Increasingly, lenders are turning to alternative data to inform underwriting decisions.

For years, credit has been granted using formalized credit scores such as FICO.

However, many consumers are rejected, leaving entire demographics underserved, despite many being able to afford the credit they seek. Alternative data sets provide a complete picture of the individual, improving inclusion.

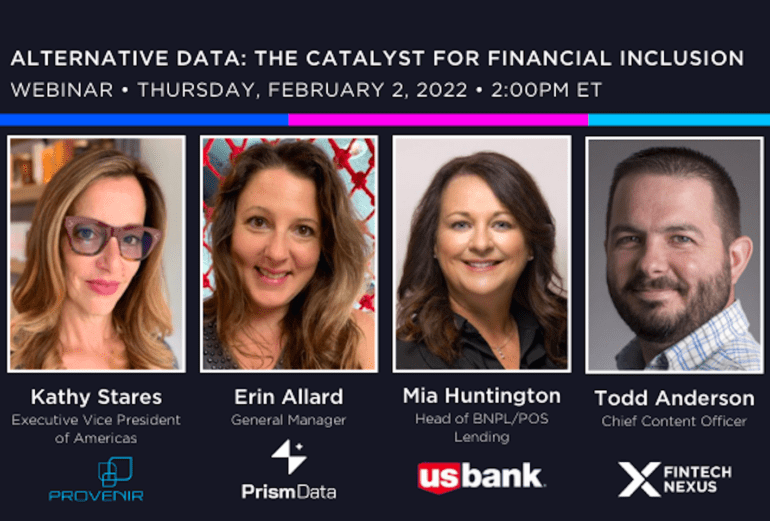

Provenir, an AI descisioning tool provider, hosted a Webinar with Fintech Nexus, which explored the possibilities of alternative data in bringing credit to the underserved. Moderator Todd Anderson started the session by thanking Provenir for setting up the webinar and introducing the speakers.

What is alternative data?

The webinar started with a definition of alternative data regarding credit descisioning.

“It’s any data that’s not directly related to that consumer credit behavior,” said Mia Huntington, Head of BNPL/POS lending at US Bank.

Erin Allard, General Manager at Prism Data, expanded, stating, “I think it goes to what is this data. If alternative data is this sort of mass bucket, that’s anything that’s not the kind of historically, institutionally used credit scoring or credit reports.

“If we’re talking about things that are real financial facts, things like, how much does a consumer make? How stable is that income? How do they spend their money? How do they save? That feels much more fundamental to how consumers make financial decisions.”

She explained that when talking to the average consumer, their current account is where they spend much of their financial life. Here, the consumer receives their paycheck, may use their debit card and pay bills.

When a consumer decides whether they can afford something and take on debt, she said, they are more likely to consider the inflows and outflows of their daily life rather than the technical elements of credit descisioning.

“(Alternative Data) is much more a completion of the data that speaks to the consumer’s life.”

Ability to improve financial inclusion

For years, many consumers have remained excluded from accessing credit due to their inability to build a suitable credit score. Traditional credit scores have been criticized for remaining too rigid and unable to account for the nuances of modern consumers’ lifestyles and circumstances.

“In combining that alternative data, you’re often able to address treatments at a much more granular level, getting right down to what is your individual customer doing and being able to see patterns across the segment,” said Kathy Stares, Executive Vice President of Americas at Provenir.

“You can use the power of alternative data, which often has a much longer history. So you can see patterns that you may not have been able to see before, which can help inform. You know the whole risk portfolio.”

“You’re meeting the customer where they’re at and providing a tailored offering, which often increases adoption.”

“Looking at that underserved market, you’re able to take data. And with that history and behavior pattern and other data sets, you’re able to make decisions that meet risk thresholds both on credit and fraud as you’re onboarding customers that traditionally you wouldn’t be able to reach and offer them financial instruments that they couldn’t use in the past.”

She explained that this granular look and long history successfully mitigate fraud when taking on new consumers. The real-time data view incorporated in many descisioning models using alternative data gives the lender insights that can identify fraud quickly.

Fintechs out front, but banks are catching up

Implementing AI and machine learning have been fundamental in financial institutions’ ability to extract and use this data. At times being removed from a large pool of raw data, these tools have given lenders the capability to quickly assess underserved consumers’ creditworthiness.

The speakers agreed that fintech had taken the lead in implementing the technology, with the skyrocketing popularity of BNPL as a prime example of their success. However, banks have started to catch on and are beginning to match the innovation of fintechs in serving consumers they would have traditionally rejected.

“It’s how customers expect to interact. It’s how the current economy works,” said Huntington. “I just don’t think it’s an option anymore for Banks to say no. This is traditionally how we’ve always done it, and we’ll keep doing it that way.”

Banks, with their legacy systems, have had difficulty incorporating the new tech, requiring extensive measures to be implemented to maintain compliant standards.

“Make no mistake about it. It is very complex to get it right and get it going, especially, as you know, larger financial institutions and some of our infrastructure,” said Huntington.

“It is highly complex to get started and get it right. I think it’s all about building those models, running them side by side to say this was the expected outcome… I think that’s a huge part of what many banks are probably thinking about at the moment.”

Explainability is difficult but essential

The use of AI has received criticism from regulators and consumers alike, who are concerned that the technology could contain inherited bias. The subject of explainability and clarity based on which decisions are made has become ever more relevant when taking on vast sets of alternative data.

Keeping compliant with standards of explainability can be challenging for institutions that want to build in-house models that will inform their underwriting process.

“So when you’ve got an AI machine learning model, you’re able to operationalize in real-time, you’re able to inform in real-time, you’re able to take the insights out, and you’re able to train and have explainability in a real-time basis,” said Stares.

“If you have the technology to incorporate the non-FCR data and take it in its native form, you can ingest that data right into your decisioning. That can then be used to inform models, and your decisioning is what would keep the compliance.”

Allard agreed, stating that ensuring the documentation and clarity when building descisioning models is critical to this compliance and could become even more important in the future.

While currently, access to data can be limited, increased efforts in developing open banking in the US have the potential to create widespread access to alternative data.

“Hopefully, in the future, it will be less complicated and much easier for a consumer to say, ‘Here are all of my accounts. Here’s where I bank, here’s where I do business, and I, as a consumer, am choosing to share my data.’ Then, it’s incumbent upon the folks making credit decisions based upon that to have access to the right technology to adjust and use it,” said Allard.

“As long as the data is available, it’s about picking the right solution to leverage it.”

All three speakers felt that the choice of the technological solution is critical to the success of alternative data in reaching the goal of increased inclusion.

The credit bureau’s time to change

One of the final questions of the webinar turned to the Credit Bureau.

The traditional credit score has been a standardized method to underwrite lending for years. Fintech’s innovation in credit descisioning has become an immediate need for alternative ways to open credit out to a broader audience. The influx of alternative data could inform the credit bureau’s scoring process, bypassing the need for alternative, in-house technologies for individual institutions.

“I don’t think there is an option,” said Huntington. “I think they have to change the model and the way this core is calculated and incorporate some of this data.”

“The question will be at what pace can they innovate to ensure that they are using the data and alternative sources of data in a relevant way.”

RELATED: