Sharing the details of my returns is one of the regular features on Lend Academy and one that I am quite passionate about. It is also the feature that I get the most emails about – people really like to see actual returns on seasoned investments. I have been investing since 2009 and opening up my accounts for the world to see since Q4 2011.

You can go back and follow my journey from an investment that has grown from $84,000 in Q4 2010 to around $681,000 today. Now, I have added substantially to my initial investments and will continue to do so for the foreseeable future. Eventually, I plan to have a diversified seven-figure portfolio made up of consumer, small business and real estate loans.

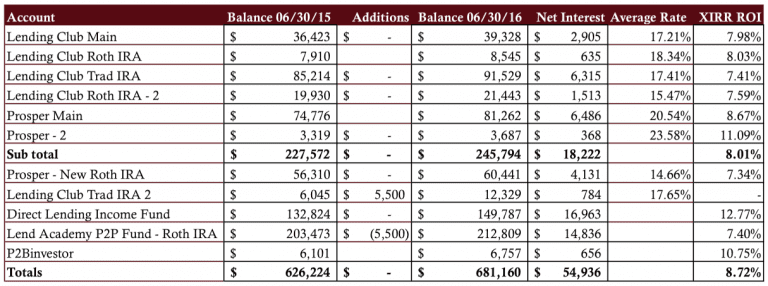

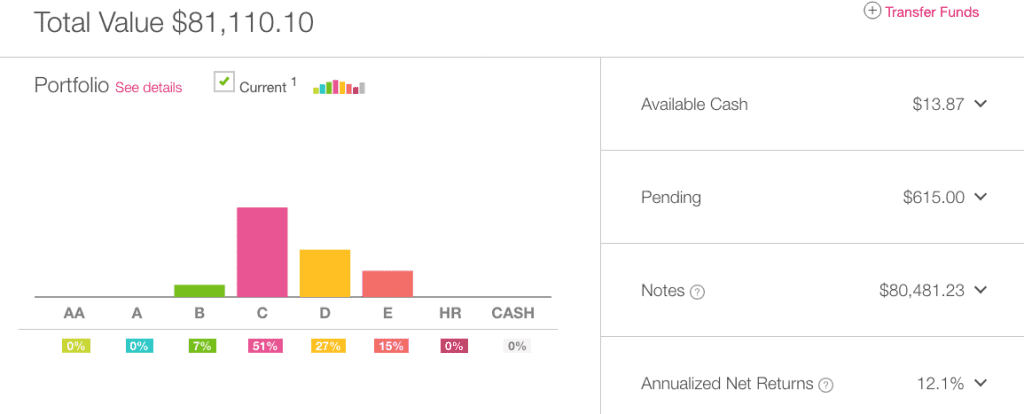

Overall P2P Lending Return at 8.72%

Now on to the numbers. Once again my trailing twelve month (TTM) returns have dropped from the previous quarter. While still a respectable 8.72% it is down from 11.30% just a year ago and also down from 9.28% last quarter. This is a trend that has continued for a couple of years now but I expect I am close to the bottom (assuming the economy still keeps chugging along). While declining interest rates and increasing defaults have been the norm for some time now there are signs this trend is coming to an end. The average interest rate on most of my accounts has risen in the past quarter as the platforms have raised rates quite aggressively this year. My six core holdings, those that have been opened the longest, also continued their decline to come in at a TTM return of 8.01%.

Now on to the details. Click the table below to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Rate column shows the weighted average interest rate taken directly from Lending Club or Prosper.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way to determine your actual return.

- The six older accounts have been separated out to provide a level of continuity with my previous updates.

- I do not take into account the impact of taxes.

Now, I will break down each of my investments from the above table grouped by company.

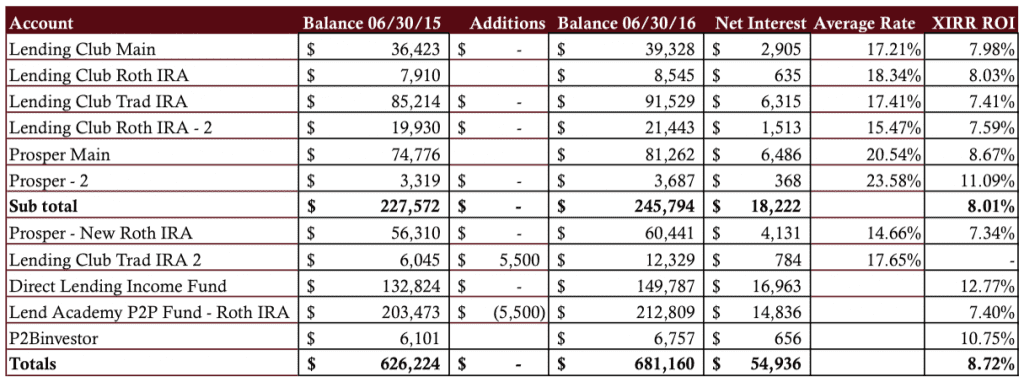

Lending Club

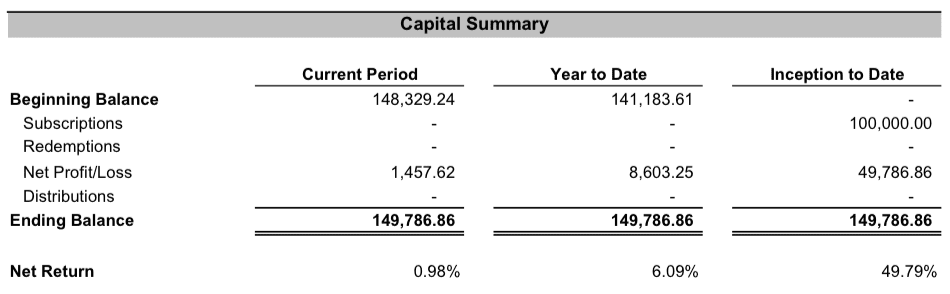

My very first Lending Club account was opened in June 2009 – the above screenshot is of that account taken at the end of last quarter. One of the interesting things about mature accounts is that you get to cycle your money many times over. I have only invested $25,000 in this account (made over the first three years) but my total amount invested in notes is now over $140,000. And I have made $27,000 in interest, more than the original investment, but also have suffered $12,000 in charge offs. I have not added to this account for many years as I only invest through retirement accounts now. I try to invest in different notes across all my five Lending Club accounts using mutually exclusive filters.

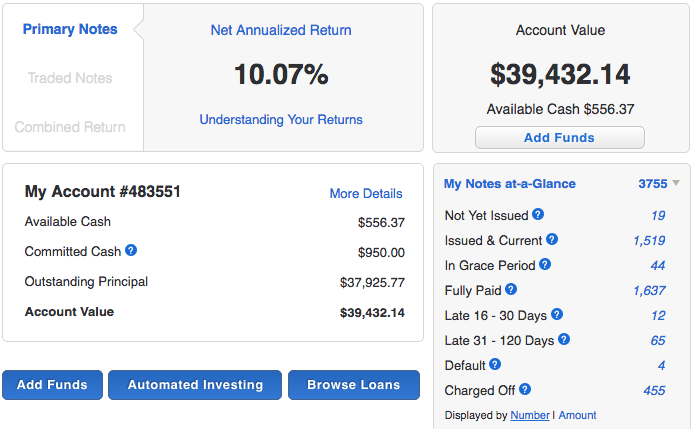

Prosper

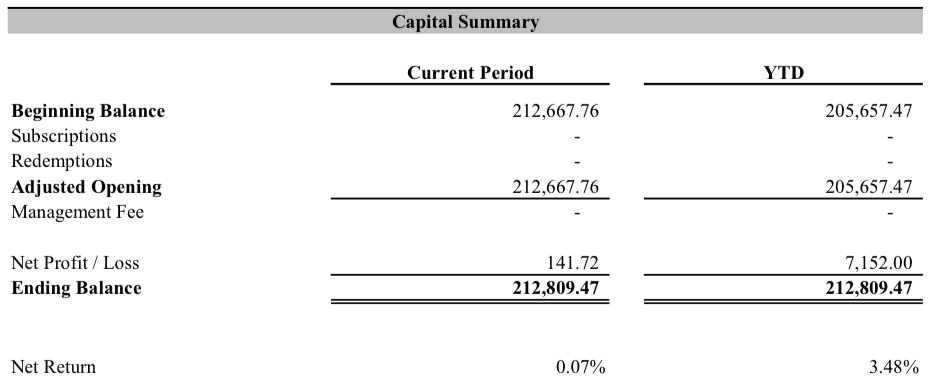

My first Prosper account was opened in September 2010. Prosper recently have done a redesign of the investor experience and you can see the new screenshot above. This is my largest taxable account – when I first opened this account Prosper didn’t have an IRA option. So, I ended up investing $50,000 in this account over a number of years. Back when I started this was my best performing account – Prosper had higher rates than Lending Club and provided higher returns to investors. That is no longer the case with Lending Club providing slightly higher overall returns in recent years (according to NSR). My newest Prosper account is my Roth IRA account which has been open for just over two years and focuses on a more conservative strategy with the lowest average interest rate of any of my Lending Club or Prosper accounts.

Direct Lending Income Fund

The Direct Lending Investments fund is over three years old and invests in high yield, short-term small business loans across multiple lending platforms and has consistently been my highest performing investment. Today, the fund has changed from buying whole loans to providing a credit facility to a number of different alternative lenders. Returns have been dropping ever so slightly as the fund has grown but at a TTM return of 12.77% I am very happy with the work that Brendan Ross and his team have been doing.

Lend Academy P2P Fund

The Lend Academy P2P fund, managed by the team at our sister company NSR Invest, invests in Lending Club, Prosper and Funding Circle loans and has a small position in Upstart as well. Like many funds this year, the returns here have been hit by the interest rate rises at Lending Club and Prosper. This fund uses the Fair Value method for calculating NAV and loan valuations are adjusted whenever interest rates increase or decrease. The interest rate increases we have seen have hit the NAV thereby reducing investor returns.

P2Binvestor

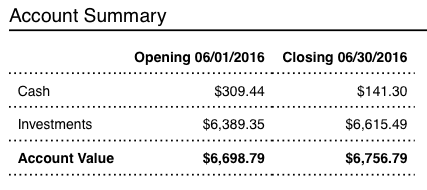

Asset-backed small business lender P2Binvestor continues to perform well and is one of my favorite investments (full disclosure: I am on the advisory board of this Denver based company). These are short-term loans, backed by accounts receivable, with 30-60 day liquidity. I have never lost any principal to defaults and with returns over 10% I am very pleased with this investment.

Final Thoughts

As my returns have been decreasing for a long time now I have been wondering when the decline will stop. I am hopeful that I am near the bottom as interest rates have risen and defaults have been remaining steady. With so much invested in existing three and five year loans it will take a long time for these increases to show have a material impact. While I would love to be earning more than 10% again I don’t expect to get back there any time soon. Regardless of what happens to my returns I will continue to share the results here.

Finally, I always highlight my Net Interest earned number. As you can see in the above table this quarter it is $54,936 for the previous 12 months. This is actually down slightly for the second quarter in a row which has come as a surprise to me. But I like to highlight this number because this is what we actually earn and for anyone looking for passive or retirement income this is the most important number.

As always feel free to share your thoughts in the comments below.