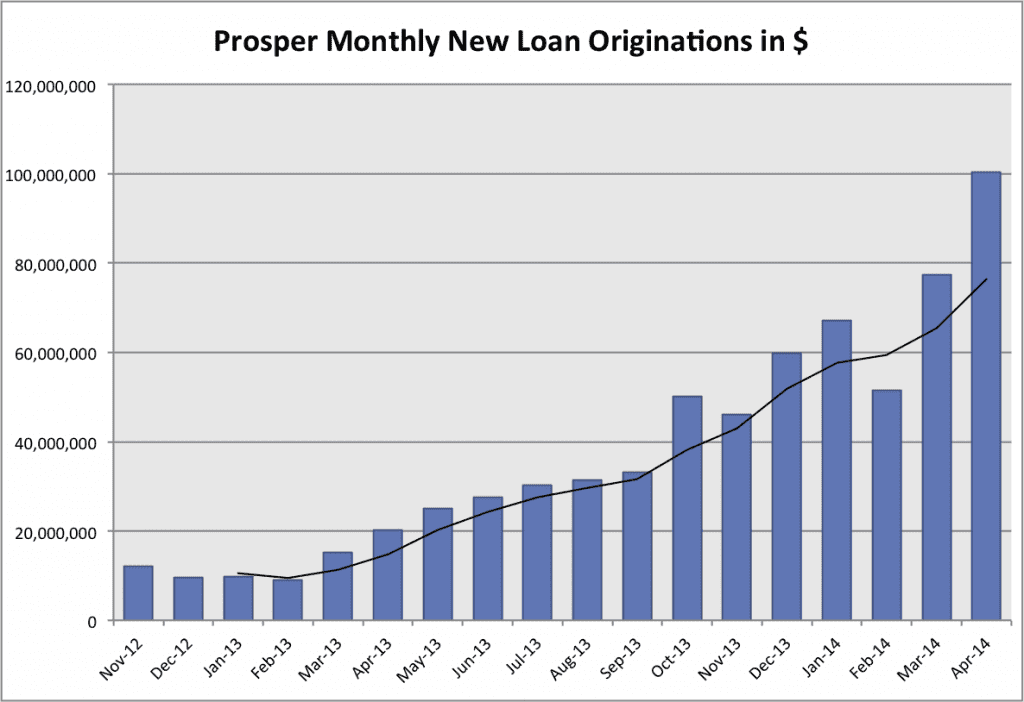

April will be a month to remember at Prosper. After doing a record $77 million in new loans in March they blazed right by that total to issue $100.3 million in April.

Prosper’s growth over the last year has been nothing short of staggering. It was just 14 months ago when Prosper originated $9 million for the month and investors were wondering whether the company would ever get on a growth trajectory again. Well, the new management team has certainly over achieved on the growth numbers since then.

I called Aaron Vermut, CEO of Prosper, yesterday to get some background on this amazing month. He was obviously very pleased with the April numbers but not so much for the milestone itself but the bigger picture about what this means. One of the interesting things that Vermut said is that their recent success has made it much easier to hire top talent. He pointed to the recent hire of their new CFO, Macy Lee, who has deep experience in marketplaces from her time at eBay Australia and Paypal.

Vermut also talked about the continued improvement of their borrower funnel. After making a quantum leap in September last year when they reworked the borrower experience they are still finding ways to improve conversions. These improvements drop straight to the bottom line because they result in more loans on the platform for no additional marketing spend.

He also talked about their new digital strategy. They have increased their social media presence dramatically this year and that has resulted in vastly increased engagement. While direct mail continues to be an important borrower acquisition channel for Prosper, they have also revamped their affiliate marketing program and their Pay Per Click program.

One final interesting tidbit Vermut shared was that now 50% of the traffic coming to Prosper is direct traffic – the result of someone typing Prosper.com into a browser. This points to an increased brand awareness for Prosper and, of course, this is free traffic.

The other piece that I noticed this month is that the number of available loans for retail investors has been slowly increasing. There were times this month when I noticed more than 150 loans available and there was even several C and D grade loans staying on the platform for longer than just a few minutes. These are signs that the limits placed on institutional investors recently are starting to pay dividends for retail investors.

Note: There is no Lending Club information this month because they have stopped updating their new loan data.