A majority of fintech companies today focus on providing faster and cheaper financial products to already well-served Americans. While this is a noble cause that has resulted in vast improvements for consumers in recent years it only scratches the surface of what is possible with technology today.

Petal, a startup aims to deliver on what we’ve often called the real promise of fintech: financial inclusion. The company describes itself as “credit with a conscience” and announced a new fundraising round of $34 million on the same day that they officially launched their credit card product to the public. Backing the vision is Jefferies and Silicon Valley Bank.

The funding will aid the roll-out to a waitlist which includes 100,000 people. The card is aimed at the tens of millions of Americans who have no credit score at all or a short credit history. According to Petal’s website:

If you have a credit history – that’s great, but even if you don’t, we can use the money you make and the bills you already pay to help you qualify.

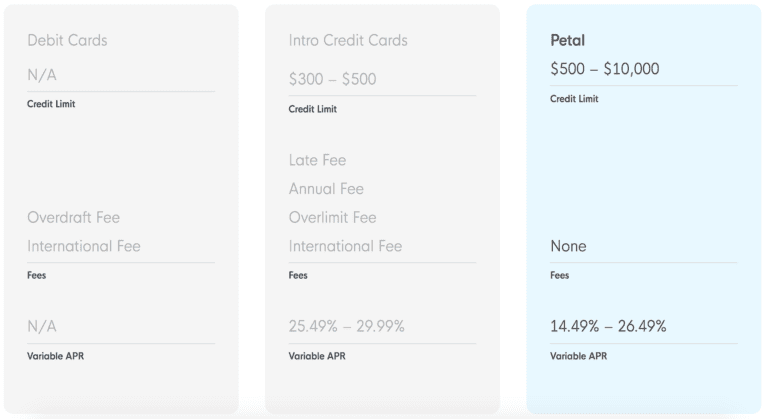

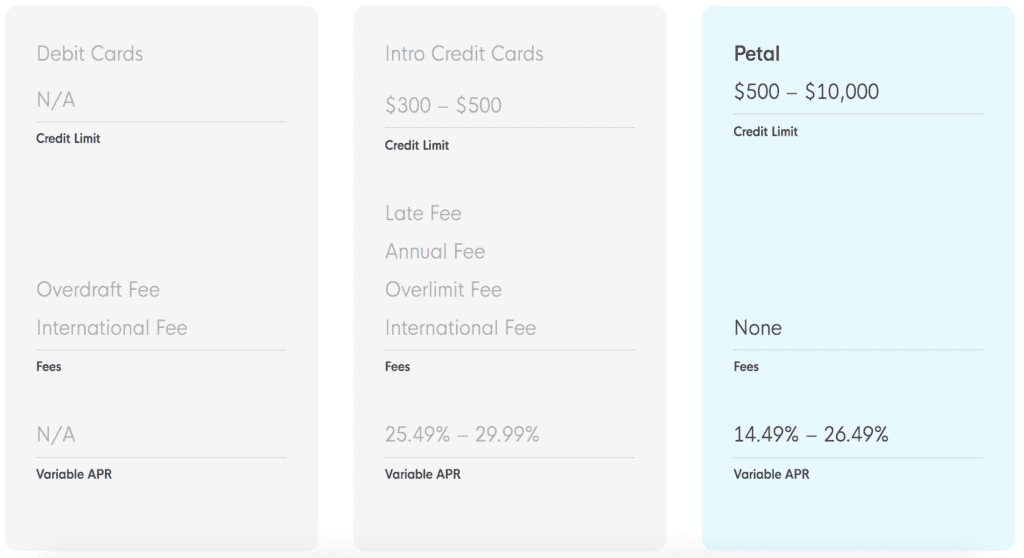

Petal card users are usually in their 20s and make between $30,000 and $70,000 per year. The product is tailored to those who are looking to get credit for the very first time as opposed to those looking to rebuild credit. The company takes into consideration savings and spending in order to come up with a credit profile that is much different than a typical credit card company. Approved customers are given credit limits that are ten times higher than what a competitor might offer. The transparency and credit limit is what the company hopes will make up for other types of rewards offered by major card companies. Petal makes money both from the interest paid by customers and transaction charges to vendors.

Conclusion

The biggest obstacle for those who are excluded in the financial system is where to start. The product Petal has built is compelling for first time credit card applicants, but one challenge Petal will face is reaching those who are not part of the financial system today. Many of these people not only lack credit scores, but also potentially any connection with a bank. It’s going to be interesting to watch whether Petal and their competitors are the key for these consumers to enter mainstream financial services.