The global economy has faced many challenges over the past few years, and this looks set to continue.

However, with skyrocketing valuations and booming figures in 2021, fintech seemed like it weathered a lot of the storm.

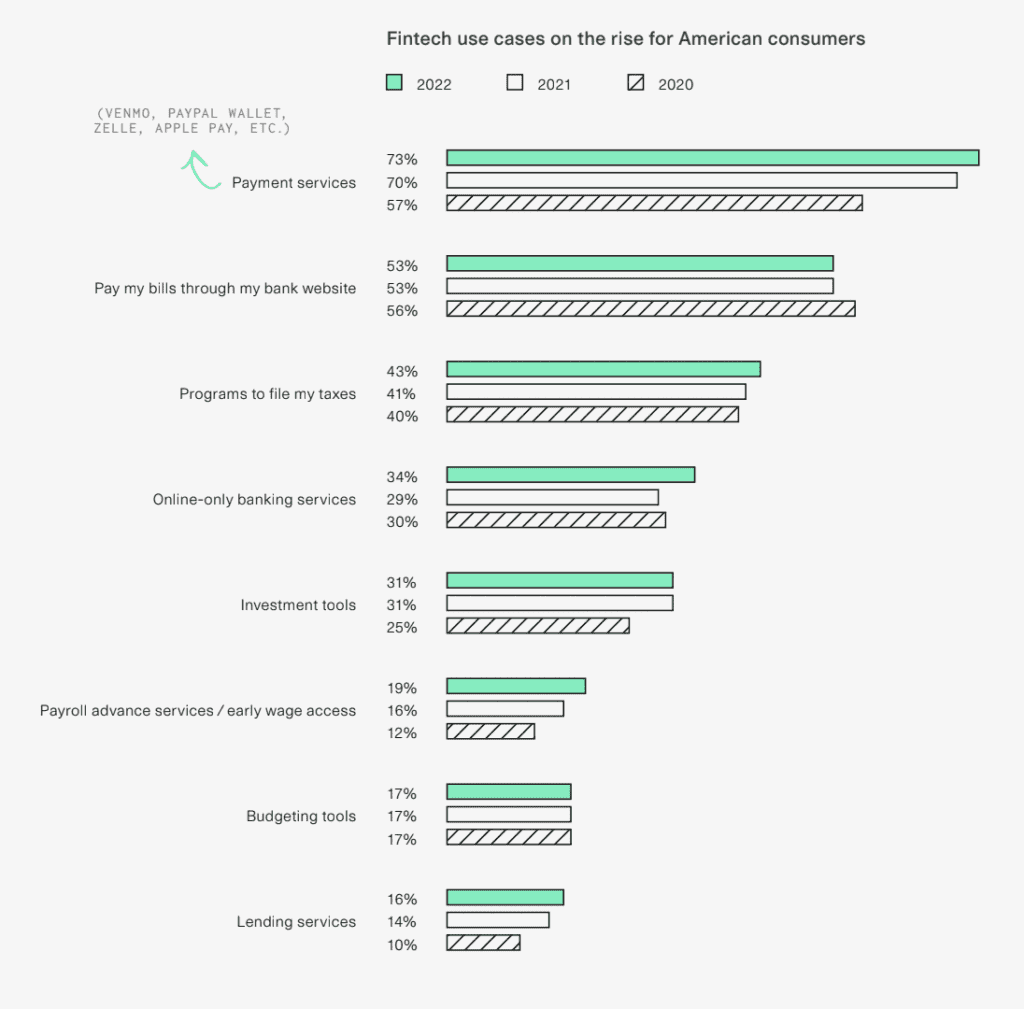

Assessing the behavior of consumers as they have been thrust into digital adoption over the past three years, Plaid’s third annual Fintech Effect report aimed to understand fintech’s outlook against this particularly unpredictable backdrop.

Fintech could be the antidote to economic challenges

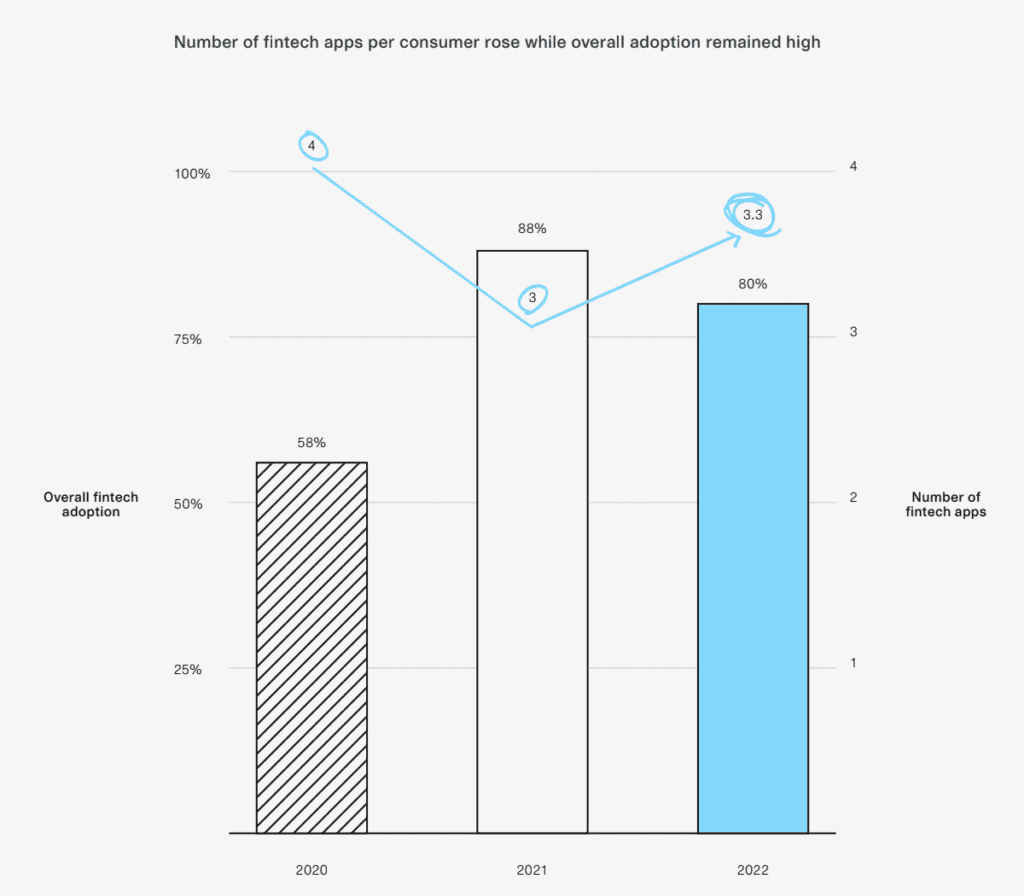

At large, despite dwindling financial confidence in the face of inflation, many consumers see fintech as the antidote. While fintech adoption dropped 8% between 2021 and 2022, it remained high, growing by 38% from 2020.

During the pandemic, many generations switched to fintech solutions out of necessity, bringing adoption up to 79% for baby boomers. Since the easing of restrictions, many have favored the in-person experience, bringing adoption down by 25% in 2022.

Despite this, younger generations were barely affected, and Gen Z user adoption continued to rise between 2021 and 2022.

While inflation continues to rise the world over, 2022 brings with it acute financial stress. Over half of respondents reported a rise in financial stress, with the cost of living being the most cause for concern.

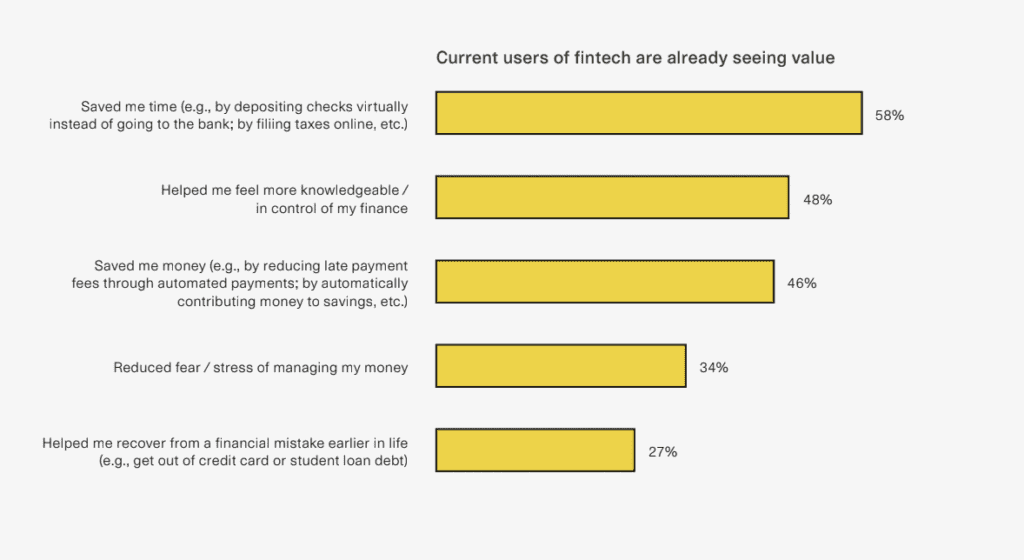

Plaid reports that two-thirds of respondents said fintech has helped them stay on top of their finances in the volatile climate. Over 90% of users saw the benefits of using fintechs, while just under half reported a feeling of control due to the tools available and used them daily.

Although many turned to fintech initially out of necessity, nine out of ten reported that the decision continues to bring them value. Traditionally considered a source of confusion, financial matters are perceived to be more manageable due to the digital tools the sector has brought.

Open finance could shape UK’s fintech future, while Americans focused on control and transparency

Fintech has set the bar high. Adoption is continuing to grow, and now consumers are demanding more.

Over the next six months, respondents expect to use fintech even more to manage their finances. Despite the findings from the UK Post Office, which said consumers were shifting back to cash, Plaid found national fintech usage to have risen by 5%.

The company stated in its report that Open Finance could be a significant factor in shaping the future landscape in the UK. The extension of access to other data areas could allow users to gain a better picture of their financial situation, opening the market to additional solutions.

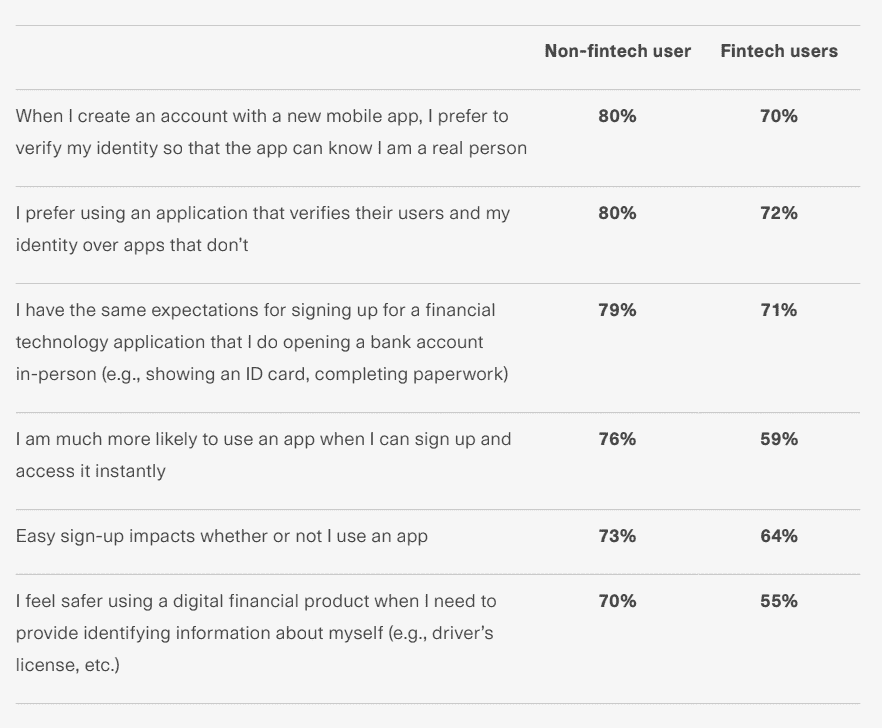

Enhanced identity verification and security could also boost trust in financial services, adding to adoption. Of all the UK respondents, 82% said they prefer products that verify users’ identities. However, increased security protocols are a balancing act, as 79% said they are more likely to use apps that allow instant access.

Unlike the UK, the American outlook for the future centers on users’ data control and transparency. Trust is a top priority.

Despite many agreeing on the importance of data access for banks, the ability to choose where data is shared is important to respondents. Across the generations, 83% of consumers preferred to personally direct the data themselves rather than allowing companies to make the decisions for them.

In addition, 76% of respondents said they would have more trust in a financial service if their privacy practices were transparent. Security was also particularly important. Many users stated they would be happy to sacrifice convenience to adhere to identity verification rules.

Gaps for growth

The trust angle marks a gap for many. However, as the fintech sector continues to mature, it could be slowly closing. Fintech is no longer the rebellious younger brother of financial services.

“What continues to be consistent with previous reports is that the lines between “fintech” and “finance” continue to blur,” stated Plaid in the report. “Fintech is no longer separate, but at the center of the new, digital and connected financial ecosystem—in the foreground and the background.”

An increasing focus on privacy and security controls may improve adoption.

Additionally, Plaid identifies an area of possible growth in the increased ability of fintech to meet users’ short and long-term needs. While many have stated that fintech has already helped them weather the economic challenges, improvements in long-term tools are also seen to bring value.

The report concluded by stating, “As the economic challenges play out, financial companies need to respond to consumer expectations and create products that will better guide consumers through volatility—all while remaining secure and easy to use.”

The ability to assist consumers in achieving financial well-being is a key strength for fintech. As financial services become more customer-centric, adaptation to meet consumer needs could be critical to the sector’s continued success.

By upholding the continued engagement of established users and providing additional use cases that appeal to those who have not yet made the plunge, fintech could continue to maintain its positive trajectory.