Traditional card payments have been a bone of contention for small businesses and merchants. With cards being the most popular consumer payment method, they have to make them available, but the associated fees can chip away significant portions of their profit. The duopoly of credit card providers leaves merchants little space for competitive rates, making them victims of their rate-raising whims.

Lawmakers have only now started to meaningfully address the lack of competition in the space. The Fed, on October 26, 2023, proposed to shrink “swipe fees”, but their move is expected to be met with significant challenges from card issuers.

Pay by Bank has offered an alternative to costly card payments for some time. Allowing consumers to pay directly via their bank account bypasses the need for a card, streamlining payments. It poses the potential of less fraud, while instances of card fraud are expected to amount to $165.1 billion in the next ten years. It allows for less friction, with authentication integrated into consumers’ mobile banking apps. And it avoids the payment of the much-contested credit card processing fees.

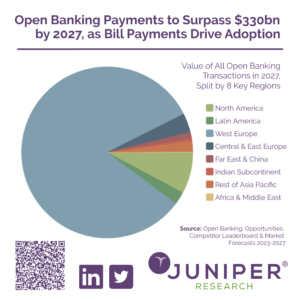

Globally, open banking payments transaction value surpassed $57 billion in 2023 and is projected to increase 479% by 2027. Driven by the increased popularity of global wallets and the adoption of open banking standards, countries such as the UK and the Netherlands have seen the sector develop significantly.

However, despite rapid uptake in Western Europe, adoption in North America has remained low. Recent regulatory proposals are set to drive growth, but to date, the majority of its evolution has relied on the private sector.

As open banking regulations are developed, the instance of utilities like Pay-by-Bank is expected to increase as customers have more control over their financial data and who they share it with.

Yesterday, November 2, 2023, open banking innovator Plaid announced a partnership with Ayden to bring Pay-by-Bank onto the North American payments mainstage.

Bringing Pay by Bank to North American Businesses

The partnership brings Plaid, the seasoned open banking provider, to the arena of bank-linked payments.

“Plaid is already trusted by about 1 in 3 Americans with a bank account and provides a secure and seamless way to connect financial accounts for bank-linked payments,” said Eric Sager, Plaid COO. “In partnership with Adyen, we’ll bring pay-by-bank and marketplace onboarding to more companies in North America, helping them lower payment cost, increase conversion, and reduce both fraud and payment losses.”

Created partly in response to Adyen’s business customer demand, it will allow partnered businesses to set up the payment method. Plaids’ customers will then be able to link bank details to make payments. The company’s software allows fintechs like Ayden to plug into bank account data that, with the customers’ permission, can then be accessed by Plaid to check balances and authenticate transactions.

“Plaid’s innovative financial technology made this partnership a great fit,” said Davi Strazza, President of North America at Adyen. “This alternative payment method not only meets our customers’ demands for continually expanded payment methods – but in the process also significantly reduces costs across the payment chain for them.”