Two key takeaways from a state of banking report should further encourage fintechs and small businesses about future opportunities for growth.

In two years, Spin has quickly carved out a place of itself as one of the most relevant fintech players in Mexico.

The frequencies of fraud and chargebacks rises during a recession, and addressing it properly requires the right data and methods.

After years of waiting, the central bank of Brazil has finally authorized Meta's WhatsApp merchant payment system.

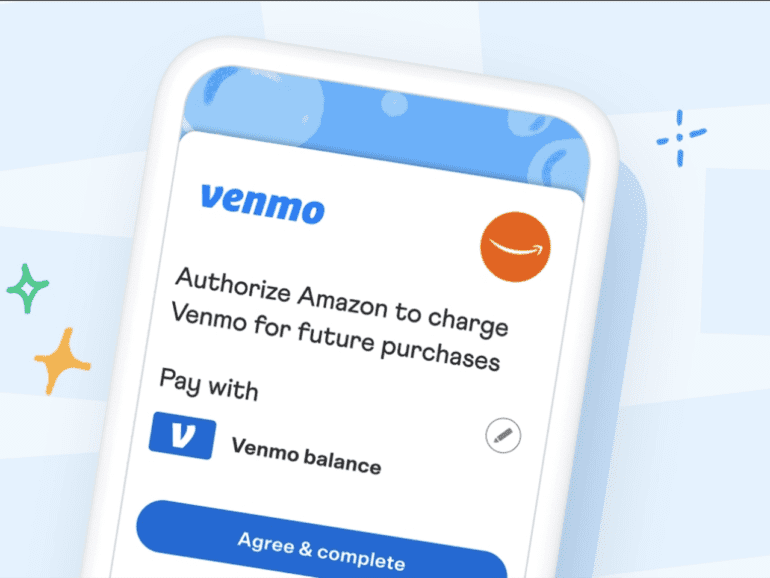

Amazon's deal with Venmo has the potential to set a new standard for payment tenders in general, and other brands are likely to follow in its footsteps.

By December 2022, PagSeguro had 28 million customers, making it the second-largest digital bank in Brazil.

To best serve the payment needs of different emerging markets, a company must have a local presence so they can understand unique traits.

Pix is a constantly-evolving product, with new features being recurringly rolled out. What is next for Pix this 2023?

Wedge's fintech product lets users spend from balances held at separate banks and financial platforms, in many ways simplifying their digital wallets in the process.

The credit giant is adding advanced analytics to further assist lenders in managing their risk profiles while adding expanded credit models for small business loans and credit-card lines.