In today’s digital world, 93% of employees receive their income payments via direct deposit.

Initially created as a convenience for employees, direct deposit is a great set-it-and-forget-it way to receive a paycheck — until you want to change it.

Adjustments such as switching direct deposit accounts and splitting a paycheck between accounts at different banks are cumbersome, paper-laden processes.

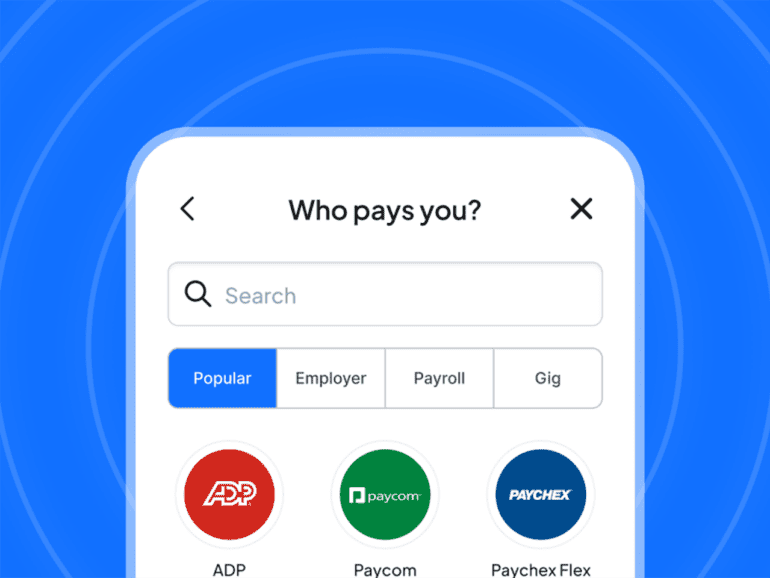

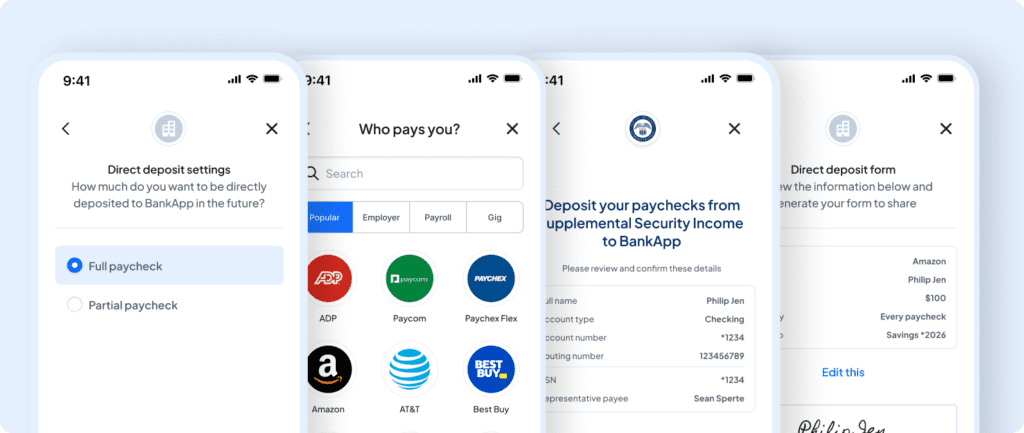

Pinwheel’s new Direct Deposit Switch 2.0 sets out to change all that. DDS 2.0 allows consumers to switch their direct deposits seamlessly from one institution to another without paper forms or talking to HR.

Direct Deposit Switch 2.0 offers universal coverage

Pinwheel allows 100% of direct deposit users to change their payroll and income settings seamlessly. This universality is a massive step for the industry, which is plagued by interoperability issues between financial institutions, employers, and payroll providers.

The universal reach of DDS 2.0 is especially attractive to community banks, credit unions, and neobanks — all of which have had trouble capturing the direct deposits critical to forging long-lasting, profitable customer relationships.

With this advantage in mind, neobank Varo has become an early adopter of Pinwheel’s DDS 2.0.

“Pinwheel’s Deposit Switch 2.0 will allow us to expand the reach of our trusted online banking services and increase our relationship with our customers significantly,” said Anton Chakhmatov, Director of Product at Varo, in a press release.

“Not only can Varo Bank now support automated direct deposit switches for 100 percent of the population receiving income via direct deposits, but this solution also strengthens our ability to hone in on the unique needs of our customers and offer more tailored solutions.”

DDS 2.0 a win for banks

Any bank’s primary goal is to capture the regular influx of cash via direct deposit. With Pinwheel’s new mobility for direct deposits, billions of payroll dollars are up for grabs. DDS 1.0 has been instrumental in growing banks’ direct deposits by 75% without the 100% coverage that DDS 2.0 offers.

Another advantage of DDS 2.0 is tapping into verified consumer data in real-time.

“Pinwheel creates a point of connectivity to a consumer’s permissioned payroll and income data,” explains Lauren Crossett, Chief Revenue Officer for Pinwheel.

Related:

“Pinwheel supplies customers with actionable data on behalf of the consumer, such as how much they’ve earned, what they’re projected to earn, or whether an employee is salaried or hourly. This is instrumental for decision-making in lending, rental applications, and more.”

Crossett also calls Pinwheel’s solution “a powerful fraud prevention measure. Uploaded paystubs are easy enough to fake. But when you’re connecting at the user-permissioned credential level, there is additional authentication that protects the bank and the consumer.”

DDS 2.0 creates seamless consumer experience

Pinwheel’s DDS 2.0 has significant implications for the user experience at banks large and small. Crossett explains that “because of DDS 2.0’s universality, no one is left without a path for moving their direct deposit to another account or bank. Consumers are no longer hamstrung when switching from a bank account they signed up for years ago.”

This seamless switching allows customers to select bank accounts with the desired customized features, such as early access to paychecks, attractive interest rates, or loyalty perks. Since a direct deposit is a prerequisite to receive most of these features, a streamlined, electronic system to change payroll settings is critical for user satisfaction.

Not only does this make for happy customers, but it also encourages competition and innovation among financial institutions.