Prosper received a late Christmas present from the SEC last month. After 10 months and eight revisions their registration for Prosper Funding LLC was approved on December 27th. This is great news for Prosper investors.

I have had several conversations with Prosper management over the last week to try and get a handle on what this all means for investors. I have also read through a lot of the final amended S-1 registration. It is a complex legal structure that I will do my best to explain to you.

What is Prosper Funding and why is it important?

Right now the legal entity at Prosper is officially called Prosper Marketplace Inc. (PMI). Prosper Funding LLC is a new legal entity that offers bankruptcy protection for investors. In the unlikely event of a bankruptcy at PMI the structure of Prosper Funding will allow notes of investors to be protected from creditors.

One of the common questions I hear from new investors is what will happen to their money if Prosper or Lending Club were to go bankrupt. Prosper has now addressed that problem with Prosper Funding by providing a new level of protection for investors. That is why Prosper Funding is so important – it is the first time a p2p lender has provided this kind of protection for all investors.

How is Prosper Funding different from PMI?

All of the loans are currently held on the balance sheet of PMI. There will be an exchange at the end of this month when these notes will become part of the balance sheet of Prosper Funding. So, this means that the bankruptcy protection will be retroactive to all notes currently outstanding. Also, once this new structure has been setup all new loans issued will become part of Prosper Funding.

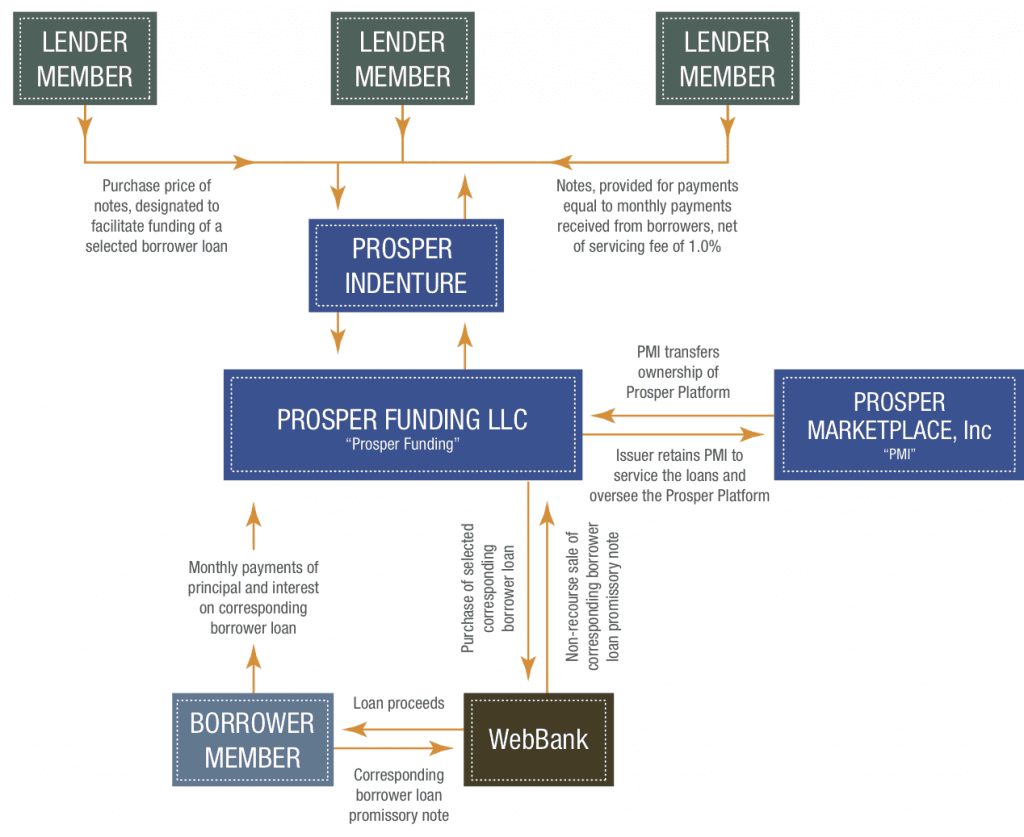

The new structure is explained in part by this diagram from the S-1 filing (you can click on the graphic to view it at full size).

For practical purposes the only real change is what happens after the loan is originated. Right now WebBank originates all the loans then sells and assigns them immediately to PMI. But going forward WebBank will sell and assign the loans to Prosper Funding. Monthly payments from borrowers will now be paid to Prosper Funding.

How is Prosper Funding able to offer bankruptcy protection?

This is where it gets a bit complicated from a legal standpoint but here is a quick summary from the prospectus:

Prosper Funding has been organized and will be operated in a manner that is intended (i) to minimize the likelihood that it will become subject to bankruptcy proceedings, and (ii) to minimize the likelihood that it would be substantively consolidated with PMI, and thus have its assets subject to claims by PMI’s creditors, if PMI files for bankruptcy. This is achieved by placing certain restrictions on Prosper Funding’s activities, including its transactions with PMI, and implementing certain formalities designed to expressly reinforce Prosper Funding’s status as a distinct corporate entity from PMI.

There is much more detail in the prospectus which I encourage you to read if you want to know more about how it all works.

Do all employees at Prosper become employees at Prosper Funding now?

No, Prosper Funding will have no employees. It will have its own officers and board of directors as required by the SEC. Two of the five directors will be outsiders not affiliated with Prosper. Prosper Funding will retain PMI to run the platform and service the loans so all employees will remain with PMI.

How is Prosper Funding different from LC Advisors?

As many readers will know Lending Club has had a bankruptcy remote vehicle for almost two years now. It is through their wholly owned subsidiary called LC Advisors. LC Advisors buys notes through a private Special Purpose Vehicle into two funds that invest in Lending Club notes. The minimum investment in these funds is $500,000 and it is the preferred investment vehicle for most large and institutional investors at Lending Club.

Now, I couldn’t really begin to explain the legal differences between the two bankruptcy remote structures but I can say this. At LC Advisors the notes are held in private funds and it is these funds that provide the protection for investors. At Prosper the new issuing structure itself is what will provide the protection – so all investors, large and small are protected.

What would happen now in the event of a bankruptcy at Prosper?

What is different now is that Prosper Funding owns the loans. Prosper Funding will have very limited scope in its operations and so will incur very little debt other than the loans themselves. Furthermore, as it was explained to me, no other creditor can insert themselves between the lender and the loans.

Now, in the event of a bankruptcy at PMI, it would not be a smooth process. The S-1/A registration goes into detail about different possible scenarios, many of them dire. PMI owns the software and hardware that runs the platform so if PMI could no longer operate the platform new loans would stop being issued at least temporarily. But there is a backup service provider in place so payments should still be processed from borrowers and distributed to lenders. While the investor money should be protected there would likely be a great deal of disruption if PMI were to enter bankruptcy.

The main point is that the likelihood of significant principal loss with a bankruptcy is much smaller now. Can Prosper guarantee no principal loss for investors? Of course not. There are no guarantees for investors outside of FDIC insured investments. We should keep in mind that peer to peer lending contains a level of risk. With this move Prosper has reduced that risk but the risk is certainly not zero.

All investors should be receiving an email from Prosper in the next day or so explaining this change. This new structure should be in place by the end of the month I have been told. So maybe February will see a big influx of investor money into Prosper. That would certainly be welcome news after the last three months.