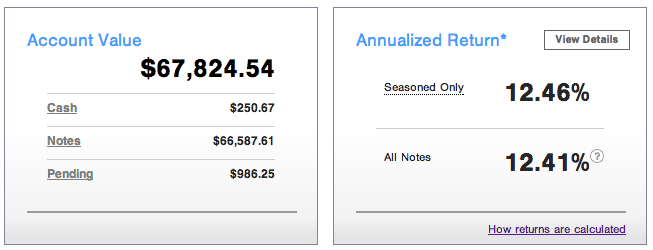

Lending Club Traditional IRA

This account is in my wife’s name and is now over four years old. This account has also been my best performing account for several quarters but as I said in my last update I expected the returns to decline from their lofty levels. And that is what happened last quarter. Thanks to 40 new defaults on this account my real return has dropped from 13.61% to 11.91%. I have been using Lending Club Filters 2 and 3 to invest.

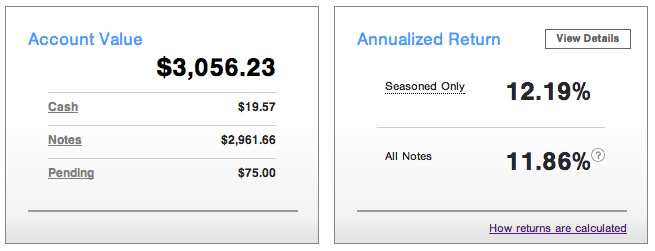

Lending Club Roth IRA – 2

This is my second Roth IRA – this one is my wife’s account. This was opened as a Lending Club PRIME account and has been my most conservative account until last year when I decided to manage the account myself and get more aggressive with it. At the time I also felt that Lending Club was doing a poor job with their PRIME service. That is no longer the case.

PRIME has been renamed simply Automated Investing and it is now an excellent service. I have been using it to invest now for several months and I have no complaints whatsoever. I have setup Lending Club’s Automated Investing with my Lending Club Filter 4 (Super Simple) and it invests in new notes for me pretty much every day, sometimes even twice a day. And the returns continue to edge up here as the more conservative loans get replaced with more aggressive loans with my reinvestments.

Prosper Main

This is my first Prosper account that was opened in 2010 as a taxable account. I have always focused on the higher interest loans in this account and it has been a consistently high performing account for me. And this quarter it has once again been the best performing account with a 12% real return. I use my Prosper Filters 1 and 2 to invest.

Prosper – 2

This has been, perhaps, my most interesting account. I have basically been running an experiment with this account for more than three years now. I have invested only $2,000 and so I have never considered this account to be well diversified. At the same time this account has the highest weighted average interest rate of 25.76% so it is investing in only the most aggressive notes. Just a year ago the real returns in this account stood at 15.87%. These days it is by far my worst performing account at a 5.12% real return. I have no plans to add new money to this account but I may make some minor adjustments. Today, I am investing a little less aggressively using my Prosper Filter 3 (Super Simple).

Prosper – New Roth IRA

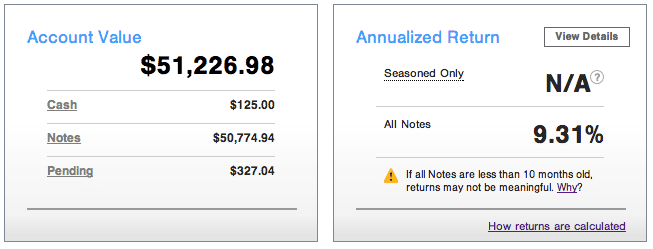

I opened this account in February through my new firm, Lend Academy Investments, when I rolled over $50,000 from a Roth IRA. I decided I needed an account that was a little less aggressive, so this is using our balanced investment approach. Basically, this means I am investing in all loan grades but with an emphasis on A, B and C grade loans. My first returns number on Prosper has come in at 9.31%. My goal for this account is a 7% real return and so I am on target for that. I am using our proprietary Lend Academy algorithm to invest.

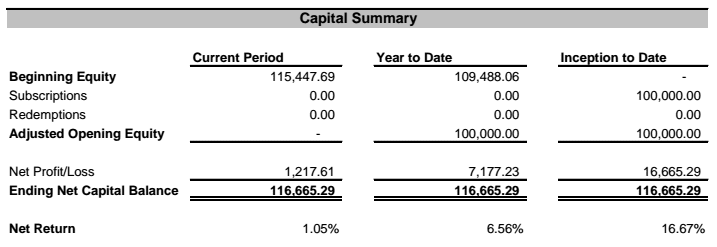

Direct Lending Income Fund

This has been my best performing p2p investment. Brendan Ross, who runs this fund, only invests in high yield small business loans and his target is a net return in the low teens. This account has been delivering those returns. Like most funds, this is a “set it and forget it” investment – Brendan takes care of all the investing, I just get a monthly statement each month with my balance. I have now had this account well over a year and am pleased with my nearly 14% return.

Final Thoughts

While some of you may expect that I would be disappointed with a decline in the returns of my core accounts, this is really not the case. While I would obviously like to receive fewer defaults, to maintain a return solidly in double digits is a good result. I will not be making any major adjustments to my accounts based on my results this past quarter.

These accounts are all on autopilot today. I am using automated investing now for all my accounts, so I am spending very little time day to day managing my own investing. I like this approach, particularly when it yields returns over 10%. Also, as I have said before I am no longer adding any new money to taxable accounts in this asset class. I want to remove the impact of taxes as much as possible and investing through retirement accounts allows me to do that.

One final note. Every quarter I like to highlight the one number I consider to be the most important – that of Net Interest earned. This is the money that shows the real gains in your account (before taxes). I am pleased this number has grown a great deal over the past year and now stands at $36,447 in the last 12 months. I want to continue to build that number every quarter.

Please share your thoughts and questions in the comments section below.