Wedge's fintech product lets users spend from balances held at separate banks and financial platforms, in many ways simplifying their digital wallets in the process.

With increasingly unaffordable healthcare costs, higher deductible health plans, and confusing medical billing statements, Americans are simply turning away from healthcare. This article will discuss how healthcare affordability and care avoidance are closely linked and how both affect patients, employers, and providers. In addition, it will explain why even patients with insurance are in desperate need of a new financial payment model that addresses the burden of healthcare costs.

Fintech Clara launched a high-yield payment account in Brazil as it aims to double down on the South American market.

According to Belvo, the new product will function as a gate for users to initiate payments directly inside third-party apps.

Just in time for the holiday shopping season, payments app Curve closed on a $1 B credit facility deal to fund loans across UK, EU, and US.

·

Environmental concerns drive many to reject the idea of CBDCs but research suggests they could actually be an improvement.

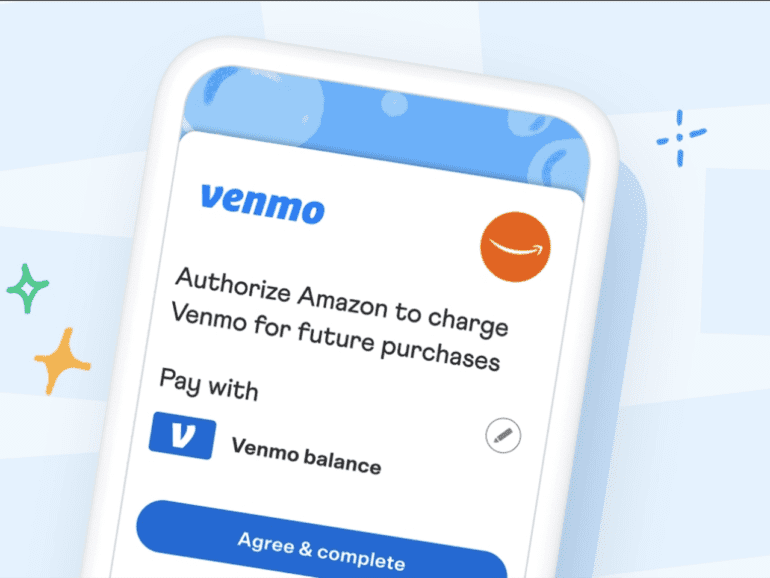

Amazon's deal with Venmo has the potential to set a new standard for payment tenders in general, and other brands are likely to follow in its footsteps.

J.D. Power's 2024 U.S. Merchant Services Satisfaction Study finds 54 per cent of small businesses accept BNPL and that those operations score the relatively new way to pay highest among payment methods, with a 744 score on a 1,000-point scale.

FedNow's launch is imminent, but the U.S. is lagging behind the rest of the world on real-time payments. It may be an advantage.

The 2024 Payments Innovation Jury Report does a deep dive into the changes happening in the payments space by interviewing 136 experts from around the world.