In an email sent out to investors earlier today Prosper announced they will be closing down their secondary market on October 27. They have been running a secondary market via FOLIOfn since 2009 but it has never gained much traction.

I have to admit I have not used the Prosper secondary market for a couple of years but I always liked knowing it was there. I am sure many other investors feel the same way. But going forward all investors will be forced to hold their loans to maturity.

There were a small number of power users but the vast majority of retail investors never used this trading market. One of these power users was Brett Byers, who I interviewed on the Lend Academy Podcast back in 2014. In an email exchange earlier this week he indicated that even he had vastly reduced his use of the Prosper secondary market.

I reached out to Prosper and received the following official comment from Aaron Vermut:

As we have rebuilt and enhanced our retail investor experience, we have found that we must focus on those areas that will provide the broadest set of users with maximum value, and this includes a focus on our primary market. Over time we’ve found that very few investors are using the secondary market. While we’ve decided to wind down this service, the decision in no way changes our commitment to the retail investor, and we continue to explore alternative secondary market for our Notes.

The official word is that while they are closing down the Folio secondary market they are still open to an alternative in the future. At the American Banker conference this week in New York Matt Burton of Orchard discussed their plans for a secondary market for the sector. While this will be a market focused on institutional investors Burton said that eventually he would like to have a secondary market to serve all investors. But it is probably years before we will see this flow down to retail investors. My point is, though, that others are working on this challenge.

My Take

While this is a disappointing move from Prosper I understand where they are coming from. Their secondary market has never been used as much as Lending Club’s so I am sure it is a cost center for them. Given their slow down this year they are no doubt looking for ways they can cut costs and this was a cut they could make without major consequences.

I have always maintained that an investment in Prosper or Lending Club should not be viewed as liquid. So my approach is unaffected by this move. Of course, there are also those people who used the secondary market as part of their investment strategy. But sources tell me that these people numbered in the single digits so I see the business sense in closing this down.

Here is the full text of the email that went out today.

We are writing to let you know that as of October 27, 2016, Prosper will no longer offer the Folio Investing Note Trader platform, the secondary market for Prosper Notes. Prosper has found over time that very few investors are using the secondary market and, as such, has made the decision to no longer offer this service. We apologize for any inconvenience that this causes. Prosper remains committed to its retail investor clients and to providing them a great experience.

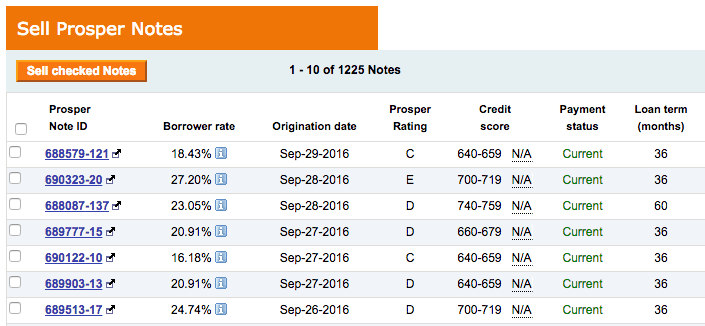

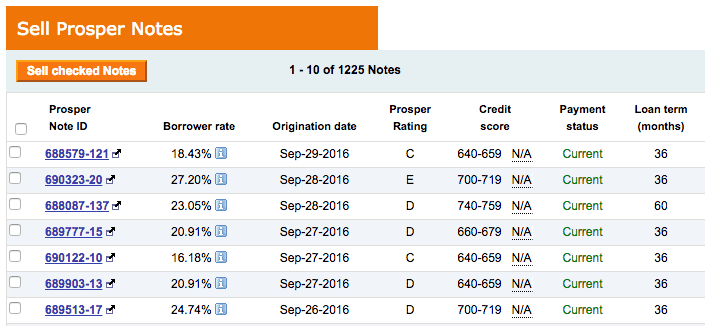

Here’s what this means for you: The secondary market trading service will be available as normal until end of day (5:30 pm PST) October 19, 2016. After that time, any new orders to list Notes for sale will not have sufficient time to be completed and processed before the site becomes unavailable to users at the end of day (5:30 pm PST) on October 27, 2016.

Once the secondary market trading service is terminated, you will not be able to sell Notes that you own, and you will need to hold them to maturity.

If you have questions about your Notes or the wind-down of the Folio Investing Note Trader platform, please contact Prosper customer service at 877-611-8797.

Thank you.

Prosper and Folio Investing