Increasing digital adoption has brought shopping to the consumers’ fingertips. The retail experience is only a few clicks away, accessed from the comfort of home regardless of where the shop is based.

In the wake of the COVID19 pandemic, the e-commerce sector boomed. In 2021 the top online marketplaces worldwide sold a total of $3.23 trillion. This number is set to rise consistently, and experts predict the B2C e-commerce market size will exceed $7.5 trillion.

PayU, an online payment service provider operating worldwide, commissioned a survey to understand this flourishing sector better. Assessing the markets of the U.S, Colombia, and Poland, they surveyed the trends in the market to identify the areas the payments sector can focus on to serve consumer needs better.

Room for growth in cross-border e-commerce

Despite a trend in more consumers buying overseas, the survey found that in the U.S and Colombia, only around one-quarter of customers purchase products outside their country. In Poland, this jumped to almost half.

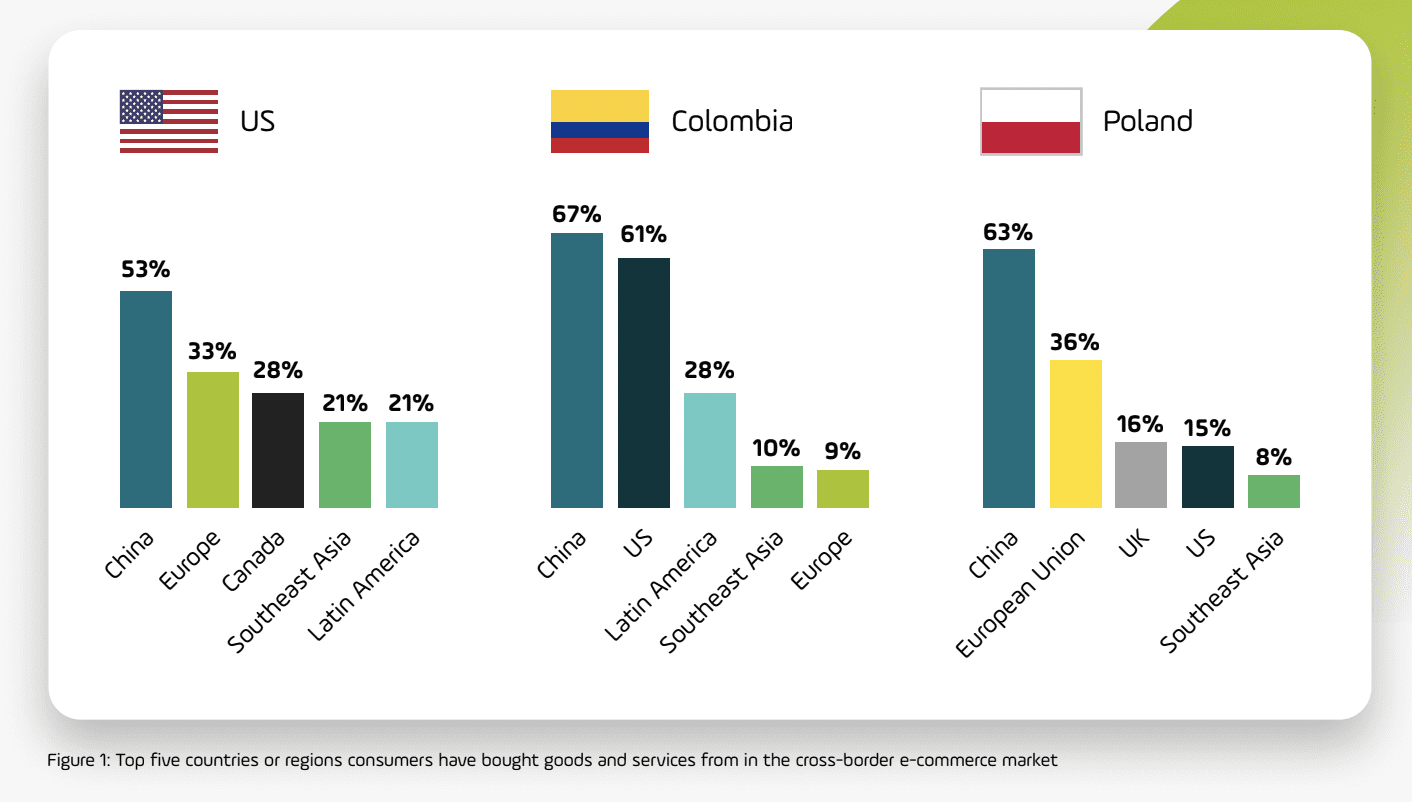

The reigning champion for these purchases was China, the origin of over half of all purchases made overseas by customers in the three jurisdictions.

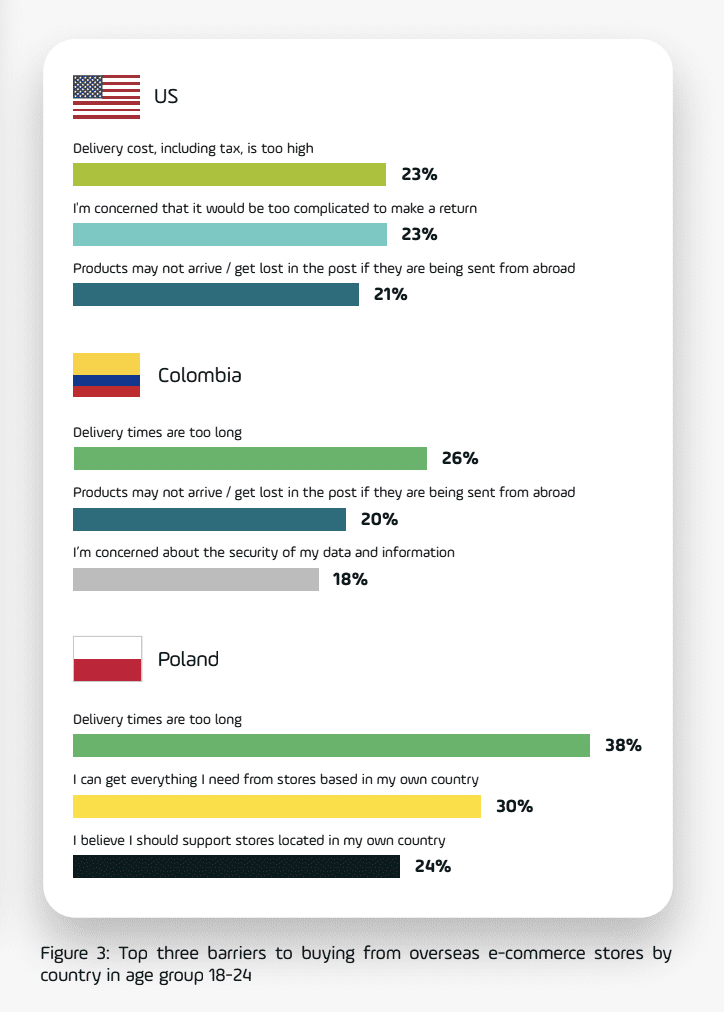

The majority of the people surveyed said that the reason they did not buy from abroad was that they could find what they needed within their own country. However, in the age range 18-24, this changed dramatically, with most respondents citing long delivery times and tax costs as the main reason for their local purchases.

Payments resulted in a decisive factor in the decision to shop abroad or not. In America, 55% of consumers stated that if their preferred payment choice were not an option, they would look elsewhere to buy goods.

Across all countries surveyed, trust in the payment provider was vital. In the US, 73% of customers said that if they did not recognize the provider, they would not make a payment. In Poland, this number rose to 88%.

Perhaps unsurprisingly, credit cards were the most popular option for payment for many. However, Colombian shoppers were split almost equally between preference for bank transfers and card payments.

Buy Now Pay Later continued to show low interest. However, for 25-30-year-olds in the US, the popularity rose by almost 10%.

Payments solutions could give retailers global competitive edge

PayU found the results of the survey to be enlightening, showing a strong need for e-commerce platforms and payments companies to work together on an international level. They stated that the increase in cross-border payment solutions provide a distinct opportunity for retailers to grow their customer base.

“It is clear that the trend for shopping internationally is accelerating, even in well-served markets like the US,” said Mario Shiliashki, PayU’s CEO of Global Payments.

“This growing trend represents an ever more attractive opportunity for retailers to boost their growth by extending their business outside their home countries.”

“To capitalize on this opportunity, it is important that merchants have the right technology partners to navigate the complex payments and logistics landscape to provide the best consumer shopping experience locally. One critical aspect is optimizing their ability to offer the most relevant payment methods in every market they expand to.”