Softening investor demand has been a topic of many news outlets covering marketplace lending throughout 2016. But PeerIQ, who has the pulse on the marketplace lending securitization market, shared their most recent report titled Marketplace Lending Securitization Tracker Q2 2016 which highlights some positive trends.

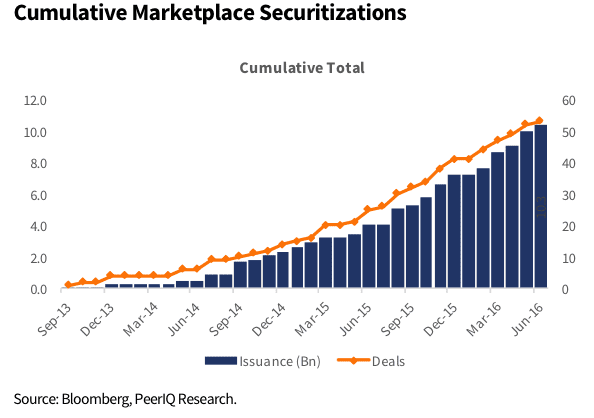

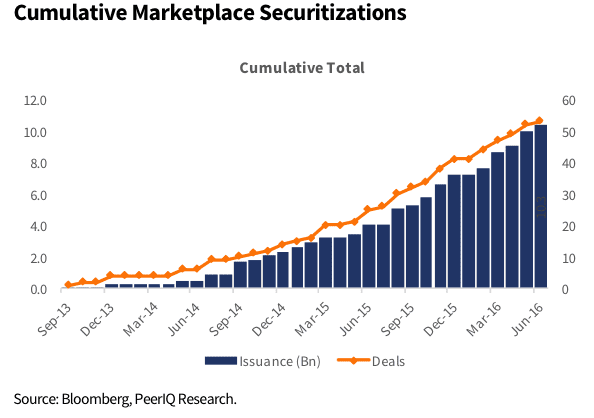

Total volume for marketplace lending securitizations was $1.7 billion in Q2 2016, up 14.8% from Q1 2016. This brings the year to date total to $3.2 billion with Q2 2016 volume nearly hitting total 2015 volume of $1.8 billion. To date, marketplace lending platforms have issued $10.3 billion in securitizations. Not surprisingly, we have seen average deal size increase to $267 million this quarter. Back in 2013, average deal size was just $64 million.

Looking at the broader ABS market, securitizations outside marketplace lending experienced a 27% year over year slowdown compared to a 77% increase we’ve seen in marketplace lending securitizations over the last year.

A total of 6 deals were done in Q2 and spanned several marketplace lenders and categories. Here is the breakdown from Q2 2016:

- 3 student loan securitizations (Earnest, SoFi, CommonBond)

- 2 unsecured consumer loan securitizations (Avant, SoFi)

- 1 SME securitization (OnDeck)

Although SoFi has been active in the securitization deals in the past, Q2 2016 marked their first rated unsecured consumer loan securitization. They also received a AAA rating from Moody’s on their recent student loan transaction. The report highlighted ratings upgrades by DBRS on past securitizations of SoFi loans from 2013 and 2014. This compares to downgrades from Moody’s last quarter on several CHAI mezzanine bonds. Q2 2016 was the first quarter where all deals were rated by at least one rating agency, another sign of the attention these securitizations are getting.

Despite Citi stopping the securitization of Prosper loans, they continue to be the leader in marketplace lending securitizations followed closely by Morgan Stanley and Credit Suisse. Citi has continued with other marketplaces, having co-lead the recent SoFi deal. According to the PeerIQ report, they expect positions of top bookrunners to change with Morgan Stanley and Credit Suisse scaling back warehouse lending and fixed income desks. PeerIQ sees increased activity from both Deutsche Bank and Goldman Sachs.

Cited as factors for an improving securitization market are increasing platform rates and spread tightening in both primary and secondary markets. A detailed analysis of specific securitizations are outlined in PeerIQ’s report.

Conclusion

While it’s hard to ignore the news that has come out over the last two months, it is nice to see some positive news from the securitization market. Due to recent events, these investors are seeking greater transparency and data validation. However, the more transparency these platforms can provide, the more likely it is that the trend of securitization being a viable funding source will continue.