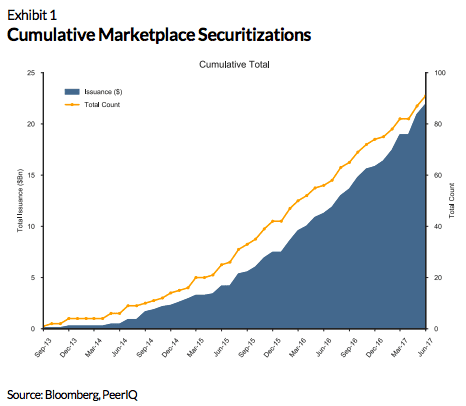

Every quarter PeerIQ releases a Marketplace Lending Securitization Tracker and every quarter there are new developments on the securitization front. Q2 2017 was no exception with nine securitizations taking place totaling $3 billion, a 76% growth over the second quarter of 2016. This is in line with Q1 2017 where issuance was the same, but there were only seven deals. Total issuance is now $21.9 billion across 92 deals.

Other highlights provided by PeerIQ include:

- Multi-seller club deals and self-sponsored deals have emerged at several leading platforms. All deals were rated in this quarter, including record-sized consumer deals from SoFi, large multi-seller deals from Marlette and Prosper, and the first self-sponsored, near-prime deals from Lending Club and Upstart.

- Dealer and rating agency participation continues to intensify. Fitch rated its first Consumer MPL ever, Prosper’s PMIT 2017-1, indicating broadening acceptance across ratings agencies. Goldman Sachs, Morgan Stanley, and Deutsche Bank lead over 47% of MPL ABS transaction volume. Noteworthy is the rising presence of BNP Paribas, which co-managed CLUB 2017-NP1. DBRS leads the rating agency league table, and Kroll dominates the unsecured consumer sub-segment.

- New issuance spreads continued to tighten and flatten—a credit friendly environment for securitization. In Q2 2017, we saw spreads tighten in riskier tranches of consumer ABS, indicating strong investor appetite for MPL ABS paper in the market.

- Delinquency rates have continued to increase across several verticals—such as subprime auto, student, and personal loans—due to exposure to riskier borrowers, a re-leveraging of consumer balance sheets, “loan stacking,” and shifting payment priority trends.

- Initial pricing is near record tight levels. Lending Club’s inaugural deal priced at Libor + 110, second only to Marlette’s MFT 2017-1 (L+100) in execution on the Class A bond. Overall, spreads have tightened with greater investor acceptance in an overall “risk on” environment.

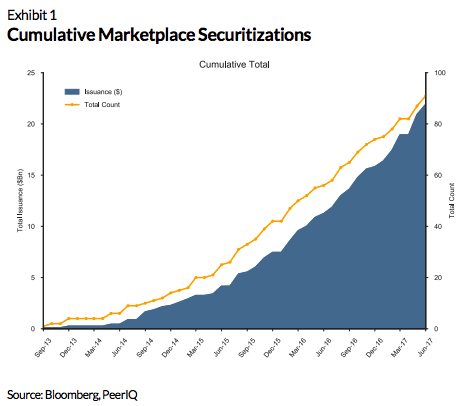

SoFi continues to lead the way in securitizations with SCLP 2017-1 being the largest unsecured consumer ABS ever totaling $650 million. Marlette Funding also reported their largest deal with a size of $370 million. The below table highlights the marketshare by originator and their quarterly issuance.

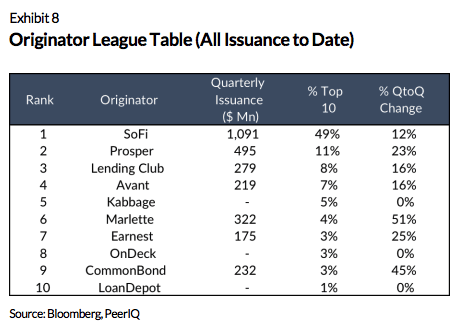

Average deal size for originators has also increased significantly since 2016.

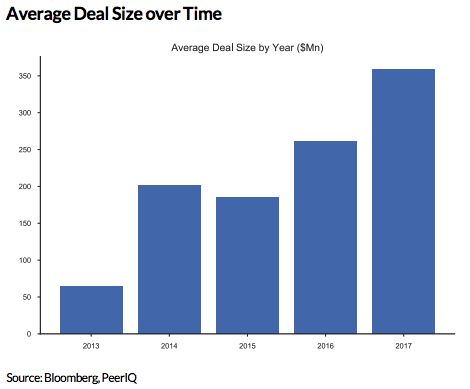

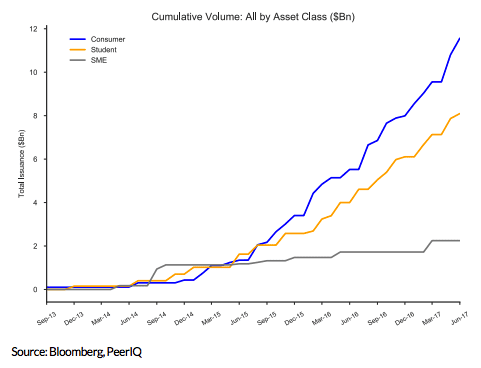

In the chart below you’ll notice that the growth of consumer volume in securitizations continues to outpace both student and SME.

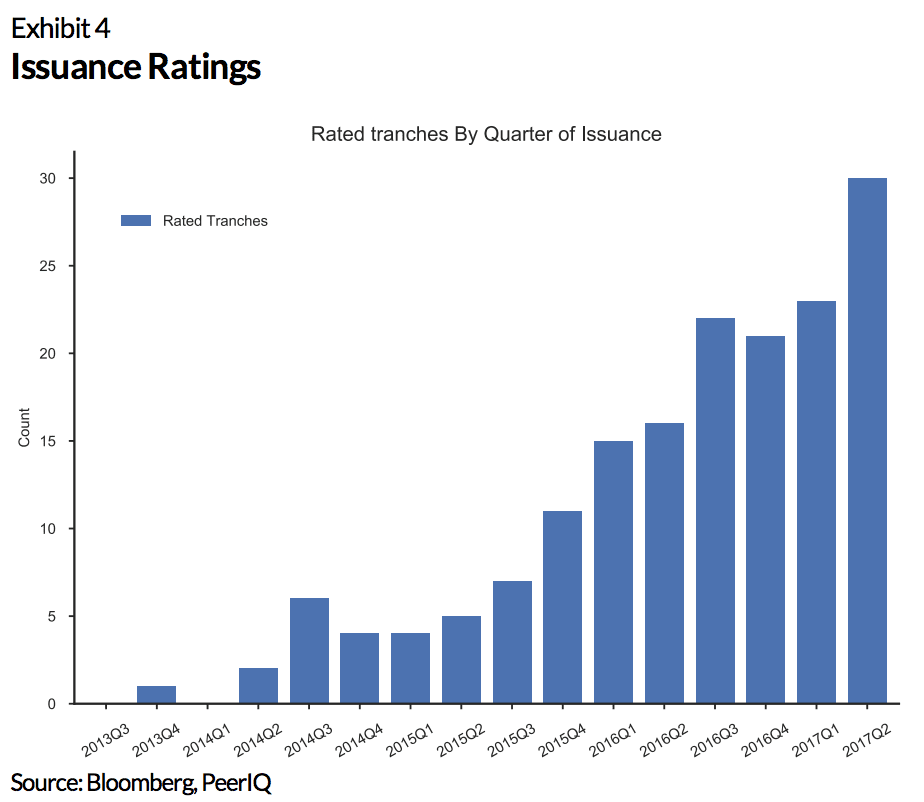

Finally you can see firsthand the increased participation by ratings agencies which continues to add more credibility to marketplace lending and the originators.

In the report PeerIQ provides their projections for the future of the securitization market:

Overall, we expect securitization volumes to continue to grow. The economic opportunity for whole loan buyers to fund via the term ABS markets is stronger than ever. Nonbank lenders have a growing addressable market and larger asset classes to tap into such as auto and mortgage. Investor and ratings agency participation continues to grow as performance history seasons. Every major federal regulator has now acknowledged the role of FinTech in creating transparency and promoting financial inclusion. There are now multiple paths to reducing regulatory uncertainty. We continue to expect the asset class to continue to mainstream into the portfolios of institutional investors that seek yield in a low-rate return environment.

Conclusion

This is just a taste of what is included in the Marketplace Lending Securitization Tracker for Q2 2017. PeerIQ publishes publicly the most in depth analysis on these securitizations and you can learn much more by downloading the report for free.