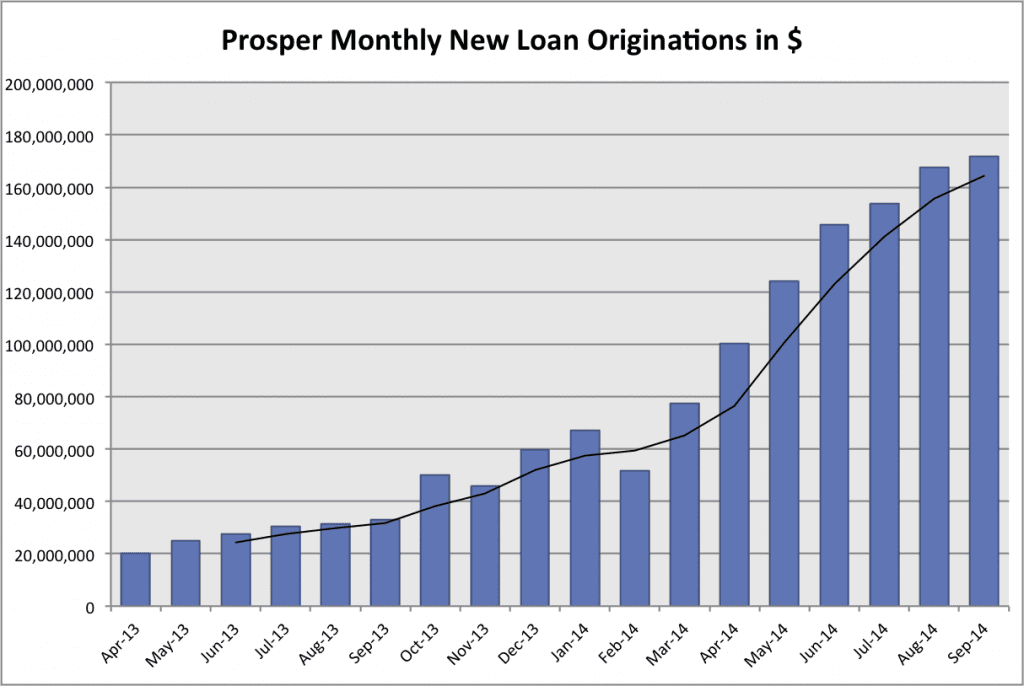

Prosper closed September with another solid performance. They issued $171.6 million in loans last month up from $167.6 in August which is a 2.4% increase. While this is the smallest percentage increase since their down month in February I should point out that on a dollars issued per business day basis the increase is 12.7% over August.

While the vast majority of loans are going to the whole loan platform I did regularly see over 200 loans available last month on the fractional platform. While this is far less than Lending Club on any given day at least there are some high yielding loans that are staying on the platform for investors. As of this writing there are 21 loans yielding 15% or more available to investors. There was a time a few months back when every loan of 15% or more was being snapped up in minutes.

Still, I would like to see more emphasis on retail investors from Prosper. They keep saying this is their plan and we are seeing some minor improvements here but more needs to be done to attract new retail dollars to their platform in my opinion.

Below are some of the key stats for last month with most metrics staying very consistent over previous months.

Average loan size: $13,291

Average dollars issued per business day: $8.6 million

Percentage 36/60 month loans: 66.0%/34.0%

Average interest rate: 14.96%

Percentage of whole loans: 90.8%

Average FICO score: 700

Note: If you are wondering about the Lending Club numbers they have unfortunately stopped updating their new loan data in real time. Their latest origination numbers are from the second quarter. You can take a look at these numbers in this post.