PayPal is a company whose name is much more synonymous with payments than lending. However, that might be changing as the company announced that they had crossed $10 billion in lending.

The originations were spread out across 225,000 small businesses around the globe. While their US lending business may be familiar to many, they also operate in the UK, Australia, Germany and also Mexico through a partnership with another online lending platform.

It took the company five years to reach the $10 billion milestone and almost two years to pass the $1 billion mark. Now they are hitting some impressive quarterly milestones, originating $1 billion per quarter, so their next $10 billion is surely to happen even quicker.

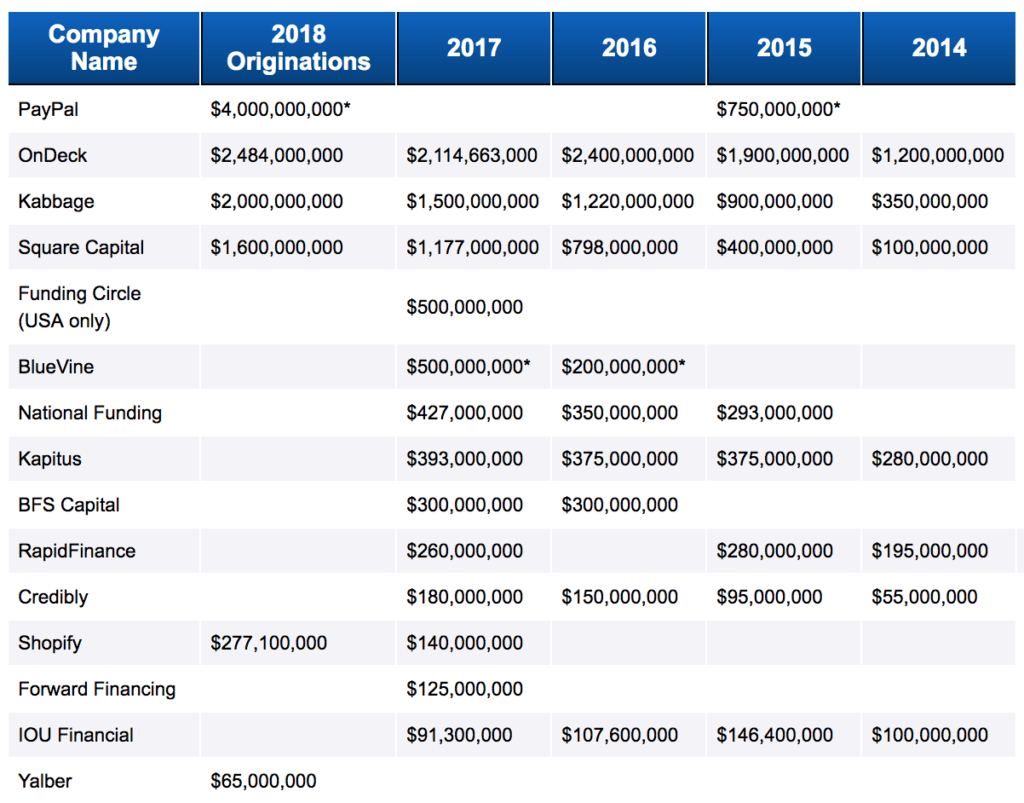

Their success is in part due to the wide range of loan amounts, from $1,000 to $500,000. So where does PayPal stand when it comes to their competition? deBanked recently highlighted the leading small business originators which showed that PayPal is solidly the leader when it comes to originations in the US. OnDeck which is second to PayPal reported originations of $636 million in Q1 2019. According to data provided by Funding Circle on their website, which includes their lending globally, they have originated $9.5 billion in loans.

Beyond just looking at origination numbers, it’s important to take note of the value that all of these small business lenders are providing to small businesses both in the US and abroad. When you look at the fact that on average a loan from the U.S. Small Business Administration takes 90 days to complete and that traditional banks have ignored this segment for years, it’s clear that there is room for many winners in the small business lending market. Looking forward it’s going to be interesting to see how all of these lenders evolve to provide much needed capital to small businesses across the globe.