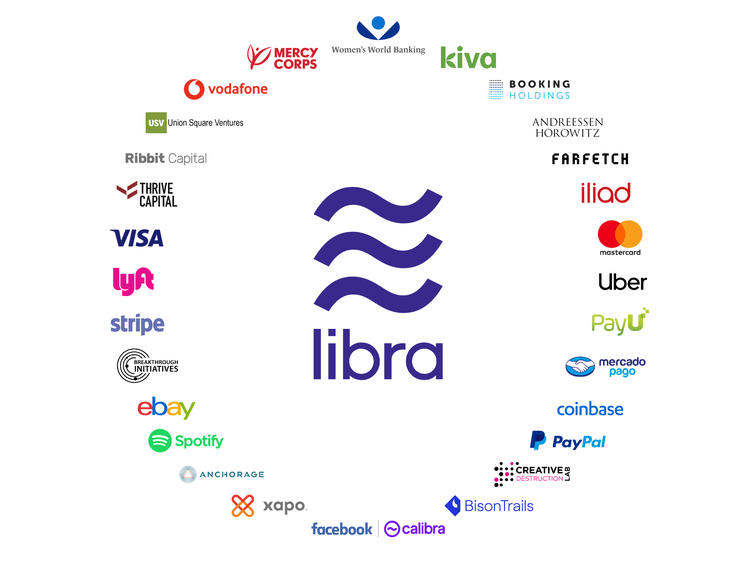

I look at the boundaries that Telegram and EOS have crashed into in the US with recent SEC actions and lawsuits, and the melting of Facebook Libra. There have been a number of interesting regulatory moves recently, and the positive headlines of 2017 have become the negative headlines of 2019. How does SEC jurisdiction reach foreign institutional investors? We also touch on the $1.5 billion NBA distribution deal now on the fence in China, and how US companies are under the speech jurisdiction of a foreign nation. How does China reach American protected speech? Through pressure, boycott, and economics.

Feelings and emotions at industry events matter. The narrative at the more traditional conferences is that Fintech innovation is just incremental improvement, and that blockchain has struggled to bring production-level quality software and stand up new networks. This isn't strictly true -- see komgo, SIX, or any of the public chains themselves -- but the overall observation does stand. Much of Fintech has been channeled into corporate venture arms, and much of blockchain has been trapped in the proof-of-concept stage, disallowed from causing economic damage to existing business.

big techChinacivilization and politicsfixed incomegovernancemacroeconomicsnarrative zeitgeistphilosophySocial / Community

·I've seen a whole bunch of headlines this past week about how Facebook is launching its version of the "Supreme Court", as if that were an app feature. The oversight board is meant to police controversial content decisions, and have the power to overrule Zuck's judgment on political matters. Its charter is drafted as if Facebook's 3 billion users were citizens of an Internet nation. Add to this the insanity over WeWork's failing IPO plans, where the CEO has been personally named in the amended filing documents with clear checks on demonstrated abuses of power. We are drifting into a Twilight Zone episode where modern corporations act as if they were feudal states run by divine kings negotiating with their nobility over a Magna Carta. Which is actually sort of where we are.

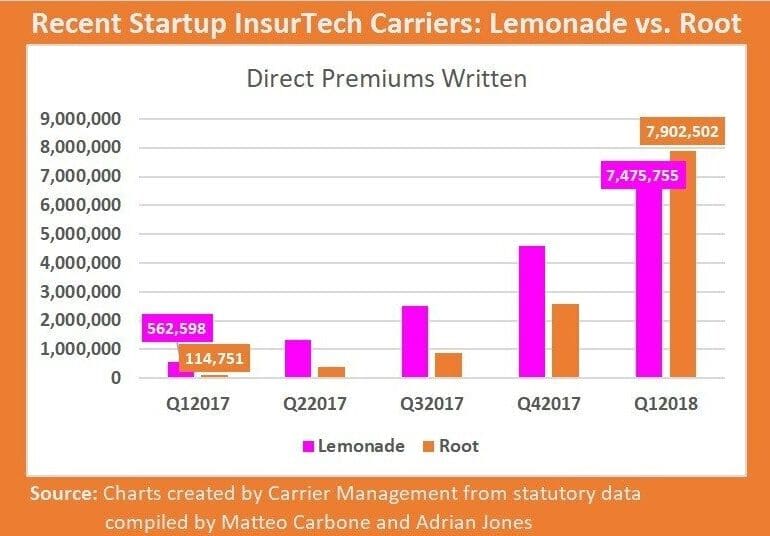

Robocop vs. Terminator in Fintech; Comparing DeFi originations to Digital Lenders in the early years

I've got a gentle, data-backed story this week inspired by a great distinction made in this Techonomy article by the Chief Digital Officer at Schneider Electric. The thesis tracks three key lessons from attempting to bring large companies into the 21st century: (1) transform the core of your business instead of fumbling around at the edges, (2) digitize your processes and separately figure out a distinct digital model, and (3) catalyze a digital ecosystem from the new model. You can think about the distinction as either taking the existing business and slowly swapping out parts from human to machine (e.g., like RoboCop), or building the robot from scratch utilizing the latest platforms, markets, and artificial intelligence (e.g., like Terminator).

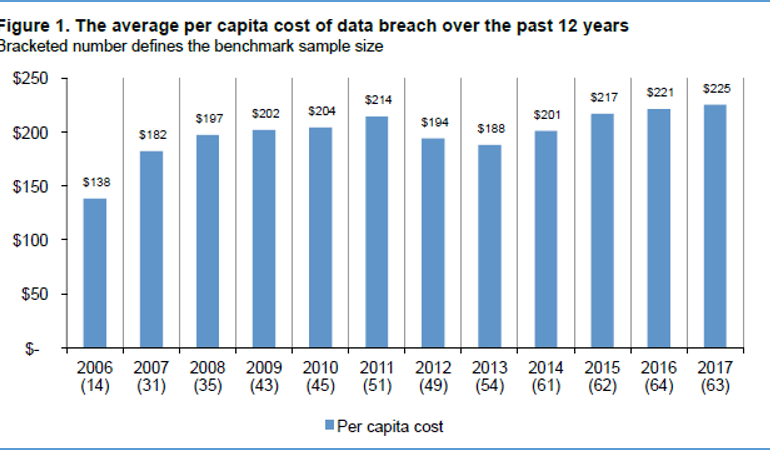

Capital One recently suffered a data breach resulting from poor security practices that exposed 100 million credit card applications and accounts. They expect the breach to cost the company $150 million. Two years back, Equifax lost 140 million identities, again from poor security practices. At the time, I said that according to GDPR this should cost them $150 million. They have since settled for about $600 million -- though some of that seems to be in-kind services coverage like free credit monitoring (lol!). Separately, Facebook has settled for a $5 billion fine associated with the Cambridge Analytica privacy "breach".

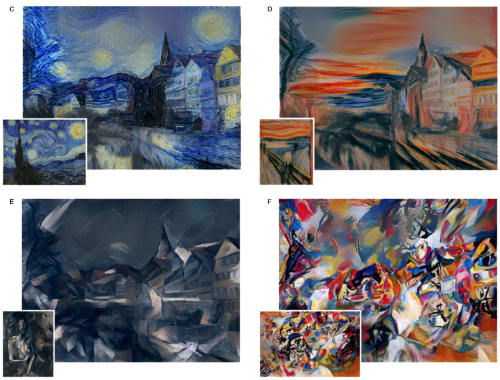

However, mastery is not immune to automation. As a profession, portraiture melted away with the invention of the Camera, which in turn became commoditized and eventually digitized. The value-add from painting had to shift to things the camera did *not* do. As a result, many artists shifted from chasing realism to capturing emotion (e.g., Impressionism), or to the fantastical (e.g., Surrealism), or to non-representative abstraction (e.g., Expressionism) of the 20th century. The use of the replacement technology, the camera, also became artistic -- take for example the emotional range of Fashion or Celebrity photography (e.g., Madonna as the Mona Lisa). The skill of manipulating the camera into making art, rather than mere illustration, became a rare craft as well -- see the great work of Annie Leibovitz.

Today's corporations and governments are in the business of defining the balance of these aspects of our participation in society and the economy. Beliefs about the immutability of different attributes about what makes a person (or an employee) and how economies are built (cutting the pie, vs. growing the pie) determine the policy decisions you make, top down. As the core example this week, let's take Deutsche Bank. Facing pricing pressure and headwinds in several of its businesses, Deutsche is responding with a plan to fire 18,000 employees by 2022 and an announced investment of €13 Billion in technology and innovation by 2022. They even spun up a hipster-colored neobank as a proof point. Wall Street ain't buying it.

Jump is an electric bike that is being distributed by Uber, and it just happened to be launching 350 of them in the London borough of Islington. You can rent a bike for 5 minutes at £1, and pay £0.12 per minute thereafter. That's generally cheaper than a taxi, on average more expensive than a public bike subscription. So why am I going on an on about these bikes? Two things come to mind as jumping off points for deeper discussion: (1) the incentives and tactics of economic organisms under capitalism to gather and retain attention, and (2) the monopoly powers of Uber and Facebook, leading to the impact of Libra's cryptocurrency on open competition, as well as the public responsibilities of supra national corporations.

I've been seeing a lot of Fintech headlines recently that make me raise my hands in the air, and go "Come on, are you for real!?". I imagine a lot of people feel similarly frustrated by Lemonade looking to go public at a $2 billion valuation on $50 million of revenue, Initial Exchange Offerings on crypto exchanges raising over $500 million this year, Facebook's tone deaf Silicon Valley club crypto money, or SoftBank talking about selling its overpriced $100 billion Fintech unicorn fund in an IPO. So other than getting crankier with age (Happy Father's day everyone!), I want to dig a little bit into the concept of fairness, asymmetric information, economic rents, and how this can help disentangle feelings from thoughts on these news items.

No More Content