Research from TransUnion suggests that the Federal Housing Finance Agency’s (FHFA) move to a bi-merge system could significantly impact both consumers and lenders while providing little benefit.

Mortgage automation can be applied to every step of the mortgage process to help make lenders more efficient and provide a better user experience.

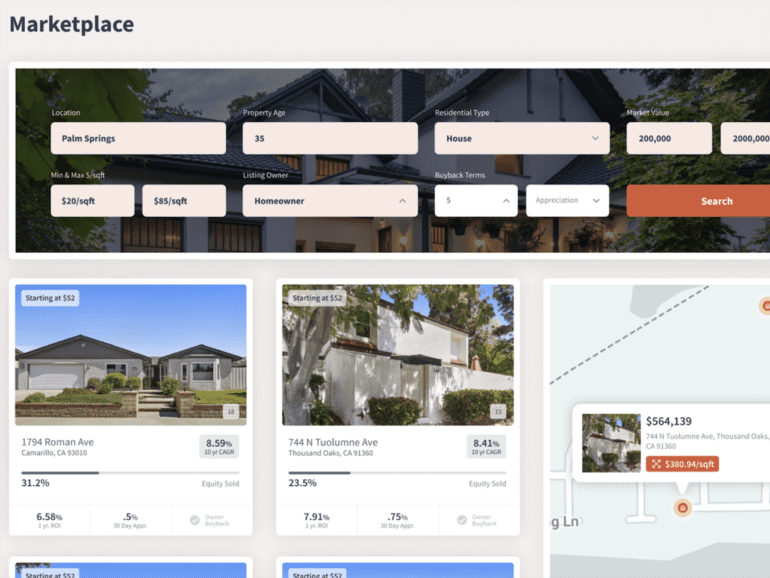

Vesta Equity is a home equity marketplace that allows homeowners to access their equity without borrowing while providing tokenized, residential real estate investment opportunities. And it works because of its owners’ faith in the future of blockchain technology and Web3.

In Latin America's highly concentrated banking industry, financial technology startups are venturing into one of the region's most undeveloped and tightly held loan markets: mortgage financing.

Acre Homes aims to build a modern home ownership experience, and with the help of data from Plaid, applications are a breeze. Learn how.

Borrowell's Rent Advantage is the latest example of a fintech using technology and a fresh perspective to solve a longstanding imbalance in the credit markets.

Polly, a company seeking to transform the mortgage industry with a data-driven capital markets ecosystem that provides value at every point in the process.

Lending as a service fintech LendKey announced record growth in March 2022, surpassing its previous record set in 2018.

Episode 255 features Vishal Garg, the CEO and Founder of Better.com; he discusses the state of the mortgage market with...

Mortgage fintech Blend is on a roll; Blend’s customer base now accounts for more than 25% of the $2.1 trillion...